The Impact of Covid-19 on the UK Jobs Market

Will mass unemployment overshadow the U.K. outlook or will we be struck by the resilience in employment following a severe, yet short-lived, recession? Using the Beveridge curve to construct a baseline points to the unemployment rate rising sharply from 4% to 10% as the UK’s Covid-19 Job Retention Scheme (CJRS) unwinds in the second half of the year.

Will mass unemployment overshadow the U.K. outlook or will we be struck by the resilience in employment following a severe, yet short-lived, recession? Using the Beveridge curve to construct a baseline points to the unemployment rate rising sharply from 4% to 10% as the UK’s Covid-19 Job Retention Scheme (CJRS) unwinds in the second half of the year.

Yet, uncertainty around that baseline estimate is high. Reduced profitability of ‘marginal jobs’ will be critical in determining if one of the two alternative scenarios obtains – and whether unemployment spikes even higher than 10% or whether the CJRS provides an effective bridge that limits the rise in joblessness after a sharp, short-lived recession.

This Is A Low

There are reasons to be pessimistic about a coming wave of job losses. As a services sector-dominated economy, the UK is exposed to the lower productivity of ‘in-person’ services resulting from social distancing. Demand for these services may also be impaired for some time. Further, as an open economy, the UK exposed to the sharp falls in trade and investment linked to severe falls in global activity and trade.

Figure 1: A looser UK labour market, despite stable official unemployment

Paul Gregg has recently suggested that US experience – where unemployment spiked close to 15% within weeks of Covid-19 – is “a reasonable guide of what we face here.” (Bell and Blanchflower, 2020). In this post, I suggest that the UK’s own Beveridge Curve provides a better guide to the outlook for when the CJRS ends. This approach also points to UK unemployment spiking higher, albeit not at as severe a level as suggested by Gregg’s US comparison.

In practice, how estimates for UK unemployment evolve will depend on the incidence and profitability of ‘marginal’ jobs which could react strongly to Covid-19. Some survey data suggest that marginal jobs at risk could be 10% of the total – which would raise the unemployment spike towards, if not above, Gregg’s estimate. Our general point, however, is that better data are needed to narrow that source of uncertainty.

Estimating the CJRS Effect – Avoiding 2.1mn Job Losses So Far

The CJRS has suppressed the rise in UK unemployment so far. The CJRS works by reducing job separations (inflows into the ranks of the unemployed); it has little or no effect on hiring (and outflows from unemployment).

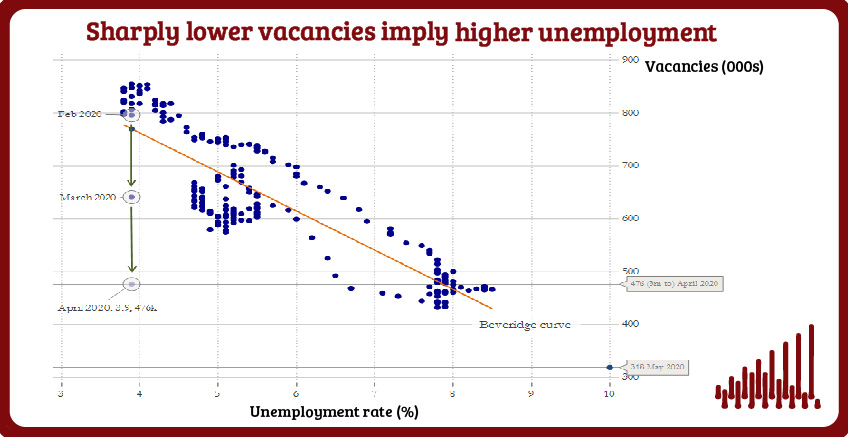

We can therefore judge how much unemployment it has prevented by the deviation of unemployment from its past link with vacancies known as the Beveridge curve (Figure 2).

Figure 2: Sharply lower vacancies imply higher unemployment

The fall in vacancies to 476k in (the 3m to) April would have implied the unemployment rate rising to 7.9% without the CJRS. On this estimate, 9million jobs being covered by the CJRS prevented 1.4 million lost jobs, by April.

Into May, the single-month number of job vacancies fell further, to 318k. Through the Beveridge Curve, this suggests a further 700k jobs would have been lost, taking the total to 2.1million. Job postings data on Adzuna and Indeed websites suggest lower job vacancies persisted well into June.

These calculations suggest further pressure pushing the unemployment rate to 10% as the CJRS unwinds. This is our baseline estimate for the rise in UK unemployment.

History suggests that falls in vacancies persist. But should vacancies recovery with the re-opening and any pent-up demand, then that would imply unemployment peaking at lower than 10% as the jobs market moves to a less unfavourable part of the Beveridge curve shown in Figure 2.

Everything Flows

Avoiding a spike higher in job separations is key to the near-term unemployment outlook. Some past research suggests that outflows from unemployment – and not separations – are key to understanding unemployment fluctuations (eg, Shimer, 2005). But that conclusion is misleading.

