Migration and the public finances in the long run: the OBR’s fiscal sustainability report

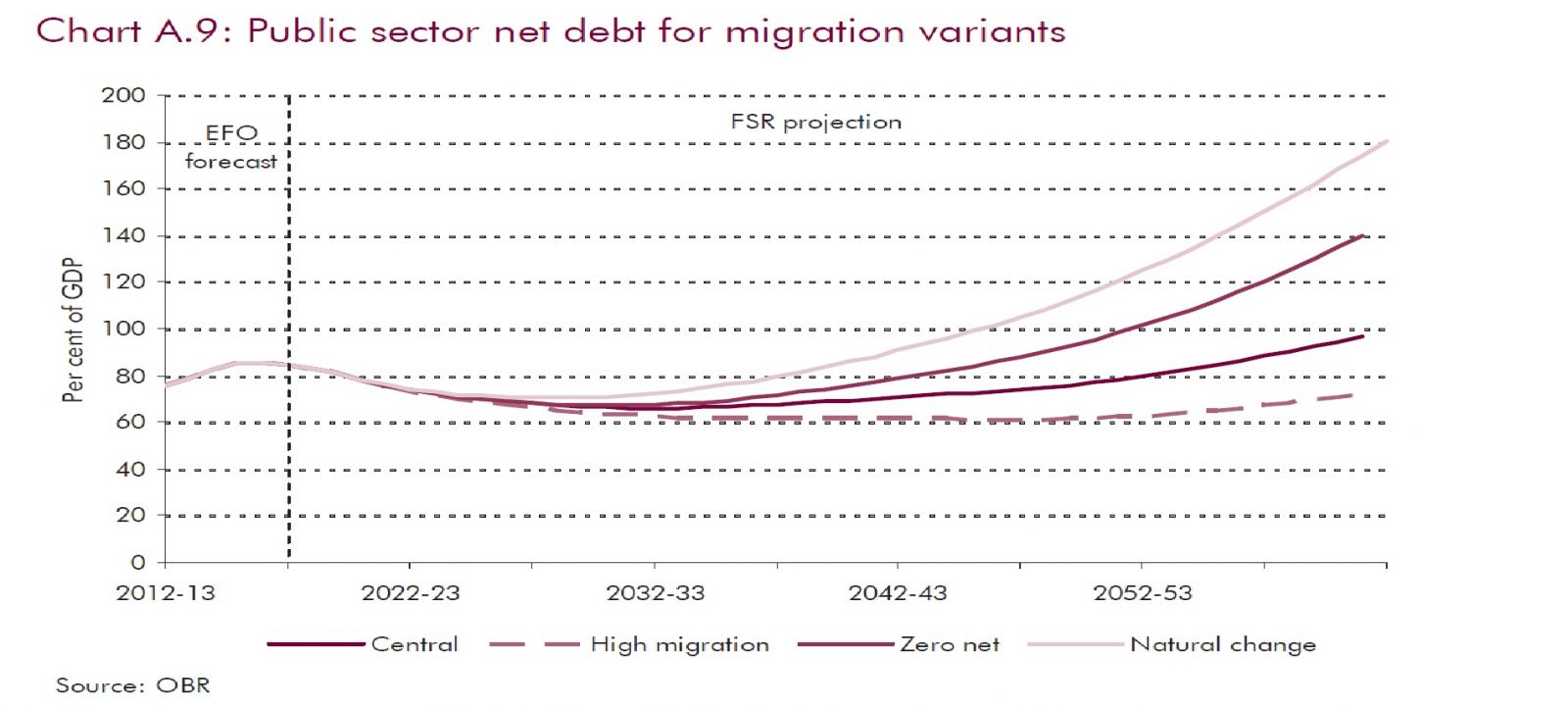

The Office of Budget Responsibility’s Fiscal Sustainability Report was published on Wednesday. Somewhat to my surprise – and I suspect the OBR’s – the most headline-grabbing aspect of the report turned out to be Annex A, on “The Impact of inward migration in the long-term projections”. Much attention focused on this chart, which shows that if we had zero net migration – instead of the OBR’s assumption of net migration of 140,000 per year – the debt to GDP ratio would be 40 percent higher, making an already difficult long-term fiscal position far worse.

