Budget 2015: welfare changes and the “living wage premium”

In the run-up to the election, Evan Davis asked the Prime Minister where £12 billion of welfare cuts would come from. He replied "We have been getting people off what was called Incapacity Benefit and back into work.

In the run-up to the election, Evan Davis asked the Prime Minister where £12 billion of welfare cuts would come from. He replied “We have been getting people off what was called Incapacity Benefit and back into work. We’re going to continue with that, successfully reducing welfare”. As I pointed out then, this was simply untrue. In fact, the failure of the government’s incapacity benefit reforms, and upward pressure on other parts of the system (especially housing benefit) meant that despite strong employment growth the government had made hardly any net savings on social security spending in its first term.

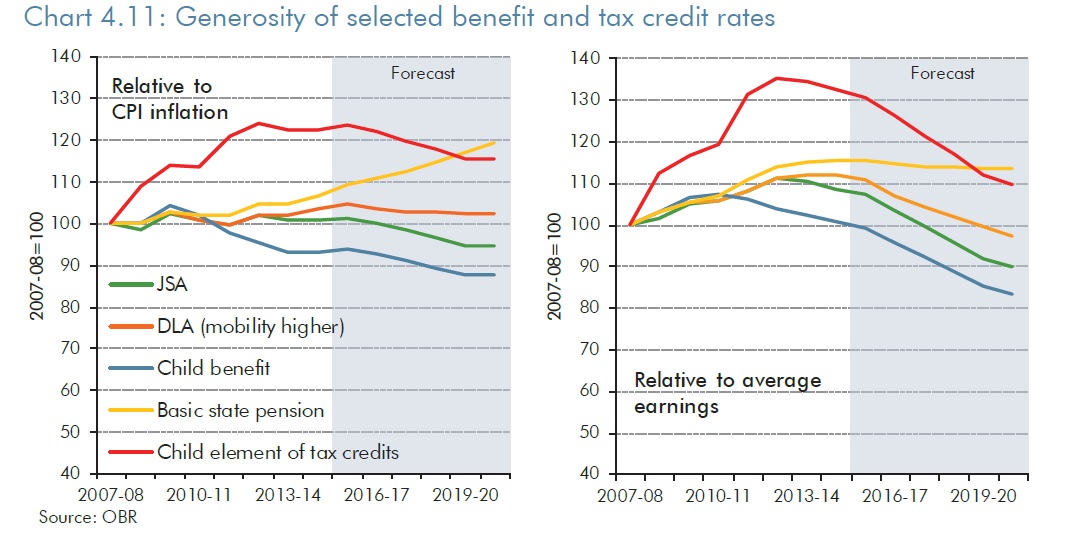

This in turn meant – given the protection afforded to pensioners – that cuts in this Parliament would, as a matter of arithmetic, have to come from cuts to tax credits, housing benefits, family and child benefits, and disability benefits; this is exactly what has happened, albeit with the £12 billion spread over the period to 2019-20 rather than by 2017-18. Two main measures account for the vast bulk of the savings: a cash freeze in most working-age benefits (representing a significant cut in real terms) and significant reductions in tax credits paid to low income families. This OBR charts shows the forecast results: while pensions will continue to outpace earnings, the value of some benefits (like JSA) will continue to be eroded sharply, while tax credits, having risen relative to earnings during the recession, will fall back considerably.

What will be the impact? Most economic research (including preliminary work here by Monique Ebell) suggests that employers are unlikely to increase wages much in response, although there may be some impact. There will probably be some negative impacts on work incentives for the low paid , although this will be mixed. However, the impact on poverty (especially child poverty) will not: there is likely to be a substantial rise as a result of today’s measures.

To what extent will this be counteracted by the announced increase in the National Minimum Wage (misleadingly rebranded as a “living wage premium”)? The answer is not much: given the way that the tax credit system works, incremental increases in the minimum wage do very little to compensate for tax credit reductions, as Resolution Foundation analysis shows. Still less, of course, will rises in the personal tax allowance, only a small proportion of which flows through to those on low incomes. That does not mean the increase in the minimum wage is a bad idea – the preponderance of the economic evidence is that any negative impacts on employment will be small, and there may be some positive impact on productivity (see this NIESR research) but it is misleading to suggest that it will outweigh tax credit reductions for low income families.

Two other measures are worth highlighting. First, the cut in social sector rents. The OBR could hardly have been more damning about this: it expects it to reduce housebuilding, since housing associations will be less able to afford to build new homes: and it notes that if housing associations were to be classified as part of the public sector (and implicitly it is saying that since government sets their prices they should be) this measure would increase, not reduce, borrowing.

Second, the reduction in the rate for those in receipt of Employment and Support Allowance (ESA) who are in the Work Related Activity Group; new claimants will now get the same as those on JSA. It is important to note that people in this group are explicitly not “fit for work”; they have been judged unfit for work, but capable of undertaking “work-related activity. ” This will indeed improve work incentives for this group, but since many are not in fact likely to move into work in the short term, may also increase hardship. It is worth noting again that this move is another result of the issues surrounding the introduction of ESA, and in particular the Work Capability Assessment, which I discuss at length here.

Finally, what about ending tax credits for third and subsequent children? Ultimately, this represents a value judgement about the extent to which society chooses to support low income families who in turn choose to have more than two children. But while there is some evidence of (limited) incentive effects (that is to say, that generous child tax credits did indeed raise the birth rate slightly) we shouldn’t delude ourselves that poor people will stop having children, or that the living standards of low income families, and children in particular, won’t suffer.