Did street unrest damage the outlook for France?

As images of unrest in the streets of Paris and other French cities continue to flood in the European media, the data on France contained in our latest global forecast, published last week, painted a subtler but still concerning outlook for the French economy.

As images of unrest in the streets of Paris and other French cities continue to flood in the European media, the data on France contained in our latest global forecast, published last week, painted a subtler but still concerning outlook for the French economy.

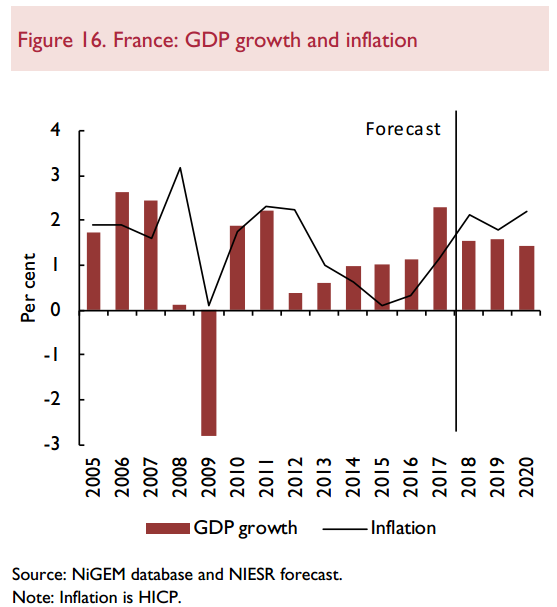

GDP growth was at 1.5 per cent in 2018 and recent developments suggest that the acceleration in growth in 2019 that we were previously expecting may not occur. We have therefore downgraded our forecast of annual GDP growth from 1.9 to 1.6 per cent in 2019.

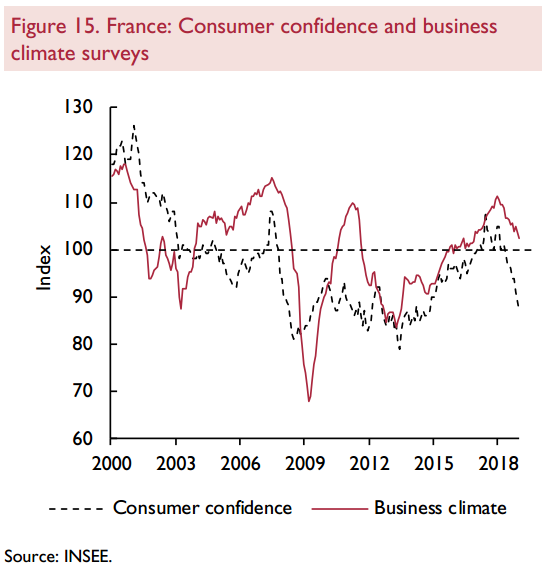

A broad range of surveys point to a marked and sudden deterioration in the business environment and consumer confidence. The business climate composite indicator, a survey of business managers compiled by INSEE, declined in December 2018 to a two-year low and the composite PMI dropped in December from 54.2 to 48.7, below the 50 mark which indicates expansion.

Social protests represented by the ‘gilets jaunes’ movement caused disruptions to businesses and retail trades during the months of November and December, when retailers usually make a significant part of their yearly sales. Households have also become more pessimistic as reflected in the INSEE consumer confidence index which declined to a four-year low of 87 in December, well below its long-term average of 100 (figure 15). As low consumer confidence in France is often associated with a high savings rate, we expect household spending to be growing at a lower rate than real personal disposable income.

Consumer price inflation eased from a peak of 2.6 per cent in July and August 2018 to 1.9 per cent in December and 1.5 per cent in January 2019 as a result of a deceleration in the inflation rates of energy, services, tobacco and a more pronounced drop in those of manufactured products. Only food price inflation accelerated. We expect inflation to average 1.8 per cent for the year because the effect of the increase in commodity prices is now past and lower oil prices will work through the economy.

In response to the gilets jaunes crisis, on 10 December 2018 French president Emmanuel Macron announced a fiscal stimulus package amounting to about €10 billion. This included the cancellation of a planned tax hike on low-income pensioners and of fuel duty; a tax free allowance for income from hours of overtime; an increase of the universal minimum income; an allowance for commuters; as well as more spending on environmentally-friendly projects.

If no compensating measures to reduce public spending were taken, the budget deficit would increase from a planned 2.8 per cent of GDP in 2019 to 3.2 per cent. This would also put in jeopardy the objectives of the 2018–22 plan to reduce public spending by 3 per cent of GDP, the budget deficit by 2 per cent and debt by 5 per cent as we explain in our forecast. This fiscal boost should support domestic demand in 2019 and mitigate any further slowdown in the economy.

Today’s Business Survey published by Banque de France points to a somewhat stronger business activity in February 2019, after a very weak January. According to the monthly index of business activity (MIBA), GDP is expected to increase by 0.4% in the first quarter of 2019, which would be roughly consistent with the average annual growth of 1.6% pencilled in our forecast.

However, street protests did have a noticeable impact on the economy via the disruptions to trade and the loss of confidence. The objective of improving the budget balance is now in jeopardy. And the perspective of a sustainable acceleration in economic activity looks now more remote.