My bet with Andrew Lilico – the result!

In May 2013, the economy had just returned to decent levels of growth. This provoked a twitter discussion between a number of economists on what it would mean for inflation – then still running above target, at 2.4 percent. Andrew Lilico argued:

“If economy's back to growing faster, inflation will go back to rising. Betcha!”

As I wrote at the time:

In May 2013, the economy had just returned to decent levels of growth. This provoked a twitter discussion between a number of economists on what it would mean for inflation – then still running above target, at 2.4 percent. Andrew Lilico argued:

“If economy’s back to growing faster, inflation will go back to rising. Betcha!”

As I wrote at the time:

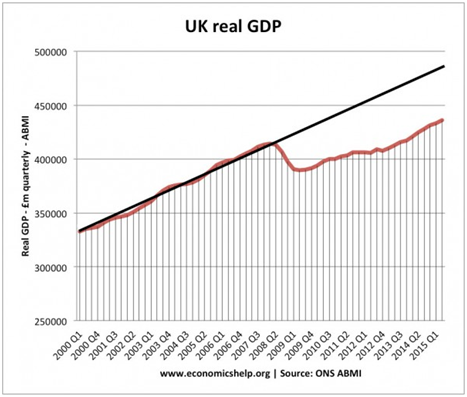

“I disagree with Andrew; I think the UK has plenty of spare capacity, and is quite capable of sustaining a period of growth above the historical trend (about 2%) without a sharp rise in inflation. So we agreed a bet. Andrew’s prediction is that if real GDP growth goes above 2% then inflation (as measured by the CPI) will rise above 5%, within 18 months. So, for example, if GDP in the four quarters to the end of 2013 is more than 2% higher than GDP in the four quarters to the end of 2012, then Andrew’s prediction is that the CPI will rise more than 5% at some point before the end of the second quarter of 2015. The bet is £1000 (in 2012 pounds – after all if Andrew wins then 2015 pounds will be worth much less!). Watch this space..”

The bet comes due today, since growth to the first quarter of 2014 was above 2 percent, and we’re now 18 months on from that (in fact, data revisions may mean that it actually came due somewhat sooner). I won, of course: consumer prices actually fell by 0.1% in the year to September 2015 – we are in (very mild) deflation. In no time in the last 18 months has it exceeded the 2 percent target. Andrew owes me about £1,040 (which I will be donating to Coram, the UK’s longest established childrens’ charity, which specialises in adoption and other programmes for the most vulnerable children. I am a Trustee).

But just because I won doesn’t mean that I was right about everything, of course. I’d make the following points (Andrew’s thoughts follow below).

First, I said at the time that I thought the only way Andrew could win the bet was if we had an oil shock. And we have had one; but it’s been a deflationary one, not an inflationary one. Even if oil (and other commodity prices) hadn’t fallen so sharply, I would still have won; but inflation wouldn’t be at zero.

Second, my fundamental disagreement with Andrew – as set out above – was that I thought the UK economy had lots of spare capacity. So I thought that once we had a proper recovery, we’d see an extended period of above-trend growth with subdued inflation, just as we did in the recovery after the recession of the early 1990s, for example. But I was wrong about this. After the 1990-91 recession fast growth meant the UK economy returned more or less to its previous trend, making up most or all of the lost ground. This time round, we’ve hardly caught up at all – our performance has been abysmal by historic standards.

Now, one possible explanation is that there still is lots of spare capacity; hence the disappointing recovery and low inflation. But that’s very difficult to square with historically high levels of employment, employers reporting skill shortages in some areas, not to mention other survey evidence.

And that brings us to the third point – the really puzzling thing about this recovery has been very rapid employment growth combined with very slow growth in both real wages and productivity. This combination “explains” both low inflation – there’s been very little upward pressure on real wages, so we’ve seen both cost-push deflation from oil prices combined with almost no wage-pull inflation – and continued sub-par growth.

And in that sense we were both very wrong. If you’d told Andrew we’d have had almost no productivity growth at the same time domestic demand was growing reasonably quickly, I’m sure he’d have been even more confident in his bet on rising inflation. And if you’d told me that employment rates (not just levels) would be above pre-crisis rates, I’d have predicted a much more rapid recovery in GDP and real wages.

