Government announced employment tax increase will hit hardest the sectors that suffered most from Covid, NIESR research shows

New analysis conducted by the National Institute of Economic and Social Research (NIESR), shows that the Government announced employment tax increase in September adds needless complexity to the tax system, encourages self-employment rather than employment, and hits hardest the labour-intensive sectors that suffered most from Covid. It also encourages a shift away from labour-intensive sectors and reduces the UK’s international competitiveness.

The levy, which aims to fund the NHS and social care, increases the tax burden on workers relative to the retired, with the latter group also set to benefit most from increased health and social care spending.

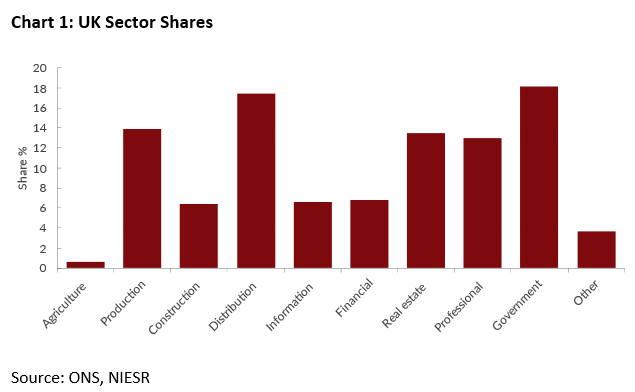

Firms expected to suffer the most would be larger employers (i.e., those not eligible for Employment Allowance) in industries where labour costs are a high fraction of total costs. As Chart 1 shows, firms in sectors such as distribution, transport, hotels, and restaurants, where there is still weak demand and therefore minimal ability to pass higher costs into prices, and which were the hardest hit by Covid with a high share of employees on furlough, will suffer most from the National Insurance hike, though the Employment Allowance will protect smaller firms.

The continued increase in the burden of taxation on employment additionally militates against long-run growth, for example, by disincentivizing skill acquisition. Since taxes on self-employment incomes will rise by 1.25%, instead of 2.5% in total on employment incomes, the incentive to be self-employed increases, which increases tax administration costs and encouraging reduced firm size and economic efficiency.

In macroeconomic terms, the combination of higher spending and a higher real tax burden is slightly beneficial for short-term GDP, though there is a drag on future growth. Simulations of NiGEM, the National Institute’s econometric model, suggest that the longer-run effect of increasing taxes and spending would be less favourable on GDP.

The research concludes that the levy is a sub-optimal way to raise the extra resources needed to fund the NHS and social care, with its main attraction being political since the public seems not to recognise it fully as a tax.

Author of the report Paul Mortimer-Lee (NIESR interim Deputy Director for Macroeconomics), said: “Introducing a new tax on income that is already subject to two others is unnecessarily complex. Hypothecating revenue from that tax and calling it a levy disguises what it is – a tax. Splitting the levy between employers and employees obscures the fact that, in the end, it will be employees who bear the burden, with a three- quarters of a percentage point reduction in real personal disposable incomes in the long run. It would have been more transparent and more equitable, for example, between younger workers and retirees, to raise the needed revenues through the income tax.”

Commenting on the NIESR’s policy paper, Kitty Ussher, Chief Economist at the Institute of Directors, said: “When the Government rushed legislation through Parliament to raise employers’ national insurance, it was unable to tell us the scale of its effect on the UK economy, beyond that the macroeconomic impact would be ‘significant’.

What we find is that the proposed tax rise acts as a dampener on investment that in the longer-run reduces GDP. It disincentivises skills investment. It will reduce UK international competitiveness by reducing the attractiveness of the UK as a location. The firms that Covid hit the hardest will suffer the most, particularly distribution, transport, hotels and restaurants. The burden will fall on a combination of employees, firms, suppliers and consumers and also adds, in NIESR’s view, ‘unnecessary complexity’ to the tax system.

We are now looking for a recognition in Wednesday’s Budget that this flat tax on employment is a step too far. In the short term it has already had real and negative effects on the business climate; in the longer run it goes against the Government’s stated policy to encourage UK firms to invest and grow”.

ENDS

——————————

Notes for editors:

The above findings are based on NIESR’s latest Policy Paper, which is available here. This policy paper presents independent research part funded by the Institute of Directors (IoD). The views and opinions expressed by the author are those of the author, and do not necessarily reflect those of the IoD.

For queries and to arrange interviews, please contact the NIESR Press Office: press@niesr.ac.uk / l.pieri@niesr.ac.uk / 0207 654 1954.

About NIESR:

The National Institute of Economic and Social Research (NIESR) is Britain’s longest established independent research institute, founded in 1938 by a group of major social and economic reformers including John Maynard Keynes and William Beveridge. As a charity, it is independent of all party-political interests and receives no core funding from government or other sources. Its aim is to improve the public’s understanding of the way that economic and social forces impact on their lives, and the ways in which policy can bring about change. As an organisation it works in collaboration with leading academic institutions, as well as government departments, charitable foundations, international organisations, and the private sector.

About the Institute of Directors:

The Institute of Directors is a non-party political organisation, founded in 1903, with approximately 20,000 members. Membership includes directors from right across the business spectrum – from media to manufacturing, professional services to the public and voluntary sectors. Members include CEOs of large corporations as well as entrepreneurial directors of start-up companies.

The IoD was granted a Royal Charter in 1906, instructing it to “represent the interests of members and of the business community to government and in the public arena, and to encourage and foster a climate favourable to entrepreneurial activity and wealth creation.” The Charter also tasks the Institute with promoting “for the public benefit high levels of skill, knowledge, professional competence and integrity on the part of directors”, which the IoD seeks to achieve through its training courses and publications on corporate governance.

For further information, visit our website: www.iod.com .