Press Release: UK Economic Outlook – UK economic performance in first quarter of 2021 likely to be worst among G7 economies despite vaccine roll-out

FOR IMMEDIATE RELEASE

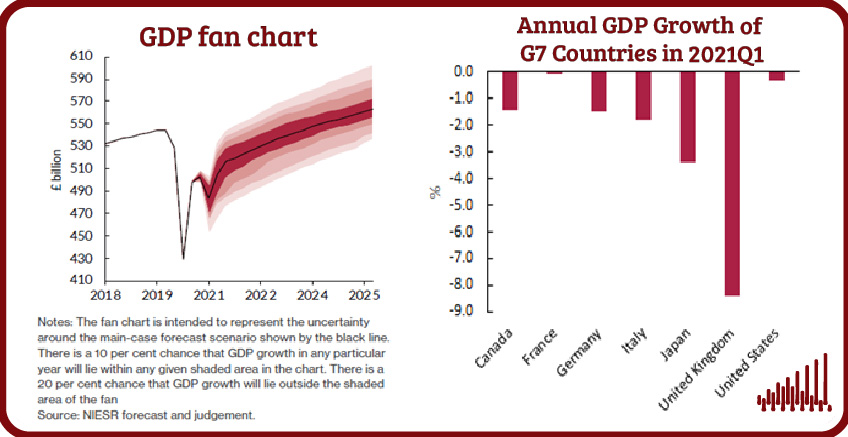

- The resurgence of Covid-19 has led to a downward revision in forecasts of UK economic growth in 2021 made by the National Institute of Economic and Social Research (NIESR): from 5.9% to 3.4%, following a contraction of 9.9% in 2020.

- Early indications are that the lockdown in the first quarter is having a larger impact on activity than in November, but a smaller impact than the Spring 2020 lockdown.

- The Coronavirus Job Retention Scheme (CJRS) and the Self-employed Income Support Scheme (SEISS) have protected millions of jobs, costing the government an estimated £100 billion or 4.8 per cent of GDP, for the 20-21 fiscal year. In NIESR’s main-case forecast scenario, unemployment is expected to rise significantly following the end of these schemes in April, reaching 7½ per cent or 2½ million people by the end of the year.

- To prevent a rise in unemployment of the magnitude of the forecast, and to limit the economic and social ‘scarring’ from the public health crisis, the Chancellor should soon announce policies to support the labour market beyond April. The pace and path of the recovery will depend on state-contingent and targeted policy interventions.

- Public sector net debt, which increased to 99.4 per cent of GDP as of December 2020, is projected to peak at 111 per cent in 2023. The Budget comes at a crucial time in the fight against Covid-19. If Covid-19 support is withdrawn prematurely, or if consolidation is prematurely applied in response to the increase in public debt, the economic recovery will be delayed and the long-term economic impact of the pandemic exacerbated.

- The gaps opened by the Trade and Cooperation Agreement with the EU require implementing mitigation policies and structural reforms over several years as well as negotiating trade agreements with key trading blocs in the rest of the world.

- There are major risks to the downside associated with the roll-out and effectiveness of vaccines, the emergence of new Covid-19 strains and their effect on the path of the virus, which might imply the continuation of lockdown measures for a longer period, suppressing domestic demand.

- A slower than expected global recovery due to Covid-19 is also a major downside risk for the UK economy through lower trade.

- Successful mass vaccination of the UK population followed by a permanent easing of social distancing rules presents an upside risk to NIESR’s forecast in 2021 and beyond.

At a sectoral level, compared to the previous recession, the recovery is forecast to be relatively stronger in the production industries, construction and finance and relatively weaker in the public sector, real estate and private traded services.

The effects of COVID-19, together with Brexit, continues to burden regional economies in the UK. There is severe downturn across all regions, followed by protracted and slow recovery, as well as long term scarring. There are also large regional variations in the effects, together with increase in inter-regional inequality. The South East and the South West have relatively less short run effects of COVID-19 together with relatively quicker recovery. London has the strongest downturn but also the sharpest recovery. These three regions evidence strongest resilience. By contrast, Northern Ireland, West Midlands and the North West suffer long term scarring. Very large effects on the extremely poor households are projected for the North West, while London, the East of England and the South East also have substantial effects on destitution. Strong and sustained targeted welfare support and regional planning for the long run are the policy needs of the day.

NIESR Deputy Director, Dr Hande Kucuk, said: “Despite the roll-out of vaccines, Covid-19 will have long-lasting economic effects. By 2025, the level of GDP is forecast to be around 6 per cent lower compared with pre-Covid19 expectations, reflecting lower consumption caused by higher unemployment, weaker business investment due to stressed balance sheets and uncertainty during the pandemic, and the adoption of a Trade and Cooperation Agreement with the EU which imposes more barriers to trade than before.”

ENDS

——————————

Notes for editors:

The full forecast for the UK economy can be found here. Details of NIESR’s previous UK economic forecast can be found here.

For further queries or to arrange interviews, please contact the NIESR Press Office: press [at] niesr.ac.uk / l.pieri [at] niesr.ac.uk / c.ridyard [at] niesr.ac.uk / 07930 544 631 / 07970 984913

For technical questions related to the forecast, please contact:

- Hande Kucuk on +44 (0)7825 642202 / h.kucuk [at] niesr.ac.uk

Further details of NIESR’s activities can be seen on http://www.niesr.ac.uk or by contacting enquiries [at] niesr.ac.uk Switchboard Telephone Number: +44 (0) 207 222 7665