Welfare savings and incapacity benefits

It has been clear for some time that the Conservatives’ plans to achieve a budget surplus in the next Parliament – regarded with considerable scepticism by most informed observers, from the IMF to the vast majority of leading UK macroeconomists – was dependent on large cuts to spending on working age social security benefits, only a small fraction of which the Conservatives were willing to specify in advance of the election.

It has been clear for some time that the Conservatives’ plans to achieve a budget surplus in the next Parliament – regarded with considerable scepticism by most informed observers, from the IMF to the vast majority of leading UK macroeconomists – was dependent on large cuts to spending on working age social security benefits, only a small fraction of which the Conservatives were willing to specify in advance of the election. As the Institute for Fiscal Studies put it:

But it is now almost two years since he announced his intention of cutting welfare spending by £12bn. Since then the main announcement has been the plan not to cut anything from the main pensioner benefits..We have been told about no more than £2bn of the planned cuts to working-age benefits. And, remember, apparently the ‘plan’ is to have those £12bn of cuts in place by 2017-18. It is time we knew more about what they might actually involve.

We got some hints of what options were being considered from some internal DWP documents leaked to the BBC – these include cuts to Carers’ Allowance, disability benefits, Council Tax benefit and Child Benefit. It would be very surprising if cuts to housing benefit, and to tax credits for low-income working families were not on the agenda as well, as they have been in this Parliament. Although the government refused to comment on these options, they are hardly news – given that the vast majority of working age benefit spend is tax credits, housing benefits, family and child benefits, and disability benefits, that is where the cuts must inevitably fall.

So it’s not surprising that Evan Davis asked the Prime Minister for some more detail in his interview last night. What is more surprising, for those interested in the details of the benefit system, was his response:

Q: You are able to tell me the tax cuts in detail with specific numbers, the tax cuts you’re going to make in 2018,19 and 20 but you cannot tell me the bigger welfare cuts that you’re making next year. That’s terribly cynical isn’t it? It’s good news, we tell you that.

A: We’ve set out – we’ve set out the biggest ones as you say of the 12 billion. The 12 billion is half of the 21 billion that we achieved in the last parliament, but also there’s this point, Evan. Part of this is continuing with a programme that we’ve had. We have been getting people off what was called Incapacity Benefit and back into work. We’re going to continue with that, successfully reducing welfare –

Q: So Incapacity Benefit will go down? The Bill go down under –

A: We believe – it’s not called incapacity benefit anymore but we’re convinced we can go on getting people back to work.

Now, there are a number of issues here. It is of course not correct that the Conservatives have set out “the biggest ones” – as the IFS says, we know about only £2 billion of specific savings of the £12 billion target. Nor is true to say that the government saved £21 billion in the last Parliament. As Declan Gaffney shows here, spending was only about £2 billion less in 2014-15 than forecast in March 2010, before the government took office. Cuts have been offset by overspends.

But the most significant point is the reference to Incapacity Benefit. The Prime Minister clearly believes that incapacity benefit reform – the introduction of a new test, the Work Capability Assessment (WCA), and a new benefit, Employment and Support Allowance (ESA), has resulted in significant reductions in the numbers on benefit and hence significant savings.

