A Budget for hard-working Poles

My colleague Monique Ebell wrote an excellent blog yesterday setting out the combined impact of reductions in tax credits and increases to the National Minimum Wage announced in the Budget. She works through the impacts on incomes and work incentives for a number of example families, and concludes the following:

My colleague Monique Ebell wrote an excellent blog yesterday setting out the combined impact of reductions in tax credits and increases to the National Minimum Wage announced in the Budget. She works through the impacts on incomes and work incentives for a number of example families, and concludes the following:

1) The changes to tax credits intensify the disincentives to work for all tax credit claimants earning more than the new threshold of £3,850, except for those earning in the very narrow range between £10,600 and £11,000.

2) The following types of families will be worse off in 2017/18 after the changes:

- Childless and non-disabled individuals currently working 30 hours on the national minimum wage (NMW)

- Lone parents and couples with children currently working 30 hours on the NMW

- Lone parents and couples with children currently working 40 hours on the NMW

- The average lone parent on in-work tax credits, who works 26 hours at an hourly wage of £8.53

- The average single-earner family on in-work tax credits, working 37 hours at £8.78 an hour

All of these families will lose more in tax credits than they will gain from the changes to income tax and the new living wage.

3) The following types of family will be better off in 2017/18 after the changes:

- Childless and non-disabled individuals currently working 40 hours on the national minimum wage (NMW)

All this is of course well known and other analyses, such as that by the Resolution Foundation, have come to much the same conclusion: the net impact of the changes will be to increase household incomes and work incentives for workers without children on low pay; it will reduce incomes and (mostly) work incentives for low income households with children.

The purpose of this blog is to highlight one consequence which, as far as I know, has been little remarked upon so far. That is the impact on the relative attractiveness of the UK labour market to EU migrants and to UK workers, particularly those with children.

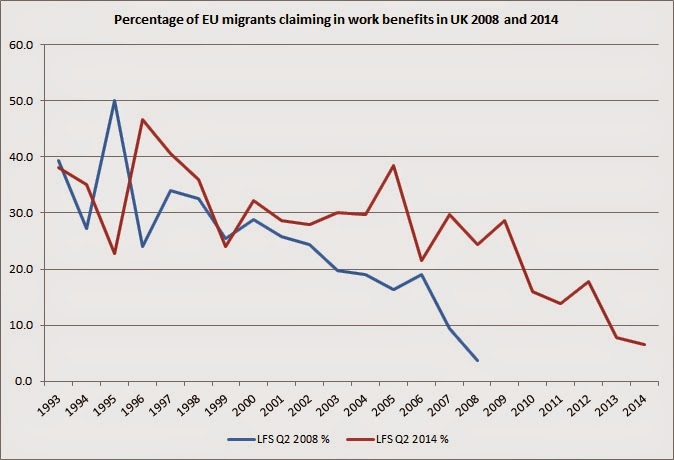

The point is this. Most EU migrants coming here to do relatively low-skilled/low –paid jobs (usually from the newer Member States of Central and Eastern Europe and the Baltic states) do not have significant eligibility for tax credits upon arrival, since they are generally single and childless. Later on, they go on to partner, have children, and claim tax credits in at least as high a proportion as the native-born; but initially, they are quite unlikely to be eligible and to claim. Although data is sketchy, this chart (from Open Europe, based on the excellent Michael O’Connor’s analysis I believe) shows that fewer than 10% of EU migrants claim in-work benefits within the first two years. [The chart – somewhat confusing – shows year of arrival on the x-axis, and the proportion of EU migrants who arrived in that year on the y-axis].

So, while wage rates – in particular the level of the minimum wage – almost certainly do impact migration decisions, there is little or no evidence to suggest that the availability of in-work benefits does so. It follows, therefore, that the impact of the changes described is likely to be to increase labour supply from EU migrants; and to reduce labour supply from low income natives with children.

One further point is worth noting. As I understand it, the higher level of the National Minimum Wage won’t apply to the under-25s – and of course quite a significant proportion of new EU migrants, especially the ones we are discussing here, are under 25. How does that affect the above analysis? Well, from the perspective of someone under 25 either here or abroad, the changes will have little direct impact. However, there is also a relative price effect.Employers will have a significant incentive to employ the under-25s, who will be considerably cheaper.So some employers may choose to hire relatively more under-25s. Again, this may provide a boost to the relative employment prospects of EU migrants.

Some of this is speculative. But it is difficult to avoid the conclusion that the net impact of these changes will be to make the UK labour market more attractive to low-paid EU migrants; and, possibly, such migrants more attractive to UK employers.