Press Release: NIESR Monthly CPI Tracker – Supply-side effects feeding through to headline inflation

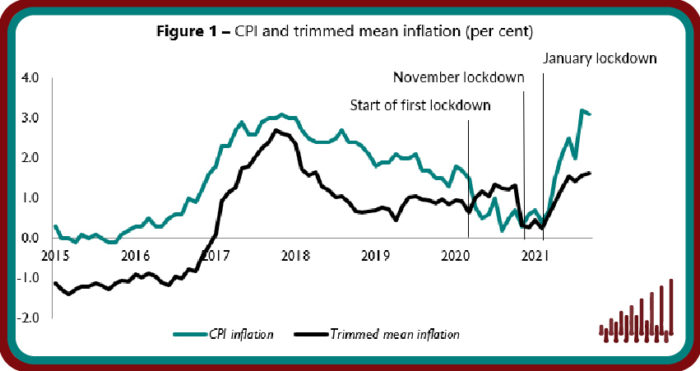

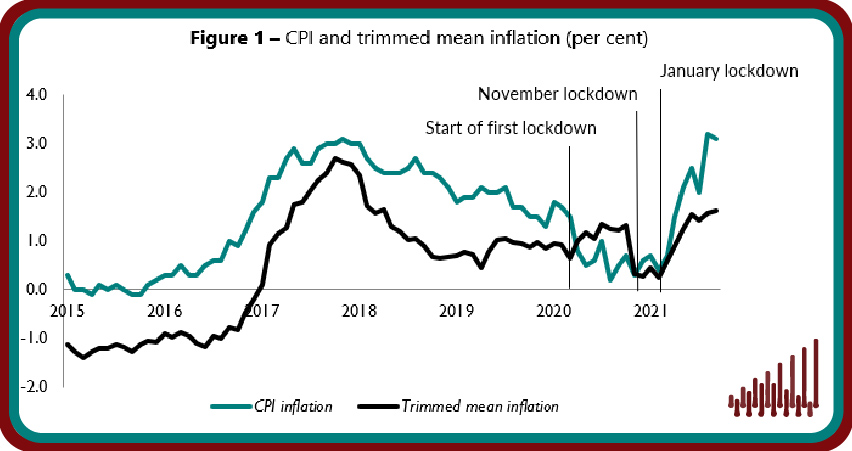

- Headline consumer inflation decreased marginally, from 3.2 per cent in August 2021 to 3.1 per cent in September. Our measure of underlying inflation as measured by the trimmed mean, which excludes 5 per cent of the highest and lowest price changes remained unchanged at 1.6 per cent in September (figure 1).

- Most categories recorded an increase in September, reflecting the inflationary pressures associated with strong demand, higher commodity prices and ongoing supply-chain disruptions.

- 19.3 per cent of goods and services prices changed in September, implying an average duration of prices of 5.2 months. 4.2 per cent of prices were reduced due to sales, 3.9 per cent fell for other reasons and 11.2 per cent recorded increases (figure 2).

- Our measure of underlying inflation increased in most regions of the UK. Underlying inflation in London decreased to 2.5 per cent in September, down from 2.7 per cent in August. Scotland saw the lowest regional trimmed mean inflation of 1.2 per cent in September (table 1).

- We expect the first scheduled reversal of the 2020 VAT cut in October 2021 and the increase in OFGEM household energy price-cap in November 2021 will likely give further impetus to consumer prices in the coming months.

- Shortages in intermediate inputs and ongoing disruption in supply chains have filtered through to consumer goods prices, while labour shortages and the associated increase in wages could also feed through to headline inflation in the coming months.

- Short-term inflationary pressures will likely keep inflation elevated in the year to September 2022. Our analysis suggests that headline inflation will peak above 4 per cent in the first half of 2022 and that the Bank of England will consider a rate increase to prevent a wage and prices spiral from de-anchoring inflation expectations

Figure 1 – CPI and trimmed mean inflation (per cent)

“Annual headline inflation decreased to 3.1 per cent in September from 3.2 per cent in August. A broad-based increase in prices across the categories was offset by a 0.4 percentage point decrease in prices in the restaurants and hotels category. Our measure of underlying inflation, which excludes extreme price movements, remained unchanged at 1.6 per cent in September. Higher commodity prices and ongoing supply-chain disruptions have already filtered through to consumer prices which will remain elevated over the short-term. The first VAT hike in October 2021 and the scheduled increase in the OFGEM household energy price-cap in November 2021 will give further impetus to inflationary momentum. Our analysis suggests annual consumer price inflation will remain elevated in 2021 before peaking above 4 per cent in the first half of 2022, well above the Bank of England’s 2 per cent target in the short-term.”

Janine Boshoff

Economist, Macroeconomic Modelling and Forecasting

Notes for editors:

For further information please contact the NIESR Press Office: press@niesr.ac.uk or

Luca Pieri on l.pieri@niesr.ac.uk / 0207 654 1954