Rising Interest Rates and Higher Mortgage Repayments: What’s the Impact on Households?

As inflation increases and interest rates rise, higher mortgage repayments will add to the cost-of-living crisis that is affecting millions of households across the UK. Our Director Prof. Jagjit S. Chadha spoke with our Deputy Director Prof. Adrian Pabst and our Economist Max Mosley about the distributional impact of rising interest rates. NIESR has previously estimated the effect of peak interest rates on those households with a variable rate mortgage. Recent research by the Public Policy team led by Prof. Pabst extends the previous analysis by estimating the effect that higher interest rates could have on those households with a fixed rate mortgage. The work also updates NIESR’s projections for households with no savings by taking into account the effect of peak interest rates.

What is the distributional impact of rising interest rates and higher mortgage repayments?

The research paints a dire picture for millions of households. Overall, nearly 4 million households will see higher monthly mortgage repayments as a result of higher interest rates. With an interest rate of 4.75 per cent, the typical monthly repayment on a fixed-rate mortgage will rise from around £700 to £1,100 on average, and from around £500 to £900 on average for those on a variable-rate mortgage. That represents a 50 per cent increase.

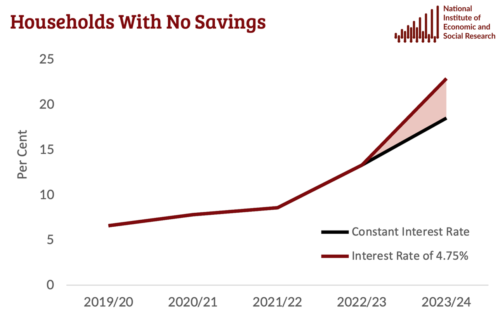

This £400 increase in monthly repayments will wipe out the savings of a further 1.4 million households by 2024 as a result of higher mortgage repayments. This would take the total number of households with no savings to around 7 million, that is 25 per cent or 1 in 4 UK households.

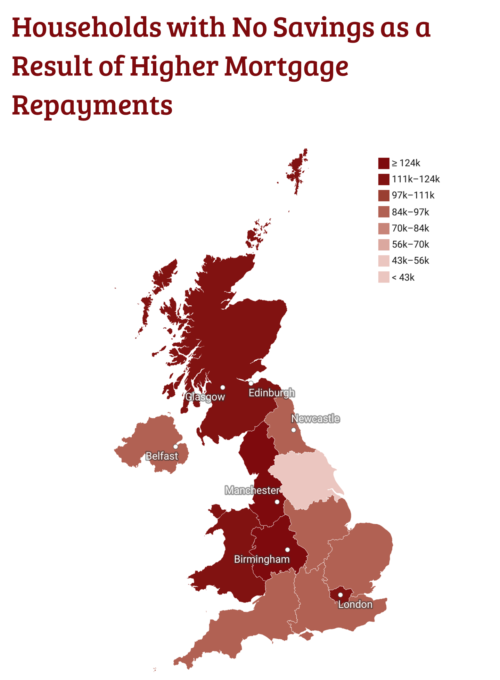

There is a strong regional dimension to this pattern. The households who will lose out the most are concentrated in the West Midlands, the North West, Wales and Scotland, which are home to some of the most economically and socially deprived areas of the country.

How did you arrive at these numbers?

Based on the ONS Wealth and Assets Survey (2022) and using the standard Robert Kohn equation, we are able to analyse a representative sample of around 15,000 households, including their financial characteristics and what part of the country they are in. This allows us to increase the bank rate in line with market expectations or existing NIESR forecasts, and our latest projection is for a peak bank rate of 4.75 per cent.

So far our analysis has focused on those households with variable rate mortgages, as they would be more affected in the short run from changes in the bank rate than those on fixed rate mortgages. Now UK Finance have estimated that 1.8 million households on a fixed rate mortgage will have to refinance in 2023. This allows us to extend the previous analysis to incorporate the effect of re-mortgaging. As 1.8 million is about 27 per cent of the total number of households on a fixed rate mortgage (6.5 million), we assign the new higher interest rate to 27 per cent of households on a fixed rate mortgage in our sample and increase their monthly repayments accordingly.

To determine the impact of higher monthly payments alongside higher energy and food bills on people’s living standards, we apply these findings to our previous projections of household savings. NIESR’s model is able to split rent and mortgage payments apart and to have them develop at differential rates. Our findings simulate what is likely to be on the horizon for millions of households in the UK and provides policymakers with clear insights of how this additional income shock could affect living standards.

What should policy-makers consider doing?

In general, better off households hold a mortgage but the greater concern is a rapid increase in unsecured debt. The stock of mortgage debt is about £1.65 trillion, which represents approximately 75 per cent of GDP. A £400 increase in monthly debt for 3 million households is 1.2 billion per month or £14 billion per year or around 0.5 per cent of GDP. This the demand contraction from higher interest rates and a necessary adjustment in the face of soaring inflation.

Our analysis suggests that increased mortgage repayments could have been absorbed by households in ‘normal times’, but the once-in-a-generation cost-of-living crisis means that increased mortgage repayments will likely push millions of households to the edge of insolvency. We need further targeted help to limit private indebtedness and avoid the prospect of home repossession.

There are two potential mechanisms. One is for mortgage lenders to exercise careful judgement about who is suffering a temporary shock to incomes and how best to help. Forbearance is an important principle when it comes to households with fundamentally sound finances but with an unexpected short-term repayment problem. The other mechanism is to establish a Housing Support Fund worth £2 billion administered at local authority level to help with fast-rising housing costs – both mortgage repayments and rents.

Our interventions are designed to limit extreme problems for the households facing payment issues. Given the sequence of shocks, the finances of many households are fragile and require targeted support.