China’s Economic Horizon: Looming Threats in the Long Run

Associate Economist Patricia Sanchez Juanino sits down with our Deputy Director Professor Stephen Millard to discuss NIESR’s recent Topical Feature: Modelling the Chinese Economy using NiGEM – the Chinese economy accounts for 18 per cent of global GDP, what knock-on effects would a slowdown in it’s economy have?

Why is a slowdown in China so important?

Throughout recent decades, the Chinese economy has evolved from predominantly agricultural to become a manufacturing powerhouse. However, Chinese GDP growth has slowed over the late decade and is likely to be slower into the future. Beijing announced 5 March a target of “around 5%” growth in gross domestic product for 2023, which indicates the pickup in China’s growth continues to face headwinds.

The increased importance of China in the global economic system – it now accounts for around 18 per cent of world GDP – has led to an intensified awareness of how a downturn or slower growth in the Chinese economy might affect other economies. International trade and financial globalisation have further enhanced interconnectedness and rendered economies more sensitive to global shocks

While we expect that the Chinese economy will continue growing, we are concerned that long-term threats may drive slower Chinese GDP growth than expected.

How did you assess the long-term risks associated with a slowdown?

To illustrate some of these risks, we use our global econometric model, NiGEM, to model the impact of two long-term factors affecting the Chinese economy on the global economy and on a selection of partner countries). First, we study the effects of a lower level of productivity in China in coming decades. Then we examine the question of how the economy might evolve if the population growth rate is lower than anticipated.

In NiGEM, economies are linked with each other through trade, competitiveness, and financial markets. As a result, the impact of a Chinese slowdown on other economies will largely depend on the significance of those links for the different countries and to some extent, their monetary policy response.

In the first scenario we look at the effects of a reduced level of Chinese productivity in the long-run (relative to our baseline) resulting from a gradual negative growth in Chinese technical progress. We assume that Chinese productivity by year 10 of the simulation reaches a level 2 per cent lower than the baseline and stays 2 per cent below the baseline from that point onwards.

In the second scenario we examine the role that Chinese demographic changes play in its economic growth. There have been some concerns raised about the likelihood of a slower future growth rate of the population of China, being accentuated by the fact that in 2022 China’s population fell for the first time since 1961. In our baseline projections we use the United Nations’ ‘mean’ projection for population growth that uses the medium-fertility assumption. For this simulation we use the ‘lower’ projection which is based on the low-fertility variant.

What were the results?

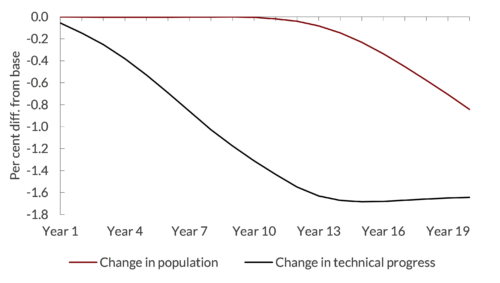

Figures A and B show the results of the two long-term simulations on the Chinese economy and the global economy, indicating lower levels of GDP that persist for a long period as expected. The change in technical progress leads to a permanently lower path for GDP. The demographic effects start to show an effect after around 10 years.

Figure A traces out the path of GDP implied by both simulations. The lower population level implies China’s GDP would be 0.8 per cent lower than the baseline projection after 20 years, and the lower productivity simulation implies GDP at 1.6 per cent lower than the baseline projection in year 20. So, in both simulations Chinese GDP is negatively affected in the medium and long term.

Figure A. Impact from long-term factors on Chinese GDP

Source: NiGEM simulation

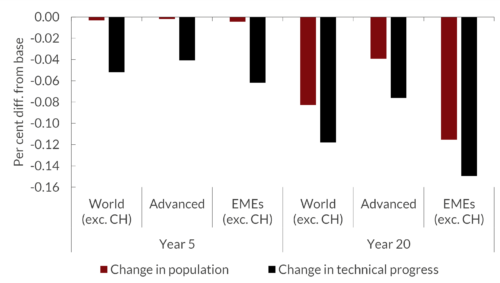

Figure B makes the point that the effect from lower Chinese GDP spills over to other economies, especially the Emerging Economies due to their higher level of interconnectedness with China. Global GDP is around 0.1 per cent lower than the baseline in year 20 and Emerging Economies (EMEs) GDP is around 0.16 per cent lower.

Figure B. Impact on GDP from long-term factors in year 5 and year 20

Source: NiGEM simulation

Our simulation results show that long-term challenges for the Chinese economy, such us lower productivity growth or a lower demographic profile, reduce the level of Chinese GDP relative to our forecast baseline in 20 years’ time, as well affecting global GDP (excluding China) underlining the importance of considering demographic trends and technical progress developments in long-term macroeconomic projections.

Read our Global Topical Feature for more insight on this topic.