Press Release: World economic growth set to slow – NIESR’s latest Global Economic Forecasts

The global growth story has evolved from a bounce-back to a slowdown, but inflation fears are escalating as the virus continues to crimp global economic activity, severe supply chain disruptions hold back the recovery and demand has been stimulated by loose monetary policies.

Our new forecast, using NIESR’s global macro-econometric model, NiGEM, projects higher inflation than we forecast three months ago, while our 2022 global growth picture is more downbeat than other major forecasters.

Inflation overshooting targets is likely to prompt central banks to dial back monetary policy accommodation in advanced economies, albeit gradually.

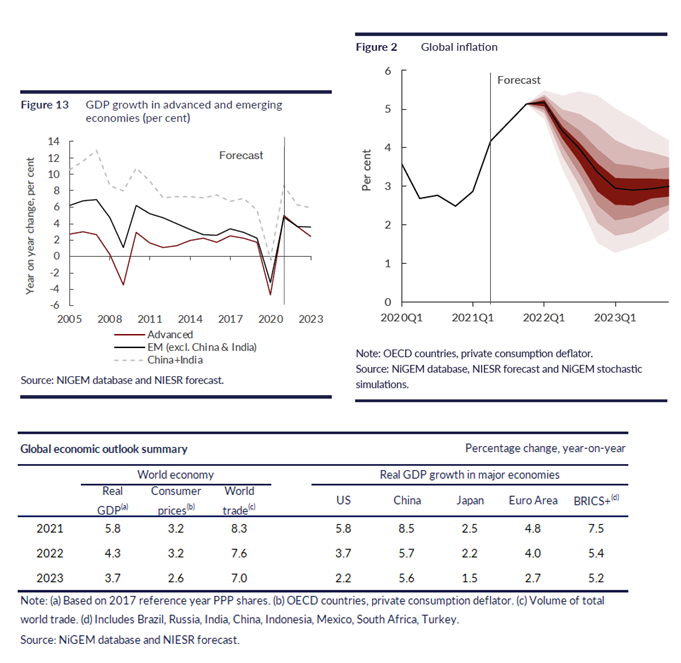

We forecast that global economic growth will be 5.8 per cent in 2021, with a slowdown in 2022 (4.3 per cent) and a further one in 2023 (3.7 per cent). However, at an individual country level there is still considerable heterogeneity in growth experiences, particularly across advanced and emerging economies.

Other key points include:

- We have downgraded our forecast for the US economy which is now projected to grow by 5.8 per cent this year, and 3.7 per cent next year. Supply constraints are affecting Euro Area growth prospects, particularly as economies most reliant on global supply chains, such as Germany, slow down. Even with this, Euro Area GDP growth is now forecast at 4.8 per cent this year – thanks to the expected rebound in some large economies such as France, Spain, and Italy – and 4 per cent in 2022.

- There is a divergence in economic growth performance within emerging economies between fast-growing China and India, on the one hand, and other emerging economies, whose growth patterns are more exposed to cyclical demand swings in advanced economies, on the other hand. We expect this divergence to continue.

- Procurement problems for raw materials and intermediate goods are putting the brakes on the global economy. We do not expect supply chain problems to be resolved quickly, as the combination of increased demand over the Christmas season in some major economies, a further wave of the virus in countries producing intermediate goods, and weather conditions means that supply chain disruptions could continue until the second half of next year.

- Our OECD consumer price inflation forecast sees a sustained increase at 3.2 per cent until 2022, moderating to 2.6 per cent in 2023, and remaining above the rates seen before the pandemic (figure 2). How central banks will respond to inflation will have an impact on bond yields, with a combination of ending quantitative easing and higher policy rates. Higher long term interest rates and tighter monetary conditions in advanced economies pose a particular risk to emerging market economies with high external debt and expected low growth, leaving those economies exposed to financial market stress should investors’ risk appetite reverse.

- The main downside risk to our central forecast is that the pace with which vaccinations are deployed, as well as the efficacy of current vaccines, may not prevent the spread of more infectious variants of the virus. We explore this in our risk scenario.

Corrado Macchiarelli, NIESR’s Manager for Global Macroeconomics Research, said: “The global economy is still recovering from the pandemic shock, but at a slower pace than we expected three months ago due to new strains of the virus and severe supply-chain disruptions that are contributing to an escalation in inflation. Bond yields in advanced economies will be affected the central banks response to inflation, with a mix of ending quantitative easing and tighter policy rates. For now, the global financial system looks to be functioning well, but bond markets remain vulnerable to inflation and interest rate increases.”

ENDS

——————————

Notes for editors:

The full forecast for the Global economy can be found here. Details of NIESR’s previous global economic forecast can be found here.

For a full copy of the world economic forecast or to arrange interviews and background briefings with our country specialists and senior researchers, please contact the NIESR Press Office: press@niesr.ac.uk / n.lakeland@niesr.ac.uk / 020 7654 1920

For technical questions related to the forecast, please contact:

- Corrado Macchiarelli on c.macchiarelli@niesr.ac.uk

- Iana Liadze on i.liadze@niesr.ac.uk

- Barry Naisbitt on b.naisbitt@niesr.ac.uk

Further details of NIESR’s activities can be seen on http://www.niesr.ac.uk or by contacting enquiries@niesr.ac.uk Switchboard Telephone Number: +44 (0) 20 7222 7665