Brexit politics and bond prices

Those of us with long memories will have seen elements of previous political and economic crises in the last week’s events. There was a whiff of the resignation of Mrs Thatcher in November 1990, the end of Sterling’s membership of the European Exchange Rate Mechanism in September 1992 and not a little of the financial crisis, which was triggered in August 2007. And yet while the former events bookended a recession and the latter led to one, so far our political crisis has not led to an extreme economic downturn. I think this is because the most likely outcome for an end game in the exit process is some form of agreement that leaves near frictionless trade in place with the EU for some years to come. Such an outcome, despite the political opinions of it, will limit the transitional costs of an exit from the EU.

Those of us with long memories will have seen elements of previous political and economic crises in the last week’s events. There was a whiff of the resignation of Mrs Thatcher in November 1990, the end of Sterling’s membership of the European Exchange Rate Mechanism in September 1992 and not a little of the financial crisis, which was triggered in August 2007. And yet while the former events bookended a recession and the latter led to one, so far our political crisis has not led to an extreme economic downturn. I think this is because the most likely outcome for an end game in the exit process is some form of agreement that leaves near frictionless trade in place with the EU for some years to come. Such an outcome, despite the political opinions of it, will limit the transitional costs of an exit from the EU.

Even though an exit on the terms announced by the Cabinet last week and subsequently championed by the Prime Minister may not be the first choice of Remainers or Leavers, it represents a second best for Remainers who do not want disorderly exit and for Leavers who at least get an exit. Whilst it is unlikely to be a permanent solution to the question of the UK’s economic, political and institutional relationship it might offer a valuable commodity: time. On the long view it is hardly surprising that the reversal of the integration project started in 1961 and completed in 1973 with accession to the European Economic Community will take a number of years to engineer. Particularly if we start to list the number and depth of institutional relationships that we need to unpick. Easy does it. But the stakes are high in this knife-edge equilibrium as we cannot know who will lead the endgame and what the final result will be and any collapse in the concord may leave the economy reeling.

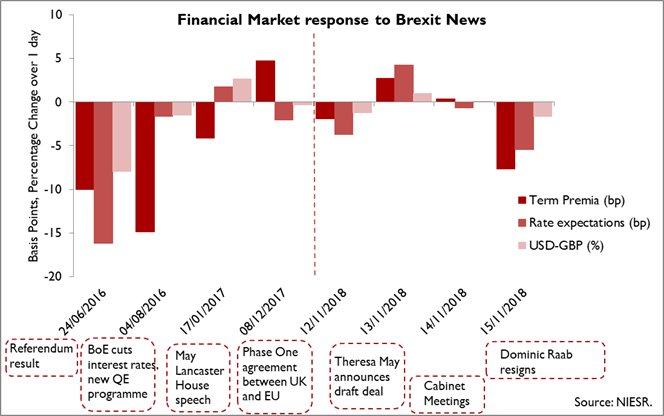

Given the political turmoil, how have bond prices reacted to recent news on EU exit? Financial prices seem to have become an arbiter of so much government policy and may yet matter in a more significant matter as we near the Parliamentary vote next month. What we find looks like a seeming disconnect between economic and the politics. The Institute has examined the reaction of 10-year UK bond prices to recent news on the exit process. There are two components of the bond price, first one that reflects a change in the expected path of Bank Rate and secondly one that reflects elements of risk (which might reflect liquidity and/or default) attached to government bonds.

Note further that when we try to understand the response of bond prices to economic and political news we also have to remember that market participants are trying to understand simultaneously the impact on the economy and the response of policy makers. So, for example, whilst strong economic news may be thought to be good for the fiscal position and lead to more buoyant tax receipts and so reduce the risk attached to bond prices for a given path of expenditure, and so tend to push bond prices up. But if at the same time it was felt that policy rates might rise more quickly in line with this strong economic momentum then bond prices might also have a tendency to fall. What we then observe is the outcome of both forces, which might result in a fall of the risk premium and a shift upwards in the expected path of interest rates, and very little change in bond prices.

The Figure below shows the impact of recent news on EU exit on bond prices, decomposed into those rate expectations and term premia, and as a reference point on the sterling-dollar exchange rate. Our forthcoming paper (Chadha, Hantzsche and Mellina, Bremia: A study of the impact of Brexit based on bond prices, NIESR mimeo) suggests that the fall in the risk premia following the referendum was a result of an expectation about the resumption of the Asset Purchase Facility that offset the increased risk of UK plc. Contrary to what we might have anticipated, risk premia fell because of an expected policy response to the primitive shock. Accordingly Sterling fell alongside that fall in expected path of Bank Rate, and an anticipated sustained loosening in monetary conditions.

Viewed through the prism of our “Bremia” analysis, last week was remarkable. Whilst Monday and Tuesday actually offset each other, the events of Thursday were very much like a mini-referendum result: risk premia fell, alongside interest rate expectations and Sterling. The key point is that although the political turmoil was of great concern, the impact on bond prices followed a pattern we have seen before in which risk rises but expectations of a policy response militate against the risk. To the extent that policy can respond to the impact of an exit deal, the consequences for the economy can be mitigated in the short run. And hopefully allow a smoother adjustment to the long run costs of terms of lower levels of integration with the European economy and the global economy, while we wait for trade deals to materialise. The long run impact on the economy cannot though be avoided.

With thanks to Arno Hantzsche, Amit Kara and Garry Young for discussions and to Jasmin Manetta for providing the calculations. For more on our risk premia measures please click here.