If and when a wave of jobs losses happens, the larger number of unemployed itself slows down the rate at which the jobless can then find a job. Like a longer line of cars stuck at the traffic lights, the longer queue lengthens the average time spent waiting to move on through a congestion effect. Increased numbers joining the queue at the start play a critical role.

This is essentially why the CJRS has been so key; and, having gone to the £14bn monthly expense of the CJRS, it would be unfortunate only to have postponed (rather than avoided) a wave of job losses.

Covid-19 Lowers Services Sector Productivity, post-Reopening

After the economy’s re-opening, Covid-19 affects the jobs market by lowering productivity, especially in the services sector. This is what challenges the ‘resilient’ scenario for employment once the furlough scheme unwinds, even if the recession itself is short-lived.

Figure 3: The productivity/profitability squeeze will raise unemployment

Social distancing will lower the average output of staff, especially those working in ‘in-person’ services (eg, in accommodation and food services including restaurants and cafés). While the lockdown had a dramatic effect in reducing corporate cash flows – estimated at £140bn by the BoE – that effect is now largely behind us, although it will have lingering balance sheet effects. This productivity effect shapes the post-lockdown period through its impact on lower profitability.

In the traditional ‘search and matching’ model of the jobs market, lower productivity leaves the Beveridge curve that we have just illustrated largely unaffected. But it pivots the ‘job creation condition’ shown in Figure 3 that determines outcomes in the jobs market alongside the Beveridge Curve. In this model, lower productivity raises unemployment by initially lowering profitability. Businesses shed jobs as a way of trying to restore their profitability (at lower wages).

This framework captures key parts of what is happening in the jobs market. But it can also understate the sensitivity of employment to Covid-19 via impaired productivity. In particular, it can understate the role of ‘marginal jobs’ and marginal profitability.

Marginal Jobs At Risk

While average profitability is squeezed as the economy re-opens subject to social distancing, some fraction of an employer’s (marginal) staff may be made completely unprofitable. These are the marginal jobs that generated little surplus to the employer, even before Covid-19. This fraction of marginal jobs at risk adds to unemployment volatility and the expected rise in unemployment (Elsby and Michaels, 2013).

As an example, Gregg notes that company profitability had fallen by 20% even before Covid-19 struck. Yet, this provides little guide to the fraction of marginal jobs at particular risk that is likely to play a key role.

Nonetheless, this point echoes Gregg’s suggestion that companies could recognise that “Holding on to too many workers will push them to bankruptcy”. Implicitly, Gregg’s view is that the fraction of marginal jobs is also high. Ultimately, though, this is an empirical question.

Are 10% of Jobs ‘Marginal’?

Despite this importance, most survey data do not shed much light directly on the incidence of marginal jobs most sensitive to businesses’ need to restore their profitability. Most business surveys simply ask businesses whether they plan to raise or lower employment, not by how much. In current circumstances, asking businesses about the fraction of staff they will let go is potentially much more informative.

The BoE’s Decision Maker Panel survey suggests businesses will reduce employment by 9.1%, on average (unweighted) by Q4 on account of Covid-19. Weighted by each sector’s share of total employment brings this employment reduction to 10.2% of all jobs. Those sectors most affected by Covid-19 are also more labour-intensive. Businesses in the Accommodation and Food services sector expect employment to be 20% lower by Q4.

This survey provides one estimate of the fraction of marginal jobs. But could 10% of all jobs really be eliminated, being made unprofitable by Covid-19? Given its critical role, more light needs to be shed on this fraction of marginal jobs.

Figure 4: Estimated Incidence of Marginal Jobs At Risk is High (But Uncertain)

Source: BoE Decision-Maker Panel (May, 2020). The survey question asks: “Relative to what would have otherwise happened, what is your best estimate for the impact of the spread of coronavirus (Covid-19) on employment at your business in 2020 Q2, 2020 Q3, 2020 Q4 and 2021 Q1?”

Summary and Conclusions

The critical importance of job separations in driving rising unemployment has rightly gone a long way to motivate the Covid-19 Job Retention Scheme. Unemployment would have risen to 7.4% (an additional 1.2million) by April and to 10.0% (by 2.1million) in May, absent the CJRS.

That estimate goes a significant way to justify the scheme. The remainder of the 9million furloughed jobs imply a straightforward transfer that has simultaneously supported business cash flow and employee earnings via job attachment.

As the economy re-opens, but subject to social distancing, impaired productivity and profitability in the ‘in-person’ services sector pose the main risk to the UK jobs market. The CJRS has provided a bridge to that point. Yet, the risk at that stage will be that businesses try to restore their average profitability by shedding ‘marginal’ jobs.

Some survey data suggest that these jobs at particular risk amount to 10% of all jobs – a high incidence. Yet, we need better data on this incidence of marginal jobs, their sensitivity to the cycle and their sensitivity to different policy options.

Andrew Benito is a visitor at NIESR