Covid economic recovery: US sprint, Italian marathon?

Our recently published Global Economic Outlook included an upward revision to our projections for global GDP growth this year and next. Across countries, however, there is considerable divergence in the projected dates at which they will recover their pre-pandemic GDP levels. Output has already recovered its level from before the pandemic struck in China and the US. But the US is the only one of the G7 economies to have achieved that so far.

Our recently published Global Economic Outlook included an upward revision to our projections for global GDP growth this year and next. Across countries, however, there is considerable divergence in the projected dates at which they will recover their pre-pandemic GDP levels. Output has already recovered its level from before the pandemic struck in China and the US. But the US is the only one of the G7 economies to have achieved that so far.

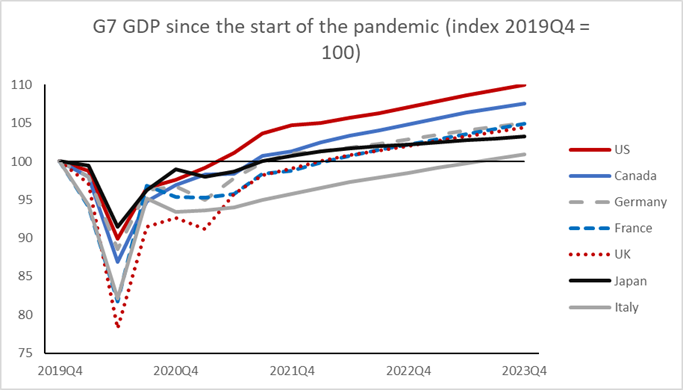

Our projections for GDP for the G7 economies are shown in figure 1. The deep falls in GDP in the second quarter of last year are clear, with the largest falls in France, Italy and the UK reflecting the severity of Covid and the reactions to it in terms of lockdowns which particularly affected service industries. The US and Japan had the smallest – but still sizable – falls in GDP between the end of 2019 and the second quarter of 2020. Output snapped back in each economy in the third quarter of last year, but that process has stalled somewhat with the second surge of the pandemic.

Figure 1

Source: NiGEM database and NIESR forecastSource: NiGEM database and NIESR forecast

We now expect that the economies of Canada, Germany and Japan will regain their pre-pandemic GDP levels (or recover) later this year and then start to expand output above its pre-pandemic level next year. Figure 1 shows that we expect that France and the UK will join them next year, taking almost two and a half years to regain their levels of output from before the pandemic hit. Italy stands out – we estimate that it will take the Italian economy until late 2023, almost four years, to get its output back to that of late 2019.

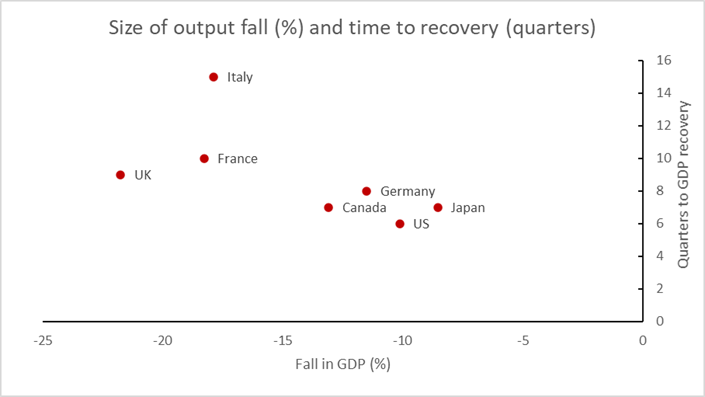

These differences in recovery time between countries reflect several factors. The size of the fall in GDP when the pandemic struck, which is related to economic structure and to the restrictions imposed to fight the virus, is an important factor, as shown in figure 2. The G7 countries with the deepest GDP falls in the initial phase last year are seeing the slowest recovery times. The US is regarded to have the most adaptable economy within the G7 and it has recovered most quickly, with the sharpest initial rise in unemployment last year but a subsequent fall. In contrast, Italy was already in a relatively weak position (with GDP having only increased by 2½ per cent in the decade leading to 2019). More broadly, over the last thirty years the Italian economy has grown at a much slower pace than the other G7 economies and has found it difficult to recover quickly from previous shocks.

Figure 2

Source: NiGEM database and NIESR forecast

The nature of the pandemic, and especially its effect on the service sector and interpersonal contact, has been an additional factor. The size of the service sector and especially the importance of tourism and social interaction in services, relative to the size of the manufacturing sector, has been an important factor in determining the scale of the fall in GDP in the pandemic, as outlined by Naisbitt and Whyte (2020).

Another important factor is the role of fiscal policy support in the pandemic. Figure 3 shows that within the G7 the US has had the largest direct fiscal support, which has helped the economy to recover most rapidly. Italy, Germany and Japan have relied relatively more heavily on loans, equity and guarantees than direct fiscal support within the G7 in terms of fiscal support. Combining relatively less direct fiscal support with the issues around economic structure and severe limitations on tourism activity because of Covid testing regulations and uncertainty about the safety of travel in the light of the delta variant, means that the Italian economy faces an uphill struggle to recover.

Figure 3

Source: NiGEM database, NIESR forecast and IMF Fiscal Monitor (April 2021)

Possibly coming to the rescue is the European Union’s Next Generation EU programme (NGEU) of EUR 800 billion. Countries have made applications for funds that are available in the form of loans and grants and the largest grant allocations approved have been to Spain and Italy, with Italy also receiving loans of around 7 per cent of GDP. Our recent modelling projects that this five year initiative, which is aimed at investments and reforms, should boost Euro Area GDP by around 0.8 per cent a year (Liadze and Macchiarelli, 2021). This new programme should bolster the recovery of the Italian economy, but the scale of the turnaround needed is substantial if it is to cut the time to economic recovery to match the other G7 economies.

References

Liadze, I. and Macchiarelli, C. (2021), ‘Simulating the effect of the EU Recovery and Resilience Facility in NiGEM’, National Institute Global Economic Outlook, Series B. No. 3, Summer.

Naisbitt, B. and Whyte, K. (2020), ‘A new kind of economic downturn – a lockdown recession affecting services’, National Institute Economic Review, November, 254, F57-59.

.png)