Press Release: NIESR Monthly CPI Tracker – Lockdown unwinding boosts underlying inflation

Main points

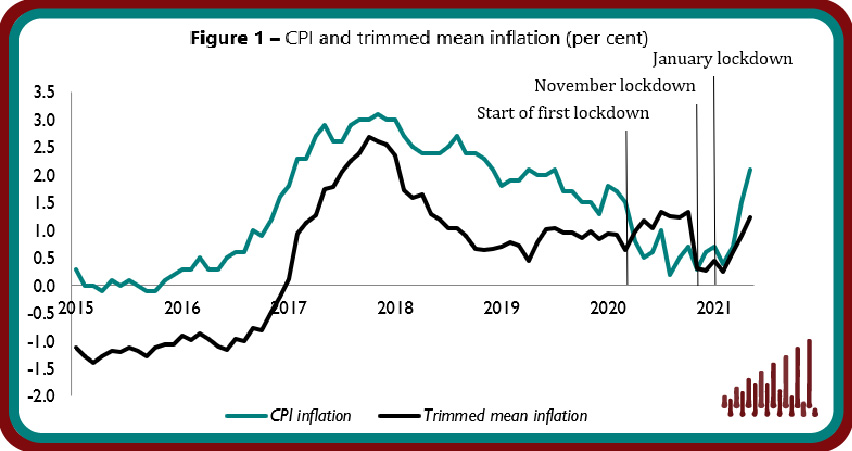

- Underlying inflation increased from 0.9 per cent in April to 1.2 per cent in May, displaying a smaller rise than headline consumer inflation which rose by 0.6 percentage points, reaching 2.1 per cent in May. The trimmed mean, which excludes 5 per cent of the highest and lowest price changes, recorded the third consecutive rise since March and has reached its highest level since October 2020 (figure 1).

- 15.8 per cent of goods and services prices changed in May, implying an average duration of prices of 3.7 months which is lower than the long-term average of 5.1 months and suggests accelerated price turnover.

- 4.0 per cent of prices were reduced due to sales, 7.4 per cent fell for other reasons and 15.8 per cent recorded increases, implying slightly more widespread price increases compared to the recent months (figure 2).

- The upward trend in the trimmed mean measure was supported by higher underlying inflation in most of the regions. Underlying inflation in London increased significantly to 3.3 per cent in May, up from 2.2 recorded in April. East Anglia saw the lowest regional trimmed mean inflation of 0.4 per cent in May (table 1).

- Rising oil prices have filtered through to UK consumers as the transport category contributed 0.2 percentage points to headline inflation. Clothing, recreation, restaurants and hotels, which have been among the most affected sectors by the lockdowns contributed more to the rise in consumer inflation in May as the economy gradually opened up.

- Higher commodity prices, base effects, and the effects of gradual reopening in certain sectors along with a strong recovery in consumption are likely to keep the headline inflation above the Bank of England’s target of 2 percent in the short-term.

- Amid increased risks of higher inflation beyond the short-term, the Bank of England should provide guidance on the direction and instruments of monetary policy, making a statement regarding the need to reverse some of increase in QE announced in Spring 2020 and announcing possible paths of interest rates conditional on the most likely economic outcomes.

NIESR economist Janine Boshoff, said: “Annual headline inflation rose to 2.1 per cent in May, its highest level since July 2019. Our measure of underlying inflation, which excludes extreme price movements, displayed a smaller rise to 1.2 per cent in May from 0.9 per cent in April, suggesting that consumer prices are rebounding after the lengthy winter lockdown. Increases in oil prices have filtered through to the transport category and coupled with the base effect from the large drop in oil prices last Spring, contributed significantly to the rise in annual inflation. We have seen some transitory upside effects in clothing due to the effects of lockdowns and the recent opening-up. We expect these transitory effects to continue putting upward pressure on consumer inflation in the short term and will be closely monitoring underlying inflation to gauge whether the fundamental drivers of inflation imply a more persistent upside risk amid the expected recovery in consumption.”

Please find the full commentary in attachment

————————————————————————-

For further information please contact the NIESR Press Office: press [at] niesr.ac.uk or Luca Pieri on 074 054 96121/ l.pieri [at] niesr.ac.uk / c.ridyard [at] niesr.ac.uk

National Institute of Economic and Social Research

2 Dean Trench Street

Smith Square

London, SW1P 3HE

United Kingdom

Switchboard Telephone Number: 020 7222 7665

Website: http://www.niesr.ac.uk