How could protectionism affect the US economy?

The Trump administration has embarked on an ambitious trade policy agenda supposedly to strengthen the US economy and reduce its trade deficit. Amongst other things, the government initiated renegotiations of existing trade deals (such as NAFTA) and started to enforce US trade laws aggressively, not shying away from unilateral actions.

The Trump administration has embarked on an ambitious trade policy agenda supposedly to strengthen the US economy and reduce its trade deficit. Amongst other things, the government initiated renegotiations of existing trade deals (such as NAFTA) and started to enforce US trade laws aggressively, not shying away from unilateral actions. In March, new duties were levied upon steel and aluminium imports with the aim of protecting domestic industries for national security reasons. Temporary exemptions from these tariffs were granted to US allies and just extended for another month. Nevertheless, the new levies have raised the spectre of an outright trade war, as calls for retaliation emerged. Moreover, US measures against China regarding the violation of intellectual property rights appear to have the potential to escalate the trade spat between these countries. In this context, the issue of the macroeconomic fallout from trade protectionism arises. Do higher import tariffs help to raise output and reduce the current account deficit in the US?

Our model simulations appearing in NIESR’s May Economic Review suggest that, if the objective is to strengthen the US economy, the government should lower barriers to trade, not raise new ones.

By imposing an import tariff a large country boosts domestic output and can also raise its welfare at the expense of its trading partners, as the terms of trade shift in its favour. Contrary to traditional notions, however, Reitz and Slopek (2005) highlight that the tariff reduces domestic output and creates a short-run current account deficit in a macroeconomic model based on optimising agents and market imperfections. Our simulations with NIESR’s global econometric model (NiGEM) point in a similar direction.

For illustrative purposes, we focus on the hypothetical case of a virtually global tariff on non-commodity imports in the US. Following Ebell and Warren (2016) and Ebell et al. (2016), we model the import duty as a surcharge on prices of exports to the US. In this setup, the imposition of an import levy brings about a surge in US import prices, while the US dollar appreciates. Higher import prices raise inflation and reduce real private consumption, GDP, and imports. Abroad, lower export demand from the US weighs on local investment and output. At the same time, exchange rate movements fuel inflation, which restrains consumer spending. The contraction of output and demand in partner economies (in conjunction with the dollar appreciation) feeds back by lowering US exports. Overall, the macroeconomic implications of the tariff resemble the impact of a negative supply shock as prices increase while output declines.

We also show that the size and persistence of the macroeconomic impact critically hinge upon the specific assumptions underlying the behaviour of export prices. If foreign exporters are concerned about their gross price (which includes the tariff) deviating from competitors’ prices, they will respond by lowering their net-of-tariff prices gradually. Consequently, the adverse macroeconomic effects will also wane. However, we deem this scenario of a strong endogenous adjustment of net prices less plausible, at least in the short run, not least because it rests on a frictionless adjustment in economies exporting to the US.

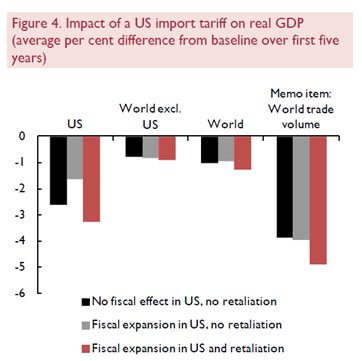

If foreign exporters are essentially concerned about their net-of-tariff prices, there will be little adjustment after the initial surge in gross export prices. As a result, the adverse macroeconomic impact will be substantially larger and more persistent both in the US and abroad. Following the imposition of a 20 per cent tariff on non-commodity imports from all major trading partners, US real GDP will fall 3.0 per cent below the baseline in the third year (figure 1), while consumer prices will be raised by 4.8 per cent.

The tariff also generates additional revenues for the US government, which can be used to dampen the adverse impact on domestic demand in the US by expanding public spending. Over time, the positive output effects of such a (government) demand shock dissipate and can only mitigate the adverse impact of the cost shock on US GDP to some extent (figure 2). Moreover, higher public spending also affects the ratio of saving and investment in the US economy so that the current account balance fails to improve. Despite the mitigating impact on US demand, the fiscal expansion aggravates output losses in the rest of the world marginally.

Given adverse spillovers, trading partners may be tempted to retaliate by imposing a retaliatory tariff of 20 per cent on imports from the US. As the punitive measure acts as a cost shock, the rest of the world incurs marginal additional output losses. But trading partners would succeed in inflicting severe additional economic pain on the US.

The author is Deputy Head of International and Euro Area Macroeconomic, Analysis Division, at Deutsche Bundesbank. The opinions expressed herein are those of the author and do not necessarily reflect those of Deutsche Bundesbank.

Further reading: “The war on trade: beggar thy neighbour – beggar thyself?” by Arno Hantzsche and Iana Liadze

.png)

.png)