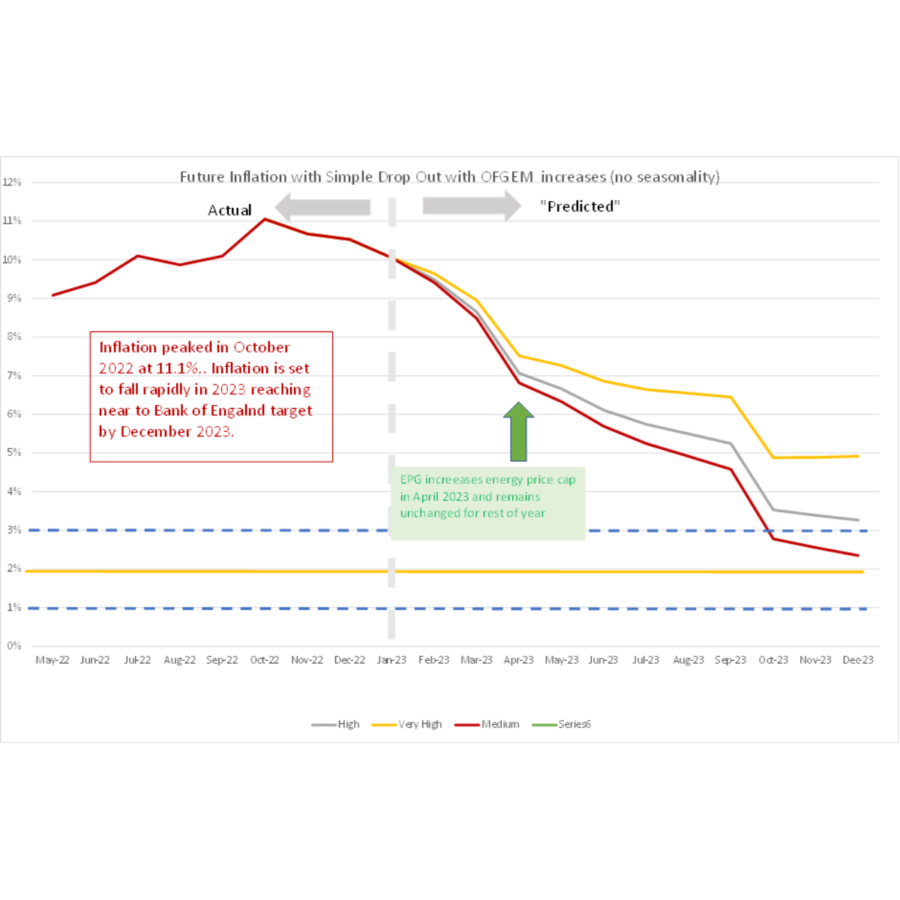

Rate of Inflation Set to Return to Historic Averages in 2023

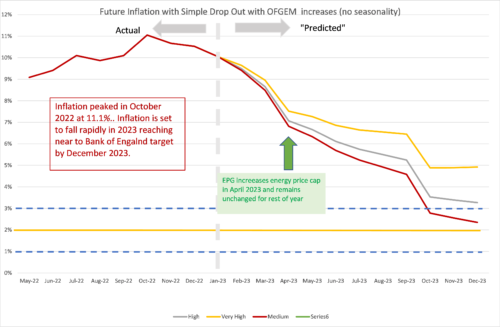

CPI fell to 10.1% in January from 10.5% in December. The new inflation coming in from December to January was -0.6%, meaning that prices were lower in January than in December. This is great news for inflation, which we can now see peaked in October 2021 and is set to fall rapidly in 2023 to reach close to the Bank of England’s target by the end of 2023.

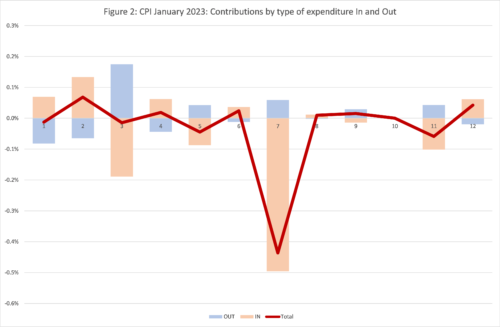

Month on month inflation was positive for 6 out of 12 types of expenditure and negative for 5. The three main contributors to the change in annual CPI inflation in October were:

