Press Release: NIESR Monthly CPI Tracker – Customers feel the bite of VAT hike

Main points

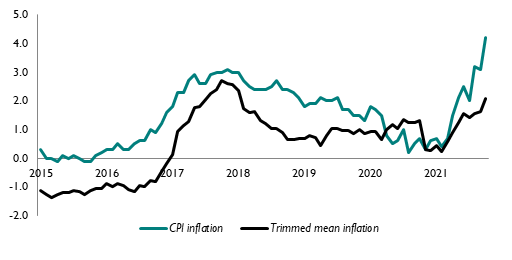

- Headline consumer inflation increased significantly to 4.2 in October 2021 from 3.1 per cent in September. Our measure of underlying inflation as measured by the trimmed mean, which excludes 5 per cent of the highest and lowest price changes increased to 2.1 per cent in October (figure 1).

- Within the CPI, all but two major categories recorded price increases, reflecting the broad-based nature of the inflationary pressure.

- Looking at prices of individual items, 19.3 per cent of goods and services prices changed in October, implying an average duration of prices of 5.2 months. 3.6 per cent of prices were reduced due to sales, 3.7 per cent fell for other reasons and 12 per cent recorded increases (figure 2).

- Our measure of underlying inflation increased in all 12 UK regions. Underlying inflation in London increased to 2.9 per cent in October, up from 2.5 per cent in September. Northern Ireland saw the lowest regional trimmed mean inflation of 1.5 per cent in October (table 1).

- The increase in the OFGEM household energy price-cap in November 2021 will ensure that consumer price inflation remains elevated until at least the end of the year, while the second VAT hike scheduled for April 2022 means there is little respite for consumers for the foreseeable future.

- Our analysis suggests that headline inflation will peak around 5 per cent in the second quarter of 2022 and we expect that the Bank of England will raise interest rates in the near future in response to the inflationary pressure.

Figure 1 – CPI and trimmed mean inflation (per cent)

“Annual headline CPI inflation increased to 4.2 per cent in October from 3.1 per cent in September, the highest annual rate of inflation since late 2011. Large price increases in housing and household services contributed 0.7 percentage points to the increase in the headline number. The effect of the first reversal of the 2020 VAT hike was also evident in the restaurant and hotels category, which contributed a further 0.1 percentage points to inflation. Our measure of underlying inflation, which excludes extreme price movements, increased to 2.1 per cent in October from 1.6 per cent in September. The scheduled increase in the OFGEM household energy price-cap next month means consumer inflation will remain above 4 per cent until the end of the year. Our analysis suggests annual consumer price inflation will peak at around 5 per cent in the first half of 2022, well above the Bank of England’s 2 per cent target.”

Janine Boshoff

Economist, Macroeconomic Modelling and Forecasting