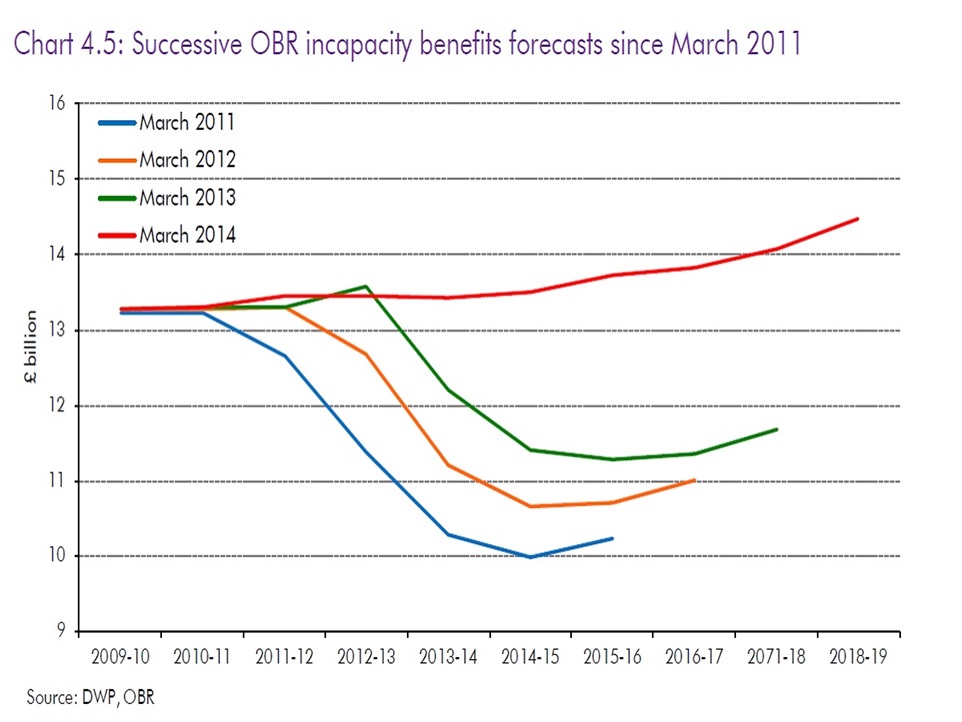

And it is indeed true that that was the plan. In 2011, the DWP forecast that by now the numbers of benefit would have come down very significantly, by about half a million, to 2.1 million. And that would indeed save substantial amounts of money – £3.5 billion a year in 2014-15. Had these plans been delivered, the Prime Minister’s statements would make perfect sense.

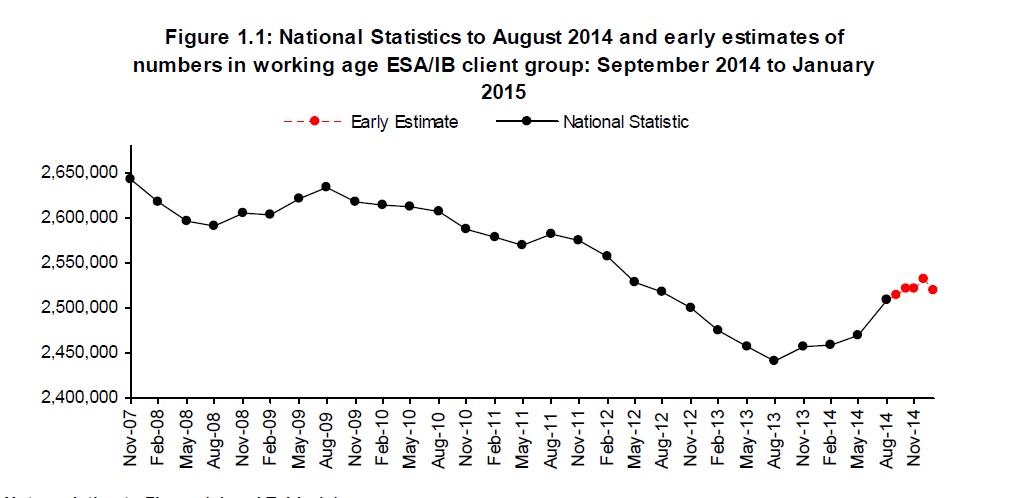

But it hasn’t quite worked out that way. The reasons for this are complex: the root cause was rushed implementation, against expert advice, of the new WCA, resulting in appeals, large backlogs, and the eventual effective collapse of the assessment system. I discuss all this at length in my Radio 4 Analysis programme on welfare reform. But the results are not. This chart, from DWP official statistics, shows the number of people on incapacity benefits:

After falling fairly steadily from 2004 or so on, with a brief but not huge rise after the financial crisis, the numbers began to rise in mid 2013. There are now more than 2.5 million people on the benefit – fully 400,000 more than DWP expected in 2011.

Not surprisingly, the result is that the anticipated savings have not materialised. This chart, from the independent Office of Budget Responsibility, shows successive forecasts for spending on incapacity benefits.

Spending was supposed to fall by £3.5 billion. It simply hasn’t happened. I have described this whole episode – costly and painful for claimants and taxpayers alike – as the biggest single social policy failure of the last 15 years.

Finally, for completeness, what about the claim that those people moving off incapacity benefit (and of course many do, as others move on, even if the overall numbers rise) are being helped back to work? The Work Programme is the government’s main tool for employment support for ESA claimants. Overall, Work Programme performance has been mixed – it has been quite successful for young unemployed people. But for ESA claimants the opposite has been the case. The latest statistics showed that about 1 in 10 ESA claimants got any sort of a “job outcome”, below DWP’s “minimum performance expectations”.

What can we conclude from this? The most charitable explanation is that the Prime Minister was told in 2010 or 2011 about the government’s plans to move large numbers of people off incapacity benefits and hence make large fiscal savings. Since then, apparently, rather like the Emperor Hirohito, nobody has dared to inform him that “the situation has developed not necessarily to our advantage”.