Government borrowing and long-term interest rates: a natural experiment

Does more government borrowing push up interest rates – or, worse still, risk a “Greece-style” panic in the bond markets? I have written about this numerous times over the last five years: here and here for example. I have argued consistently that it is one of the rare macroeconomic questions to which we can give an absolutely definitive answer.

Does more government borrowing push up interest rates – or, worse still, risk a “Greece-style” panic in the bond markets? I have written about this numerous times over the last five years: here and here for example. I have argued consistently that it is one of the rare macroeconomic questions to which we can give an absolutely definitive answer. We have overwhelming evidence, both empirical and theoretical, that in countries (like the UK) which are at the zero lower bound for interest rates and which borrow in their own (floating rate) currency, the answer is no. In the UK, it is notable that the 2010-15 government failed, by some considerable distance, to hit its deficit reduction targets (indeed even the deficit reduction targets of its predecessor) but long-term interest rates not only remained low but fell still further.

But the recent UK election gives us an even more conclusive illustration. There is nothing (empirical) economists like more than “natural experiments” with economic policy. We want to assess the impact of a policy – but how? We can only observe either what happened with the policy or without – but not both. For some microeconomic policies we can, as with drugs, come close by using randomised trials. But not for macroeconomic policies. You can’t choose identical countries and apply different fiscal policies and see what happens.

So a “natural experiment” – an exogeneous policy change imposed “as if” at random – is a rare opportunity to see what happens. And elections can provide such an experiment. If a new government suddenly changes policy, then maybe the impacts will be visible and measurable. In particular, a sudden reaction in the financial markets – a sharp change in prices – that coincides with an election may well tell us something interesting. Of course, that doesn’t work in most elections, because these days we usually know who’s going to win. So in practice elections are usually met with a yawn in financial markets. They’re already priced in.

But not this one. Financial (betting) markets rated the chance of a majority Conservative government at 1 in 10 or less. Like the pollsters, they were expecting either a Conservative-Liberal coalition, or a minority Labour government. And either of the latter would have resulted in a significantly looser fiscal policy than planned by the current, majority Conservative government (which plans to balance the budget – a commitment none of the other main parties signed up for). We don’t know how much more borrowing would have been under either of these alternatives, but the Institute for Fiscal Studies estimated that Labour’s plans implied extra borrowing of £170 billion over the Parliament. And the Liberal Democrats’ fiscal plans were essentially identical to Labour’s. As Paul Johnson of the IFS put it: “There is clearly a big difference between the two main parties, a bigger difference than we’ve seen in a very long time,” .

In other words, the election result led to a very large change in financial market expectations about the course of fiscal policy over the period 2015-20. So we have a natural experiment – how do financial markets react to this, and in particular what happens to long-term interest rates. If fiscal policy affects gilt yields – if higher borrowing means higher long-term interest rates, or vice versa – we should have expected to see a significant fall in long-term interest rates. And indeed, note that this is not a theoretical point – in 1992, a similar surprise Conservative victory did indeed lead to a fall in long-term rates, by fully half a percentage point, since again a Labour government was expected to borrow more. Of course, short-term rates were nowhere near the zero lower bound, so this was to be expected.

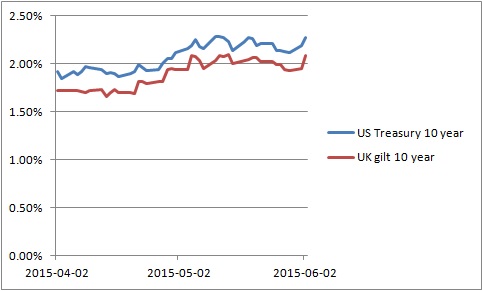

So what happened in 2015? Absolutely nothing. This chart shows US and UK 10 year bond rates from a month before the election to a month after.

Can you see the market reaction to the surprise Conservative victory? No, me neither. Gilt yields fell by a few basis points on May 8: but so did bond yields pretty much everywhere. And over the month, as they have done for some years, UK and US long-term interest rates moved almost in lockstep. The spread (interest rate differential) has remained very close to 20 basis points throughout this period. We can say with some confidence that the impact of the surprise election result on gilt yields was somewhere between tiny and zero.

And, as a further check that financial markets do indeed react in the way theory and common sense suggest they should, we have only to look at the share prices of the electricity supply companies. The Labour party had threatened them with various regulatory actions which might well have reduced their profits. So the election removed a significant downside risk – and their share prices duly responded, rising sharply. So did estate agents, like Foxtons. Financial markets may or may not be fully efficient in the sense of the Efficient Markets Hypothesis – but there is no doubt that they do respond to new information.

So what does the (non)-reaction of the gilts market tell us? That, as far as financial markets are concerned, even significant changes about expected budget deficits and government debt have little or no impact on long-term interest rates. If Labour and/or the Liberal Democrats had been in government, as expected, we’d be planning to borrow considerably more. And the market impact on long-term interest rates would have been almost nothing. When Robert Peston’s “bond market pals” told him that “Mr. Market may be capricious” [and push up interest rates if the government borrowed more] they were slandering him. It turns out Mr Market is far more sensible than that.