First, this generated headlines like “Britain needs millions of immigrants to reduce strain of ageing population“. This in turn produced a predictable backlash: “any notion of Britain importing another six million immigrants – as advocated by the Office for Budget Responsibility – is crackers.” There were also more reasoned critiques, which tended to boil down to “doesn’t the OBR realise immigrants get old and/or have children”?

What are the implications of the OBR analysis? In order to understand them, we need to be clear what the OBR is and is not doing, and hence which conclusions and criticisms are valid and which are not. The OBR analysis assumes that immigrants are identical to natives, except for their age structure. They recognise that this is a simplifying assumption: they have a good and balanced review of the evidence, which shows that immigrants tend to be more skilled and somewhat higher paid than natives, but to have slightly lower employment rates, but they draw no quantitative conclusions from this and other evidence.

This simplification means that in the OBR model immigrants make the same contributions to tax revenues as natives of the same age, and impose the same costs on public services. But – given that migrants mostly come here as adults – the implication is that migration is good for the public finances. The OBR explains:

Given this pattern, it seems probable that immigrants will make a more positive contribution to the UK public finances over their lifetimes than natives. They are relatively more likely to arrive as adults, so the UK will receive the positive contribution from their work without having to pay for their education, although their children will require support. It is also the case that upon arrival, if unemployed, they are not immediately entitled to – or are not eligible for – unemployment benefits, and they will contribute to tax receipts as soon as they start working. Those who spend enough years working in the UK will be eligible for state pensions once they retire, but to the extent that they leave the UK in later years, they will not require access to health and long-term care support.

