Monday’s Macro Memo: Do Low Interest Rates Punish Savers?

This is the second of my posts on the conference: Applications of Behavioural Economics, and Multiple Equilibrium Models to Macroeconomic Policy, held at the Bank of England on July 3rd and 4th. I feature two papers written by officials from the Federal Reserve System.

This is the second of my posts on the conference: Applications of Behavioural Economics, and Multiple Equilibrium Models to Macroeconomic Policy, held at the Bank of England on July 3rd and 4th. I feature two papers written by officials from the Federal Reserve System. James Bullard, President of the Federal Reserve Bank of St. Louis, discusses the implications of his recent research for low interest rates . And Kevin Lansing, a Research Advisor at the Federal Reserve Bank of San Francisco, discusses his work on multiple equilibria.

James Bullard: President of the Federal Reserve Bank of St. Louis

Jim’s fascinating and timely presentation was based on a research paper that he co-authored with Costas Azariadis, Aarti Singh and Jacek Suda. In that paper, Jim and his co-authors construct a stylized model of an economy with long-lived people and they study the determinants of interest rates. In a video, linked here, Jim discusses the implications of his academic research for a hot political topic: the persistence of very low interest rates almost ten years after the end of the 2008 financial crisis. In his view, there is not much the Fed can do about low interest rates; monetary policy is simply allowing the price of borrowing, aka the interest rate, to equate supply and demand. In his words, “you don’t want to encourage the suppliers too much or you’ll get oversupply: you don’t want to encourage the demanders too much or you’ll get a shortage, so the price brings these two into balance”.

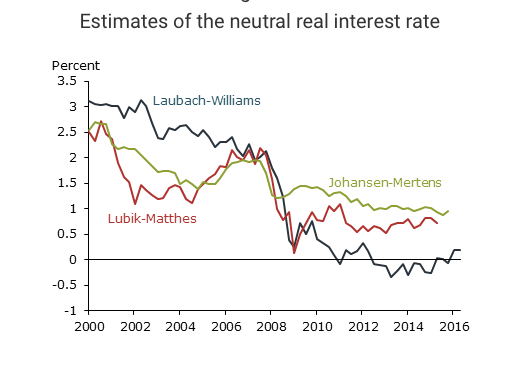

Figure 1: Source Bauer and Rudebusch

Although he doesn’t say it explicitly in his talk, Jim is referring here to what economists call the ‘real interest rate’; that is, the money interest rate adjusted for expected inflation. The real interest rate is the price that borrowers must pay to trade future for present consumption goods and much recent research suggests that this price has fallen steadily over the past couple of decades as the Chart in Figure 1 shows. This chart is reproduced from a Federal Reserve Bank of San Francisco Letter, by Michael Bauer and Glenn Rudebusch which discusses possible reasons for the decline in what Jim Bullard calls the “neutral price”. This is the market real interest rate that equates the supply of savings by lenders with the demand for savings by borrowers. Critics of the Fed blame loose monetary policy and past Fed mistakes for the current period of low rates and although I have some sympathy for this argument, it is not easy to come up with convincing explanations for permanent effects of Fed policy on the real as opposed to the monetary interest rate. In my view: the jury is still out.

Jim takes the position in his talk that the neutral real interest rate is independent of central bank policy. But is it? A second theme that arose at the conference is that any given central bank policy can lead to more than one equilibrium outcome. That theme was taken up by Kevin Lansing, a Research Advisor at the Federal Reserve Bank of San Francisco. I discuss Kevin’s work below.

Kevin Lansing: Research Advisor at the Federal Reserve Bank of San Francisco

Kevin’s pioneering research explores the idea that there may be more than one inflation rate associated with any given monetary policy. In normal times, the interest rate is positive and the central bank raises or lowers it to cushion the effects on the economy of shocks to demand and supply. But if the central bank lowers the interest rate too far and too quickly, as it did in 2008, the economy may become stuck in a low inflation rate trap. One possible solution that Kevin discusses is to raise the central bank’s inflation target. This is an idea that has been floated by a number of authors; (see for example, the Vox piece by Laurence Ball of Johns Hopkins University). Kevin finds that although a higher inflation target may mitigate the problem, it doesn’t remove it entirely. You can hear Kevin describe his paper, in his own words, here.

How should we reconcile these two conference contributions?

Jim is sympathetic to the idea that there may be multiple equilibria and he has discussed the idea elsewhere that the economy may switch occasionally between two regimes. In one regime, the real interest rate is high: In the other regime it is low. He does not take a stand on what causes the switch from one regime to the other.

Kevin’s research addresses a related, but different question. Like Jim, Kevin does not take a stand on what determines the real interest rate. He asks, how does central bank policy influence inflation and he points out that any given central bank policy may be consistent with more than one inflation rate.

You can watch the video of their contributions from the links within the text, or below (browser dependent)