Household spending in lockdown

The Covid-19 pandemic and extraordinary measures put in place to contain the spread of the virus have delivered a dramatic shock to the world economy. As the stringency of global lockdown measures gradually ease, an understanding of the short-term economic consequences of these measures is beginning to emerge.

The Covid-19 pandemic and extraordinary measures put in place to contain the spread of the virus have delivered a dramatic shock to the world economy. As the stringency of global lockdown measures gradually ease, an understanding of the short-term economic consequences of these measures is beginning to emerge.

Hale et al. (2020) have developed an index to capture the stringency of lockdown measures by country, based on the extent of school closures, workplace closures, cancellation of public events, restrictions on gatherings, closure of public transport, “stay at home” requirements, restrictions on domestic travel, and restrictions on international travel. Figure 1 scatters monthly changes in this stringency index against the percentage change in the volume of retail sales in the same month for a sample of 27 countries. The figure clearly illustrates that as lockdown measures were initiated in March, retail sales dropped significantly in most countries. As the stringency of lockdown intensified in April, retail sales plummeted further, at a monthly rate of 15% on average. By May, the majority of countries in the sample had started easing lockdown stringency, with some gradual reopening of certain types of shops and activities. The associated rebound in retail sales is evident from the figure, pointing to a degree of pent-up demand for certain types of goods and services.

Figure 1. Stringency of lockdown measures versus retail sales volumes*

Source: Oxford COVID-19 Government Response Tracker and World Bank GEM database (see Naisbitt et al., National Institute Economic Review, August 2020)

*Sample covers January-May 2020 for the following countries: Belgium, Canada, Switzerland, Czech Republic, Germany, Denmark, Spain, Finland, France, UK, Greece, Hungary, Ireland, Italy, Japan, South Korea, Latvia, Mexico, Norway, Portugal, Romania, Singapore, Slovenia, Sweden, Turkey, USA, South Africa.

Econometric panel estimates confirm the clear trend illustrated in Figure 1, and suggest that if strict lockdown measures were in place for a full year, this would deliver a 25-35% contraction in retail sales, even before factoring in any decline in household income.[1] This is in line with early projections of expenditure declines in OECD (2020), which were based on the industrial structure of consumption.

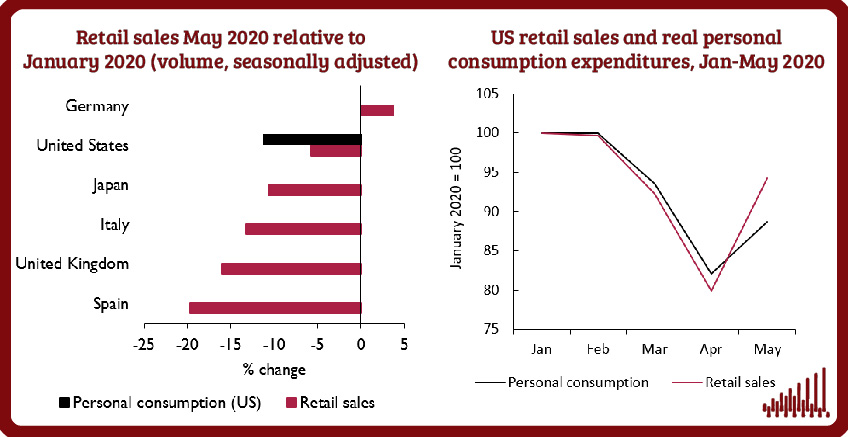

To give context to Figure 1, Figure 2 illustrates the cumulative change in the volume of retail sales in selected countries between January and May 2020. In the vast majority of countries for which data is available, the level of sales in May remained well below those at the start of the year. Exceptions include Germany, where early containment measures were effective in controlling the spread of the virus, allowing a more liberal opening of the economy during the month of May. By contrast, in the United Kingdom and Spain, retail sales were still 15-20% below levels at the start of the year, as most shops remained shuttered.

| Figure 2. Retail sales May 2020 relative to January 2020 (volume, seasonally adjusted)

|

Figure 3. US retail sales and real personal consumption expenditures, Jan-May 2020

|

Retail sales may act as a useful guide to short-term developments in household expenditure, as the data releases tend to be more timely and are widely available at monthly frequency. The two tend to be closely correlated over short time periods, although retail only captures a fraction of household spending, which also includes important categories such as housing, healthcare, education, transportation services and childcare.