Explaining all this will have to wait for another article. Meanwhile, this is another reminder of Niels Bohr’s salutary warning: “Making predictions is hard, especially about the future”.

Andrew Lilico responds:

In March 2013 I entered into a £1,000 bet with Jonathan Portes that when one-year GDP growth exceeded 2 pc, within eighteen months inflation would reach 5 per cent. That was what had happened the previous two times one-year GDP had exceeded 2 pc (with inflation reaching 5 pc in 2008 and 2011). However, that wasn’t the main reason I expected inflation to rise. I expected that, as the economy recovered, there would be two key factors driving up inflation.

First, I expected wider recovery to lead to bank balance sheets looking more healthy, meaning banks were more willing to lend, including catch-up investment on projects delayed by the Great Recession and slow recovery but also to consumers. I thought more rapid lending growth would, given the very high liquidity there was in the system because of quantitative easing, mean more rapid monetary growth, fuelling an inflation overshoot. I didn’t think the overshoot would be huge, but I did expect that the Bank of England would be unwilling to snuff out the recovery by raising interest rates so there would be some.

Second, during the Great Recession and thereafter, wage growth was extremely low. Indeed, in a number of years real wages fell. And the evidence suggested that much of that was not because workers volunteered to have their real wages fall. What seemed to me to have happened was that actual inflation was regularly higher than expected inflation. I could understand why workers would accept that in a period in which the businesses they worked for were not doing well. But once the economy started to recover and businesses started to be profitable, I expected that there would be strong demands for wages to rise.

I could have been lucky and won the bet, even without these things happening, if oil prices had spiked. And I could have been unlucky and lost the bet, even though the things I expected had happened, if oil prices fell sharply.

Well, as it happens oil prices did fall sharply, but that’s not why I lost. I lost because there was no acceleration in monetary growth at all (broad money growth was 3.8 pc in 2013 and was still 3.8 pc over the past twelve months) and because pay growth did not start accelerating until the past few months.

What does that mean? Well, clearly one reason broad money has not grown particularly rapidly is that the Bank of England has stifled such growth with strict capital and liquidity requirements. These were, of course, largely in place in 2013 but I expected the Bank to relax them as the economy recovered and in any event more rapid economic growth should have meant lending could expand faster than it has done even with those capital requirements in place. It’s also true that the Eurozone crisis has gone on and on meaning a blight over financial sector stability never quite went away.

But I don’t really believe that’s the whole story. I think I must have got something wrong about how the effects of quantitative easing are transmitted into the wider economy and about how distressed banks react as the economy recovers. I suspect I have also got something wrong about how the UK labour market works.

I’ve never really believed in doing vague economic forecasts of the “You’ll meet a tall dark stranger” or stopped-clocks-are-bound-to-be-right-eventually forecasts of the “The stock market will fall 10 pc between two dates at some point in the future” types. I get paid to advise on policy questions, so my analysis is intended to inform decision-making. I describe my forecasts with precision and detail and explanations of the mechanisms I expect to operate, in full cognisance that that means my precise forecasts will be wrong around 100 pc of the time. But usually things do work much as I say they will, even if not in every detail.

Not always, though. And when I’m wrong, that usually means something. For example, in early 2003 I forecast that house prices on the Halifax index would begin to fall some time between August 2004 and August 2005. They did not in fact start to fall until late 2007. That two to three year error was important — much of the bonds market madness and excessive mortgage pushing that contributed to the Great Recession occurred at that time. If I could have understood properly why I was wrong in 2004/5, that could have been important.

It may be that there is still a bit of inflation, eventually – though even if there is, now, that won’t really be me being vindicated. My forecast already built in the sorts of time tolerances I believe reasonable. If inflation comes now, it won’t be coming in exactly the way I expected; at the very least there are other mechanisms at play that I don’t yet understand – things about the labour market, about quantitative easing and about the banks. To me, at least, those other mechanisms may matter.