- Transport -0.5 percentage points

- Restaurants and Hotels -0.09 percentage points

- Alcohol and Tobacco 06 percentage points

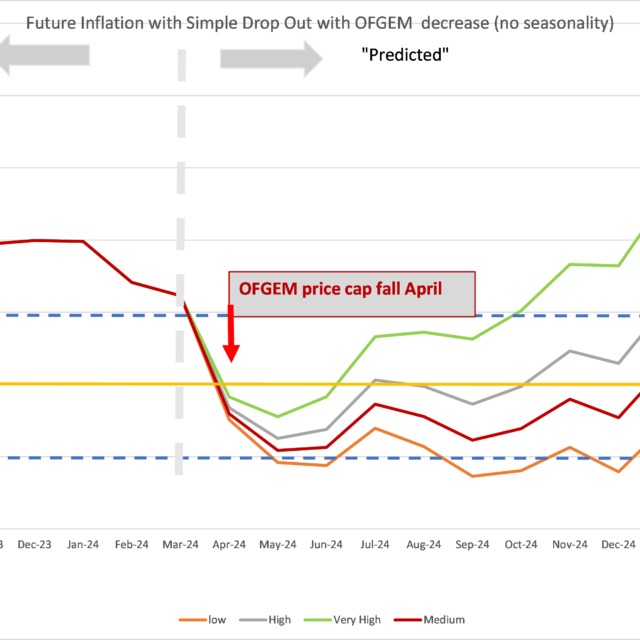

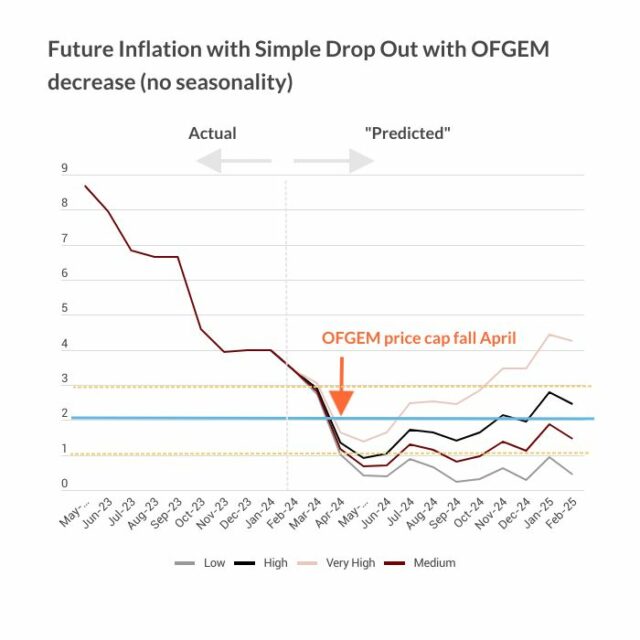

Month on month inflation was extremely high from February to May 2022, so, as we move forward into 2023, inflation will fall as these big increases drop out. The tug of war between the new inflation dropping in and the old inflation dropping out will almost certainly see the old inflation winning and inflation falling. Unless geopolitical issues deteriorate substantially, it seems likely that new inflation will become more in line with historic averages. Even the increase in the OFGEM price cap in April will be overwhelmed as the huge increase in April 2022 drops out.

The future path of inflation will depend on how the Russo-Ukrainian war affects the world economy and the impact of sanctions imposed on Russia by the Western powers. On December 5th, the G7 and EU introduced a price-cap of $60 per barrel on exports of Russian oil. The main mechanism to enforce this is via the provision of insurance and other services by companies in the G7 and EU (details of the UK implementation are detailed in Russian oil services ban). The idea is that when the price-cap is operating, the G7 and EU countries can insure and provide services to expedite the supply of Russian oil and hence avoid a reduction in the world oil supply. World oil prices remain subdued and there seems to be little expectation in the market of future increases. This indicates that the policy may have been effective in preventing an increase.

The supply of natural gas is highly inelastic in the short run as is the demand. Reductions in Russian supply have led to dramatic rises in price in 2022 and an increase in expenditure and hence the revenue of gas suppliers. Whilst the EPG will reduce CPI inflation in the UK, it will not increase the supply of natural gas, or the real price (net of the subsidy) paid to gas suppliers. Thankfully, the recent mild weather in western Europe meant that power cuts have not been necessary. The price of gas has declined significantly in recent months and is currently below the levels seen in 2022; this will significantly lower the cost of the EPG for the UK government and in the longer run lead to downward pressure on inflation. A slowdown in growth in the World as the cost-of-living crisis affects real incomes and leads to a reduction in discretionary consumer expenditure will lead to a decline in some commodity and energy prices across the world. This will mitigate the inflationary pressures somewhat, as we have already seen in the US.

China’s zero covid policy has had a major impact on the Chinese economy and global supply chains in 2022. However, the Chinese government has ended the zero covid policy in response to protests across the country against the lockdowns. This is a positive development and has lead to a freeing up of world supply chains originating in or passing through China in 2023, which will have a downward effect on inflation.

Turning back to the October inflation figures, we can look in more detail at the contributions of the different sectors to overall inflation in Figure 2, with the old inflation dropping out of the annual figure (November-December 2021) shown in blue and the new monthly inflation dropping in (November-December 2022) shown in Brown, using the expenditure weights to calculate CPI. The overall effect is the sum of the two and is shown as the burgundy line.

We can see that for most types of expenditure, there drop-outs from the previous year (the Blue team) and the drop-ins (the Brown team) are of opposite sign. January 2023 is very similar to January 2022. Thus for Clothing and Footwear a big fall in prices this January are similar to the falls last year leading to a very small overall effect, as is the case for Food.

The big exceptions are Transport and Restaurants and Hotels, where big negative drop ins predominate.

Extreme Items.