The Bureau of Economic Analysis produces monthly estimates of real personal consumption expenditure for the United States – the only major country for which such monthly data are available. Figure 3 compares this series to retail sales in the United States since January. The paths of the two series are clearly very similar, although the rebound of retail sales in May was much sharper than that of personal consumption. Similarly, retail sales in the UK jumped by 11.9% in May, while the rise in GDP was far more modest, at 2%. This suggests the need for some caution when interpreting the information in Figures 1 and 2 as illustrative of the dynamics of household spending or GDP as a whole. Retail sales are a clear indication of the direction of change in household spending. But, like other higher frequency indicators (see for example Carvalho et al., 2020, who use credit card transactions to track household consumption), can only act as a guide to the magnitude of that change.

The short-term supply shock to household spending from the enforced closure of businesses may dissipate relatively quickly as lockdown measures are lifted. However, expenditure will continue to suffer from lingering shocks to both supply and demand. On the demand side, expenditure will be constrained by losses to household income, and may also be impacted by changes in behavior triggered by the recent crisis – for example, if people choose to avoid crowded venues or non-essential travel. Longer-term supply impacts can be expected to arise from episodes of unemployment, disruption to supply chains, and changes in business practices to accommodate new social distancing norms.

In conjunction with measures to contain the spread of the virus, many countries have introduced substantial fiscal support measures to mitigate the impact on households and businesses. In terms of magnitude, the size of these packages far outweigh fiscal support introduced during the Global Financial Crisis (see Naisbitt et al., National Institute Economic Review, August 2020). While in many countries this includes generous schemes to offset income losses for those who are unable to work as a result of the crisis (see Disney, 2020), the majority of households will nonetheless see a substantial decline in income this year. For example, in the UK, the furlough scheme that runs from March to October covers 80% of an employee’s usual monthly wage, up to a cap of £2,500 a month. While some companies may top up this government transfer, for the majority this entails a 20% drop in monthly income. From October, when the scheme comes to an end, many will face even steeper losses. As of 19 July, 9.5 million jobs had been furloughed and 2.7 million people had made claims through a similar scheme for the self-employed, while the claimant count increased by 1.4 million between March and June. With over a third of the UK workforce relying on one of these income support measures, and many others working reduced hours, income losses will no doubt prove substantial and weigh on household expenditure for an extended period.

Containment measures have also induced a form of “compulsory savings”, by prohibiting leisure activities such as holidays and dining out; travel to and from work; services such as hairdressing; and shopping for essentially everything outside of food and pharmaceuticals – activities that normally absorb a significant share of household spending. As businesses reopen, some of this pent-up demand will lead to a rebound in spending, as observed in the May retail sales figures. But some spending will remain permanently lost. A missed haircut in April is unlikely to be compensated by two haircuts in August. Keogh-Brown et al. (2010) suggest that lost spending on clothing, footwear and durable goods is likely to prove temporary (income permitting), whereas lost spending on transport services, sport, culture, restaurants, hotels and tourism is likely to prove permanent.

The combined impacts of income losses and foregone expenditure during the Covid-19 crisis can be expected to leave a permanent scar on the level of household consumption. Now that many countries are starting to relax their lockdowns, we are entering a new phase of uncertainty about how people and companies will react to unlocking. The extent of lasting changes to behavioural norms will form an important source of insight into how economies recover from the extraordinary circumstances of the past few months.

[1] Based on a series of simple panel models that regress the year-on-year/month-on-month percentage change in retail sales volumes against the year-on-year/month-on-month change in the stringency index.