Press Release: NIESR Monthly CPI Tracker – Highest underlying inflation since October

Highest underlying inflation since October

Main points

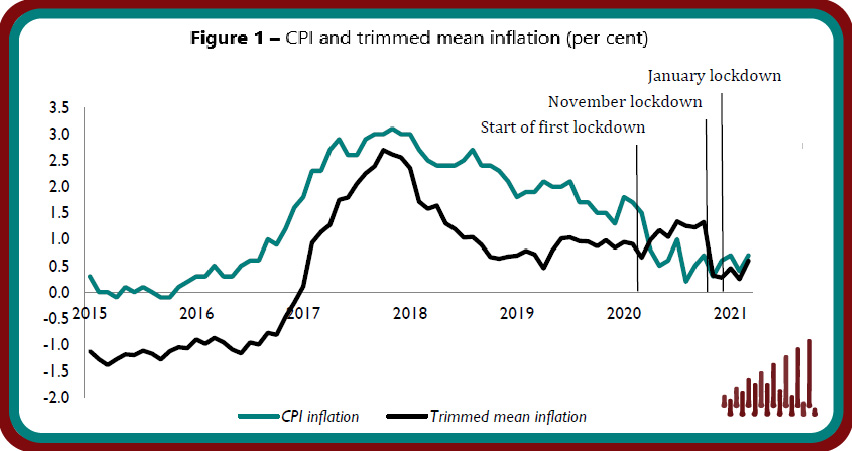

- Following the multi-year low point in February, underlying inflation increased to its highest level since October 2020. Our measure of underlying inflation recorded 0.6 per cent in the year to March 2021, up from 0.2 per cent in February 2021, as measured by the trimmed mean, which excludes 5 per cent of the highest and lowest price changes (figure 1).

- Regional dispersion in underlying inflation continues, with Wales recording the highest rate at 2.2 per cent and North West recording the lowest at -0.1 per cent. Since the start of the pandemic last year, underlying inflation has been persistently above the UK average in Wales, Northern Ireland, East Midlands, Yorkshire and the Humber and the North (table 1).

- 18.9 per cent of goods and services prices changed in March, implying an average duration of prices of 5.3 months, which when compared to the long-term average of 5.1 months suggests a return to a lower frequency of price changes. 5.6 per cent of prices were reduced due to sales, 3.6 per cent fell for other reasons and 9.7 per cent recorded increases (figure 2).

- Base effects stemming from the effect of the first lockdown on prices last year, as well as the gradual easing of the winter lockdown, could introduce some volatility to official statistics in the short term as goods in the non-essential retail and restaurant and hotel categories are re-introduced into the calculation of consumer inflation.

- CPI inflation is likely to pick up in the coming months but stay below the Bank of England’s target of 2 per cent in the year to March 2022.

NIESR economist Janine Boshoff said:“Annual headline inflation increased to 0.7 per cent in March, up from 0.4 per cent recorded in February, due largely to price increases in the transport category. Base effects and the gradual easing of the January lockdown could introduce some volatility over the short term as items in the non-essential retail, restaurant and hotels categories are re-introduced in the calculation of consumer inflation. Our measure of underlying inflation, which excludes extreme price movements, increased to 0.6 per cent in March from 0.2 per cent in February. We expect inflation to rise in the coming months as the economic recovery gains pace on the back of opening-up and the success of the vaccination programme, but we still expect inflation to remain below the Bank’s 2 per cent target in the year to March 2022.”

Please find the full analysis in the attached document

ENDS

——————————————-

Notes for editors:

For further information and to arrange interviews, please contact the NIESR Press Office:

press [at] niesr.ac.uk / 079 3054 4631 / c.ridyard [at] niesr.ac.uk / l.pieri [at] niesr.ac.uk

NIESR aims to promote, through quantitative and qualitative research, a deeper understanding of the interaction of economic and social forces that affect people’s lives, and the ways in which policies can improve them.

Further details of NIESR’s activities can be seen on http://www.niesr.ac.uk or by contacting enquiries [at] niesr.ac.uk . Switchboard Telephone Number: +44 (0) 207 222 7665