Out of over 700 types of goods and services sampled by the ONS, there is a great diversity in how their prices behave. Each month some go up, and some go down. Looking at the extremes, for this month, the top ten items with the highest monthly inflation are:

| Table 1: Top ten items for month-on-month inflation (%), January 2023 | |

| ELECTRIC RAZOR | 36.04 |

| CREAM LIQUER 70CL-1LT 14-20% | 31.57 |

| SMART SPEAKER | 29.88 |

| EBOOKS | 27.03 |

| ELECTRIC TOOTHBRUSH | 15.29 |

| COMPUTER GAME DOWNLOADS | 14.10 |

| COFFEE SACHETS PACK | 13.96 |

| MODEL RD VEHICLE EG HOT WHEELS | 13.06 |

| PRIVATE HEALTH CARE 1 | 12.45 |

| PRIVATE HEALTH CARE 3 | 12.45 |

The ten items with the highest negative inflation this month are shown in Table 2.

| Table 2: Bottom ten items for mom inflation (%), January 2023 | |

| WOMENS SHORT SLEEVE FORMAL TOP | -13.41 |

| CD ALBUM (TOP 40) | -13.82 |

| GIRLS JACKET (5-13 YEARS) | -14.28 |

| CDS- PURCH OVER INTERNET | -18.73 |

| GOLF GREEN FEES | -19.91 |

| ROADSIDE RECOVERY SERVICE | -25.77 |

| EURO TUNNEL FARES | -26.37 |

| CD ALBUM (NOT CHART) | -35.22 |

| AIR FARES | -41.75 |

| COACH FARES | -45.69 |

A great month for travel. CDs also a good purchase for those who still have CD players.

In both these tables we look at how much the item price-index for this month has increased since the previous month, expressed as a percentage. These calculations were made by my PhD student at Cardiff University, Yang Li.

Looking Ahead: Ukraine and beyond

We can look ahead over the next 12 months to see how inflation might evolve as the recent inflation “drops out” as we move forward month by month. Each month, the new inflation enters the annual figure and the old inflation from the same month in the previous year “drops out”.[1] However, the invasion of Ukraine by Russia and the western sanctions in response continue to make things uncertain. That said, the world economy seems to have adapted to the dislocation caused as supply chains are re-routed and the effect seems to be abating and is not getting as bad as some had feared. We have therefore ended the “Sanctions scenario” introduced last March in response to the invasion. We depict the following scenarios for future inflation dropping in:

- The “medium” scenario assumes that the new inflation each month is equivalent to what would give us 2% per annum – 0.17% per calendar month (pcm) – which is both the Bank of England’s target and the long-run average for the last 25 years. This is a reference point only, as inflation will be well above this level for the next year.

- The “high” scenario assumes that the new inflation each month is equivalent to 3% per annum (0.25% pcm).

- The “very high” scenario assumes that the new inflation each month is equivalent to 5% per annum (0.4% pcm). This reflects the inflationary experience of the UK in 1988-1992 (when mean inflation was 0.45%). It also reflects the continuation of the UK average in the second half of 2021. This level of month-on-month inflation would indicate a significant break from the historic behaviour of inflation from 1993-2020.

In recent months our central forecast was the “very high scenario”. However, as inflationary pressures fall, we will adjust our central forecast to the “high” and hopefully later on back to the historic “medium” scenario consistent with 2% annual inflation.

We have dropped the “low” scenario from previous releases as this is still likely to irrelevant for 2023. In all scenarios, there is a rapid fall in inflation from February 2023, which is due to the drop out of the high inflation figures in the corresponding months this year. However, inflation will remain well above 2% for the whole of 2023. There will be a significant change in expenditure weights used to calculate inflation, with energy related expenditures being given more prominence in the “consumer basket” in 2023. If energy prices subside quickly, this might lead to a more rapid fall in the headline CPI inflation rate.

This forecast assumes that geopolitical tensions do not deteriorate. Direct conflict between Russia and NATO would rapidly worsen the picture for inflation. Looking east, if the rising tensions between the US and China lead to an intensification of the trade war or even open military conflict in the South China sea or Taiwan (Republic of China), world supply chains would be disrupted, and inflation significantly raised. However, the recent local elections in Taiwan, with good results for the opposition KMT party – which supports the “one China” policy and opposes the separatist government – suggests that the Taiwan issue may calm down for some time (at least until elections in 2024). There may be a negotiated settlement to end the war in Ukraine in 2023, which would stabilise the economic situation and lead to a further reduction in commodity and energy prices, especially if sanctions on Russia are eased as part of the settlement.

Figure 2: Looking forward to December 2023

For further analysis of current and future prospects for inflation in the UK see:

NIESR Blog: Is the governments energy price plan fit for purpose?

How does Inflation affect the economy when interest rates are near zero? Economics Observatory.

How are rising energy prices affecting the UK economy? Economic Observatory.

NIESR Economic Outlook Summer 2022

[1] This analysis makes the approximation that the annual inflation rate equals the sum of the twelve month-on-month inflation rates. This approximation ignores “compounding” and is only valid when the inflation rates are low. In future releases I will add on the compounding effect to be more precise at the current high levels of inflation.