Should the Bank of England Lose its Independence?

Chancellor Kwasi Kwarteng said that the Bank of England’s independence is “sacrosanct,” trying to dampen speculation about the government curtailing the Bank’s autonomy. This blog argues that there are good reasons for considering formally reducing the Bank’s independence.

Chancellor Kwasi Kwarteng said that the Bank of England’s independence is “sacrosanct,” trying to dampen speculation about the government curtailing the Bank’s autonomy. This blog argues that there are good reasons for considering formally reducing the Bank’s independence. First, it is not as independent as it looks. Second, and most important, it lacks the accountability to make intrinsically political judgements about the trade-off between unemployment and inflation over the coming years. Third, the Bank currently lacks competence and credibility. The main argument against reducing its independence is that the alternative is worse and so it may be better to make the Bank more independent, not less.

The Bank of England is less independent than it appears. The government owns the Bank (since 1946) and the three Deputy Governors on the Monetary Policy Committee are ex-Treasury. The 1998 Bank of England Act gave the Bank operational independence over monetary policy, which means the government sets the targets and the Bank acts as an agent in striving to achieve them. The Treasury has Reserve Powers to give instructions to the Bank and its wish to avoid such an order could sway Bank decision-making, especially when it is dependent on the Treasury to protect its capital. Future Prime Minister Truss speculating in the summer that she might trim the Bank’s independence exerts pressure on the Bank to do what the government wishes.

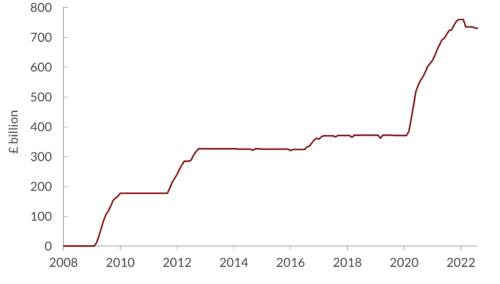

The Bank lost substantial independence due to Quantitative Easing (QE), which intensified Bank/Treasury cooperation. The Treasury must authorise quantitative easing and indemnifies the Bank against losses – effectively, therefore, the Treasury is the principal in QE and the Bank the agent. Agents do what principals want. Quantitative Tightening (QT) requires coordination with government debt managers. Moreover, financial risks to the Treasury, since it indemnifies the Bank, lead to substantial Bank/HMT discussions over balance sheet management. Treasury input on QE and QT, and therefore monetary policy, inevitably reflect fiscal considerations. This input risks monetary policy falling into fiscal dominance, where monetary policy is set to meet fiscal and therefore political objectives. The explosion of the Bank’s balance sheet during the fifth episode of QE during the Covid-19 crisis doubled the Bank’s gilt holdings (Chart 1) and funded the enormous increase in the government’s fiscal deficit. Monetary policy in this period, even more than before, was a quasi-fiscal operation. The Bank’s recent temporary foray back into QE in response to the markets’ reaction to the mini-budget is redolent of monetary financing and fiscal dominance. Since QE and QT substitute for rate moves, Treasury influence extends indirectly to interest rate policy.

Chart 1

When Gordon Brown set the Bank’s mandate in 1997 as delivering 2% inflation, the decisive battles over inflation had been won. Significant unemployment increases brought inflation down in the 1980s and early 1990s (Chart 2), requiring tough political choices. By 1997, however, with both falling, there was no contradiction between keeping inflation subdued while achieving low unemployment. The Bank was handed the tiller and told to steer a steady inflation course. It has spectacularly failed in that and there are now tough intrinsically political inflation-unemployment choices.

Chart 2

There is currently a vicious contradiction between low inflation and moderate unemployment. After years of arguing that inflation is unresponsive to unemployment, central banks now claim that reducing inflation will require only modest joblessness increases. This belief is delusional. Choosing the speed of inflation reduction is an intensely political decision given the output and unemployment costs and should not be taken by unelected central bankers. When policy creates large-scale winners and losers, democracy requires that politicians should take the decisions. Technocratic decision-making may help to fuel populism. Both populism and technocracy stem from a distrust of deliberative democracy.

The Bank of England’s independence previously served the UK well because the environment was non-inflationary, and the Bank was competent and credible. However, the environment has changed, and the Bank’s credibility has evaporated. It was addicted to quantitative easing (QE) and maintained a super-soft monetary policy for far too long. Covid 19 and the Ukraine-Russia war provided the sparks that ignited the ocean of inflationary fuel the Bank had created. In its September meeting, the Bank delivered a 50bp rate hike rather than a sorely needed 75bp. There was even one vote for 25bp, underlining the Bank’s lost inflation-fighting credibility. That loss explains the markets’ reaction to the mini-budget. A fiscal expansion with a credible central bank would give no change in inflation expectations, higher expected future interest rates, and exchange rate appreciation. In practice, inflation concerns soared, and the currency tumbled, showing that neither fiscal nor monetary policy is credible.

Now, the Bank is playing catch-up. With asset prices, including housing, geared to excessive monetary slack and with monetary policy affecting the economy over months if not years, the MPC is hiking rates in a fog. Excessively sharp rises to try to recapture squandered credibility risk driving the economy into a deep recession. The recent pension fund Liability Driven Investment (LDI) crisis symptomises a larger malaise stemming from QE-driven asset price distortions. Given its evident incompetence in forecasting, there are questions about entrusting monetary policy decisions to the current Bank.

If decisions on monetary policy were to revert to the Treasury, a reconstituted Bank would provide and publish its independent advice, but with decisions on rates taken democratically by the Government – in the fashion of the Eddie George-Ken Clarke arrangement pre-1997 (“the Ken and Eddie show).” Democracy, accountability, and objective central bank advice would be restored.

The decisive argument against removing the Bank’s independence is that monetary policy decisions would be worse, not better. In the short term, the markets would react extremely badly because the Chancellor lacks credibility and there would be a risk of the government suppressing rates to moderate the government’s debt interest costs and to influence economic developments around elections. Inflation expectations would rise, and the currency would plunge. Restoring the Bank’s credibility requires changing personnel and behaviour rather than structure.

An alternative would therefore be to increase the Bank’s independence, making it more directly answerable to Parliament rather than HMT. Removing the Treasury’s right to instruct the Bank would be one step and changing personnel, starting with reducing the number of Treasury old boys on the MPC, another. The Treasury currently indemnifies the Bank against losses that result from funding short-term and investing in long-term assets, but the Deed of Indemnity is secret, raising doubts about Treasury leverage over the Bank. For example, is there a limit to the indemnity? Is there a deductible? What other conditions apply? Why is the government’s agent, the Bank, bearing losses in the first place? Losses can damage its credibility and indemnities often come with strings. The Treasury and not the Bank should unequivocally face the full interest rate risk of QE-related gilt holdings, either through Bank-Treasury swaps or, preferably, by HMT holding the gilts itself (i.e., by it owning the Asset Purchase Facility, not the Bank). The Bank would fund these HMT holdings through short-term Bank loans to the Treasury, so avoiding losses for the Bank, reducing its dependence on the Treasury, and unifying debt management. QT would see reductions in Bank credit to the Treasury, with the arrangement making clear that QE constitutes monetary financing of government. Moving to a more independent Bank would require a much clearer debate and a political decision on how quickly the Bank should seek to reduce inflation. It is highly likely that those Bank/Treasury conversations are taking place behind closed doors, but democracy and rebuilding the Bank’s credibility requires an open discussion and not a pretence, shown through another series of over-optimistic Bank forecasts, that the task ahead will be almost painless.