Turning minutes into measures – Text-mining MPC communication

Today, the Bank of England published minutes of the meeting of the Monetary Policy Committee that came to an end yesterday. At the meeting, the MPC decided to keep interest rates unchanged. The minutes also record the discussions that took place at the MPC about the Bank’s appropriate monetary stance. At NIESR, we have started quantifying the information content of MPC minutes and construct an index of the monetary stance.

Today, the Bank of England published minutes of the meeting of the Monetary Policy Committee that came to an end yesterday. At the meeting, the MPC decided to keep interest rates unchanged. The minutes also record the discussions that took place at the MPC about the Bank’s appropriate monetary stance. At NIESR, we have started quantifying the information content of MPC minutes and construct an index of the monetary stance.

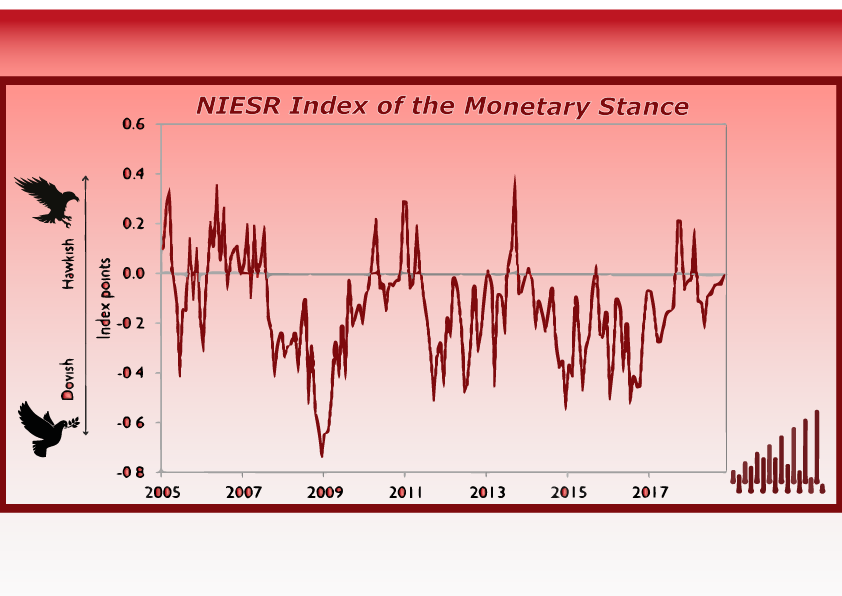

Compared to previous MPC meetings this year, the balance has gradually shifted away from discussions about looser policy to a more hawkish stance (Figure 1). This is consistent with the Committee’s statement in the minutes that ‘an ongoing tightening of monetary policy over the forecast period would be appropriate to return inflation sustainably to target at a conventional horizon’. Although the MPC does not say explicitly what this implies for Bank Rate, its forecast is conditioned on a market interest rate curve that implies that Bank Rate rises to 1.5% over the next three years. This is also based on the assumption of a smooth adjustment to the outcome of Brexit negotiations. The uncertainty around Brexit also featured heavily in the Committee’s deliberations and it is unlikely to increase Bank Rate before the outlook becomes clearer.

How do we arrive at our new index of the monetary stance? In our latest National Institute Economic Review we explain how we use text mining approaches to measure policymakers’ inclination whether to tighten or loosen policy. In short, we collect a corpus of Bank of England monetary policy summaries and MPC minutes spanning from January 1999. Minutes and policy summaries inform the public about the MPC’s assessment of current and future economic conditions, financial market developments, and its decision around the policy interest rate and unconventional policy instruments. Unlike policy summaries and minutes, other forms of communication, such as speeches, are published not as regularly and are structured in a less coherent way rendering them less suitable for a computer-based text analysis. The structured nature of minutes and policy summaries allows us to employ an automated search and word-counting approach of “hawkish words” (e.g., increase, tighten, etc.) and “dovish words” (e.g., decrease, expansionary, etc.). The index of the monetary stance is computed as the difference between hawkish and dovish words in every release of MPC minutes.

Figure 1 plots the time series of the index of the monetary stance. It shows, for instance, that at the onset of the financial crisis in 2008, central bank communication started to become much more dovish, as indicated by negative values. It remained on balance more dovish than hawkish for most of the time since. In the run-up to the Brexit referendum on 23 June 2016, MPC minutes became gradually more dovish, signalling that the Bank could loosen policy should the referendum result negatively impact the economy. With the exception of on balance more hawkish meetings in September 2017 and February 2018, the index has remained negative since while gradually becoming less dovish recently.

This suggests that text mining can serve as a powerful tool to quantify the signals provided by central bank communication about the monetary policy stance. Going forward, we will apply our methodology to MPC minutes when they are released and provide a timely, quantitative measure of the monetary stance.