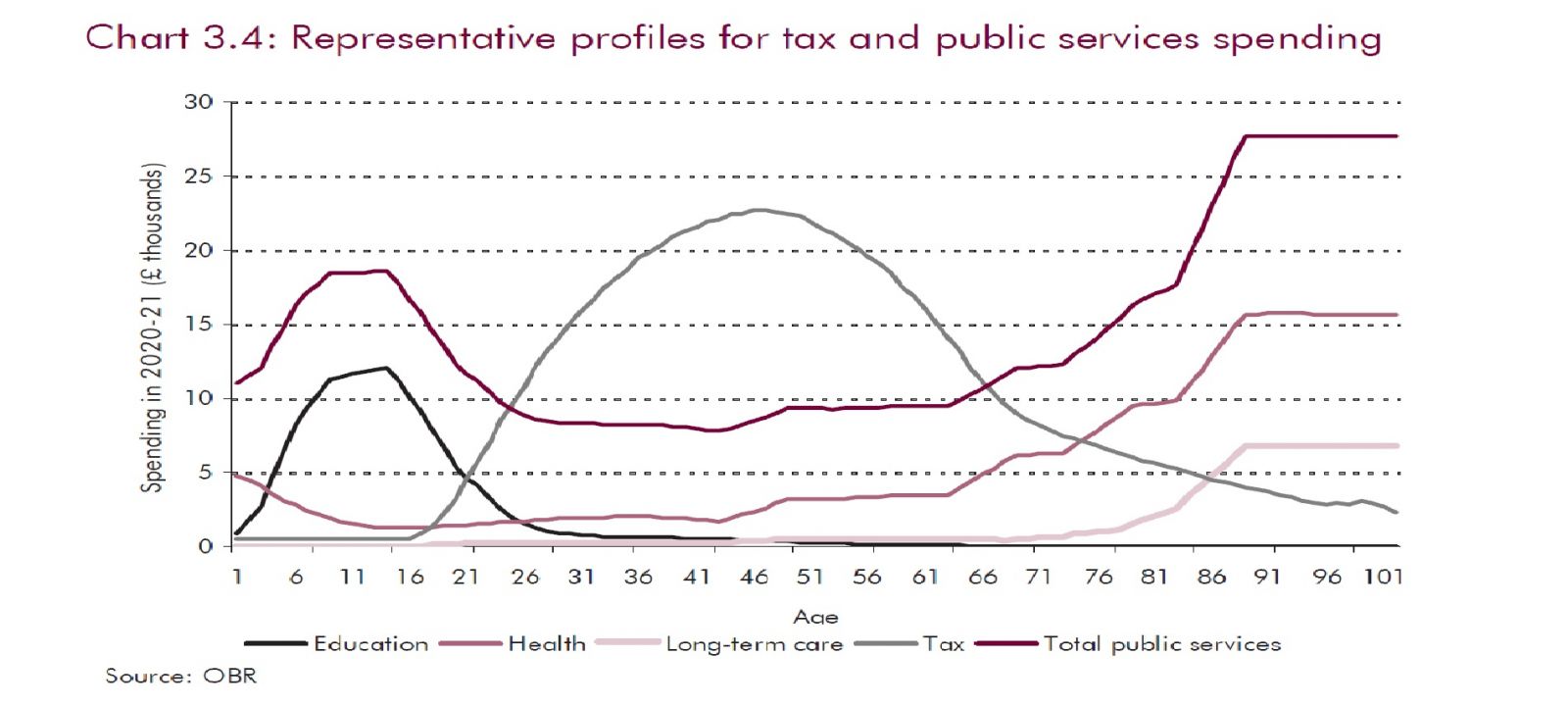

In other words, migrants’ net positive contribution is a logical consequence of this chart:

which shows that on average, not surprisingly, children and old people are a net fiscal burden, while people in work, especially “prime-age” workers, make a large fiscal contribution.

A few important points emerge from this:

-

the analysis is basically arithmetic. It is saying that if immigration runs at lower or higher levels than the central scenario there will be consequences for taxes and spending, and these will be quite large. By the middle of the century, the impact on the deficit of moving to zero net migration would be more than 2 percent of GDP, well over £30 billion in today’s money.

-

the OBR analysis definitely does not ignore the fact that immigrants get old and have children. That is fully incorporated into the population projections. The OBR analysis does stop in 2062, and not all new immigrants will be old by then, so the full effects of extra immigration haven’t worked through; but it has to stop somewhere and 50 years is quite a long time

-

nor does the analysis ignore the fact that immigrants need health care, have kids who need to go to school, and will eventually draw pensions. Spending is assumed to rise to reflect the increased population and the change in the age structure resulting from migration.

-

the lifecycle chart above shows definitively that the fiscal benefits from immigration are not just in the short term or a “Ponzi scheme”; there is a significant positive fiscal impact from extra migration over the full life-cycle of the extra immigrant. This result is well known in the economics literature already – see here.

-

however, the analysis does not take into account the fact that immigrants are likely to be different from natives (in more respects than just age). My view of the evidence is that immigrants are likely to be in some respects at least complementary to natives, enhancing overall productivity, which would of course mean that the fiscal impact of lower immigration would be even more negative; but it is perfectly reasonable for the OBR not to attempt to quantify this in their models.

-

it is true that the OBR’s central projection assumes population continues to rise throughout this period, although at more or less the same rate as it has done over the last century. The OBR does not attempt to take into account any negative impacts of “congestion” resulting from extra population growth (although it does, as I note above, assume spending increases to match that growth).

What can we conclude from this? First, I should state that I do not think mitigating the fiscal consequences of demographic change can be achieved through increasing immigration alone. As I wrote (in 2001):

one way or another, the ageing of the population will have to be addressed: presumably by some combination of these changes inlabour market activity, increases in the fertility rate, net migration, changes to the provision and financing of public services, and increases in productivity (including increasing the skills of the labour force at large). There is no “right” level of net migration to address demographic change, and migration is only one (and unlikely the most important) of a number of measures likely to be used to address this problem