Monday’s Macro Memo: Beliefs, Networks, History and the Housing Premium Puzzle

This is week five of my posts featuring research presented at the conference on Applications of Behavioural Economics and Multiple Equilibrium Models to Macroeconomics Policy Conference held at the Bank of England on July 3rd and 4th 2017.

This is week five of my posts featuring research presented at the conference on Applications of Behavioural Economics and Multiple Equilibrium Models to Macroeconomics Policy Conference held at the Bank of England on July 3rd and 4th 2017.

Hector Calvo-Pardo, from the University of Southampton presented his paper on social networks, coauthored with Luc Arrondel Research Director at CNRS in Paris, Chryssi Giannitsaro of Cambridge University and Michael Haliassos of Goethe University. Alan Taylor, a Professor at UC Davis, helped organize the conference. In a linked video, he discusses an amazing new data set developed jointly with Òscar Jordà, Vice President of the Federal Reserve Bank of San Francisco and Moritz Schularick, Professor of Economics at the University of Bonn.

Quoting from the paper [page 2]

“…we design, field and exploit novel survey data that provide measures of stock market participation (relative to individuals’ financial wealth), connectedness, but also of subjective expectations and perceptions of stock market returns via probabilistic elicitation techniques. Our empirical analysis exploits cross-sectional variation for a representative sample by age, asset classes and wealth of the population of France, collected in two stages, in December 2014 and May 2015.

… the questionnaire [also] contains a rich set of covariates for socioeconomic and demographic controls, preferences, constraints and access and frequency of consultation of information sources, typically absent from social network empirical studies.

And this is where networks come in:

[our data set] … contains specific questions designed to obtain quantitative measures of relevant network characteristics that enable identification of information network effects on financial decisions from individual answers…”

ACGH break up a person’s network into a small inner circle of contacts who are financially knowledgeable, and a separate larger set of contacts who are not. They find significant peer effects from contacts in the financial network to a person’s beliefs about future financial variables. The paper provides evidence of how beliefs spread through social networks, a mechanism that may help to promote the spread of asset prices bubbles. I recommend listening to Hector’s explanation in his own words, linked below.

The unifying theme in all of these papers is a new data set that the authors have painstakingly assembled. Here I quote from JKKST (2017):

“Our paper introduces, for the first time, a large dataset on the rates of return on all major asset classes in advanced economies, annually since 1870. Our data provide new empirical foundations of long-run macro-financial research. Along the way, we uncover new and somewhat unexpected stylized facts.

… Notably, housing wealth is on average roughly one half of national wealth in a typical economy, and can fluctuate significantly over time… But there is no previous rate of return database which contains any information on housing returns.”

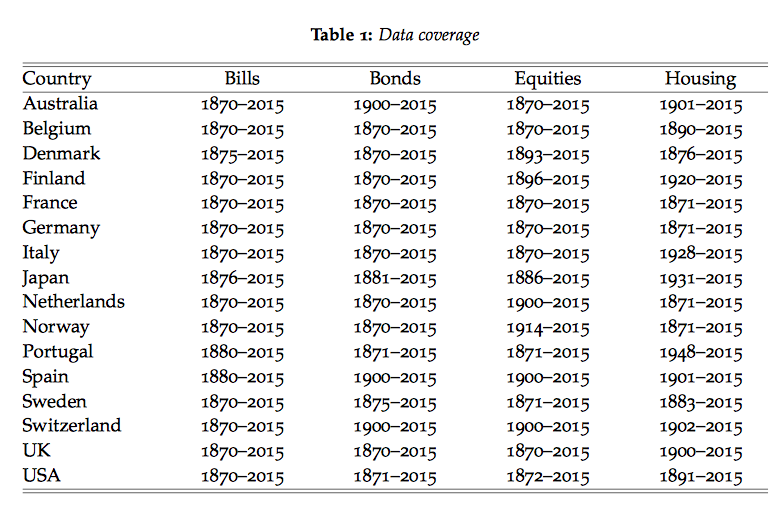

Table 1 shows the extent of the coverage which includes sixteen advanced economies for 145 years.

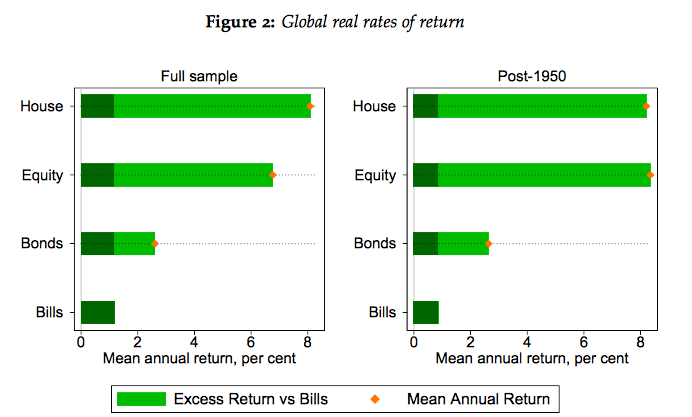

There are many nuggets to be mined here, some of which have already been dug out by the authors. For example, it is well known that the return to equity has been 5% higher than the return to T-bills in a century of US data, a fact that Rajnish Mehra and Ed Prescott labeled the equity premium puzzle. JKKST provide evidence that the equity premium puzzle is universal across all sixteen economies and, in addition, there is a second ‘housing premium puzzle’, documented in Table 2. This second puzzle is all the more intriguing since the variance of returns to housing are significantly lower than the returns to equities.