Press Release: Monthly CPI Tracker – Headline Inflation at Multi-Year Low but Underlying Inflation Unchanged

MONTHLY CPI TRACKER

*FOR IMMEDIATE RELEASE*

Headline Inflation At Multi-Year Low But Underlying Inflation Unchanged

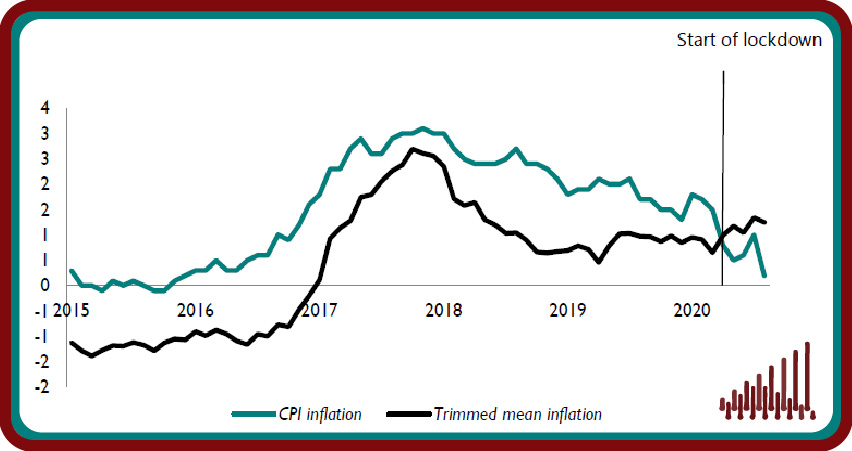

Consumer price inflation has moderated to a multi-year low of 0.2 per cent in the year to August 2020, as per data released by the ONS. The impact of the government’s ‘Eat-out to help-out’ scheme was particularly noticeable in the restaurants and hotels category, which took 0.6 percentage points off headline CPI in August and resulted in the lowest reading since December 2015. Our new analysis of 118,153 locally collected goods and services indicates that price decreases were broad-based with only the recreation and culture category recording an increase in prices from the previous month. Nevertheless, we expect inflation to pick-up from its current levels for two reasons: the downward effect of the restaurant subsidy scheme will abate in the coming months and our measure of underlying inflation, which excludes the most extreme price changes, remains unchanged at 1.3 per cent in August 2020. Although the historical relationship between current trimmed mean inflation and future CPI inflation implies headline CPI inflation to rise above 2 per cent in the year to August 2021, weak demand and employment prospects are likely to keep inflation below this number.

Main points

- Underlying inflation remained unchanged at 1.3 per cent in the year to August 2020, as measured by the trimmed mean, which excludes 5 per cent of the highest and lowest price changes (figure 1).

- At the regional level, underlying inflation was highest in Wales at 2.4 per cent and lowest the South West which saw an increase of only 0.7 per cent in the year to August 2020 (table 1).

- 37.2 per cent of goods and services prices changed in August, implying an average duration of prices of 2.7 months. This is well below the average duration of prices of 5.2 months. 4.8 per cent of prices were reduced due to sales, 14.1 per cent fell for other reasons and 18.2 per cent were increases (figure 2).

- The historical relationship between current trimmed mean inflation and future CPI inflation implies CPI inflation above 2 per cent in the year to June 2021. However, weak demand and employment prospects are likely to keep inflation below this number.

NIESR economist Janine Boshoff said: “There has been much comment that headline CPI inflation decreased to 0.2 per cent in the year to August 2020, down from 1 per cent recorded in July but this reflects the most recent government subsidy programme, with the restaurants and hotels category reducing headline CPI by 0.6 percentage points. NIESR’s measure of underlying inflation remained unchanged at 1.3 per cent in August. However, it is weak demand and employment prospects that are likely to keep inflation below 2 percent next year.”

Please find the full commentary in attachment

ENDS

——————————————-

Notes for editors:

For further information and to arrange interviews, please contact the NIESR Press Office:

press [at] niesr.ac.uk / 079 3054 4631 / l.pieri [at] niesr.ac.uk

NIESR aims to promote, through quantitative and qualitative research, a deeper understanding of the interaction of economic and social forces that affect people’s lives, and the ways in which policies can improve them.

Further details of NIESR’s activities can be seen on http://www.niesr.ac.uk or by contacting enquiries [at] niesr.ac.uk . Switchboard Telephone Number: +44 (0) 207 222 7665