Thousands Of Households Projected To Face Monthly Mortgage Repayments Greater Than Their Monthly Incomes

Today’s announcement from the Bank of England’s Monetary Policy Committee that the bank rate has risen by 0.75ppts will push up the monthly repayments of those on a variable rate mortgage. We have therefore forecasted the number of households who will be affected by this decision, specifically what will happen once the bank rate hits its predicted peak of around 5 per cent.

Today’s announcement from the Bank of England’s Monetary Policy Committee that the bank rate has risen by 0.75ppts will push up the monthly repayments of those on a variable rate mortgage. We have therefore forecasted the number of households who will be affected by this decision, specifically what will happen once the bank rate hits its predicted peak of around 5 per cent.

Main findings include:

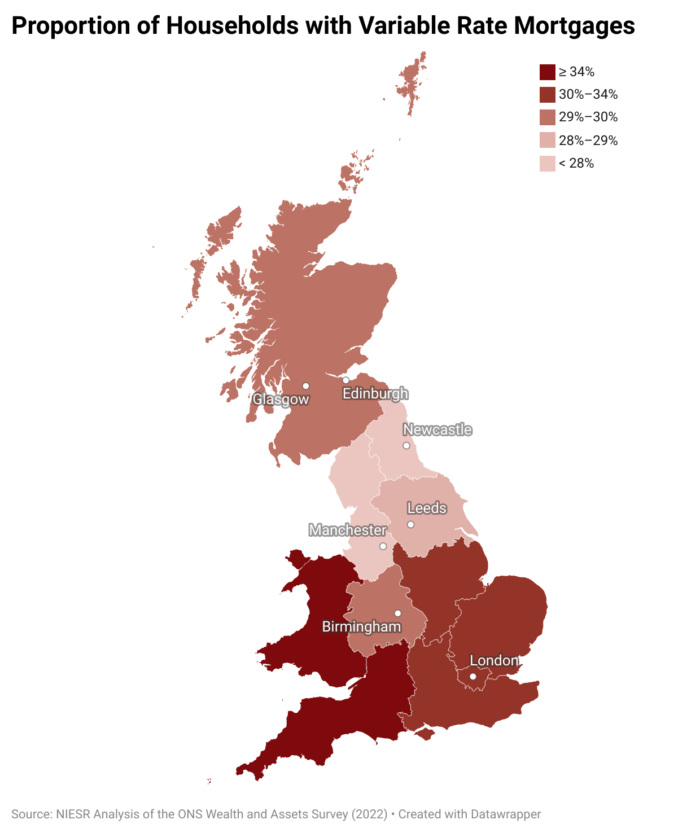

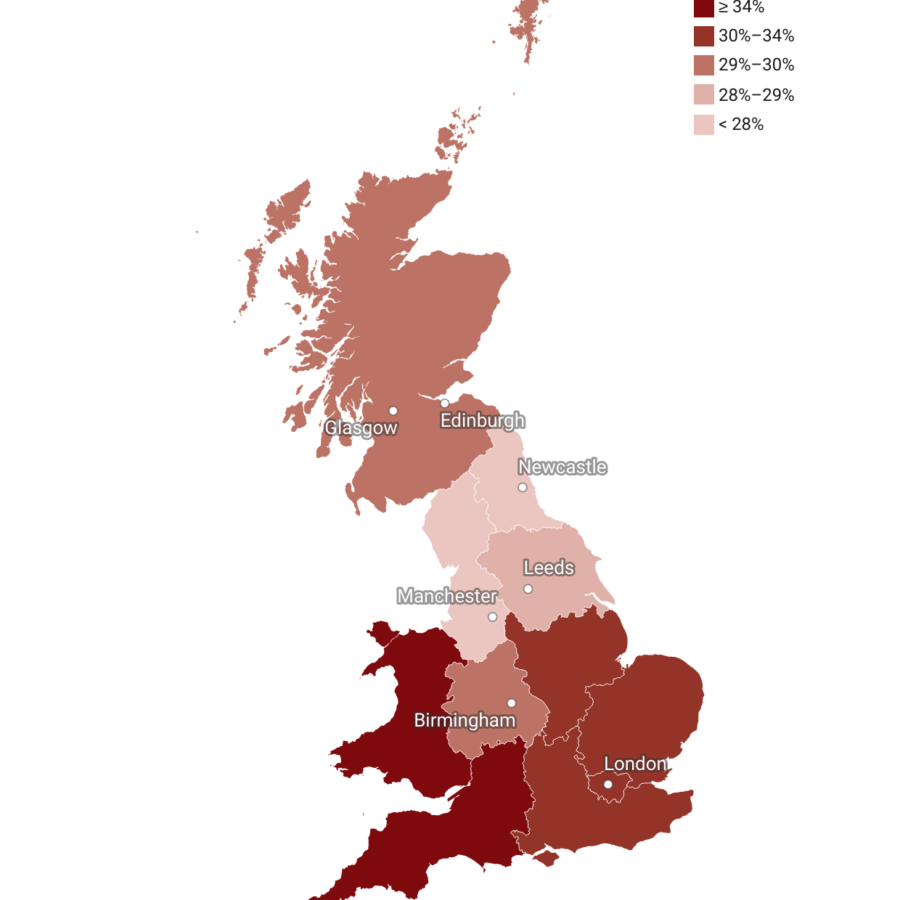

- Variable rate mortgage repayments are set to double if the bank rate hits 5 per cent; potentially affecting the two a half million of UK households on a variable rate mortgage

- On average, the monthly repayment on a typical variable rate will rise from around £500 to over £1,000

- Around 30 thousand households could see monthly mortgage repayments greater than their monthly incomes

This analysis was undertaken using a combination of NIESR’s unique economic models – the National Institute Global Econometric Model (NiGEM) and the Lifetime Income Distributional Analysis (LINDA) – together with the latest round of the ONS Wealth and Assets Survey (WAS). We forecast the mortgage repayments of a representative sample of households in the UK. WAS is the base of this analysis, as this contains key financial information of each household within the sample, while NiGEM provides the growth rate of their incomes and LINDA predicts their consumption patterns.

Max Mosley, NIESR Economist, said: “We now have evidence of what is potentially on the horizon for millions of households. Those most vulnerable to mortgage rate rises could see their real incomes decimated if interest rates surpass 5 per cent. This shock to mortgage repayments, in combination with a decade of stagnant real incomes, the impact of Covid-19, inflation and a cost-of-living crisis, presents an unprecedented assault on the country’s living standards.”

ENDS

————————————

Notes for editors:

For more information about the analysis and to arrange interviews, please contact the NIESR Press Office: press@niesr.ac.uk / l.pieri@niesr.ac.uk / n.lakeland@niesr.ac.uk / 020 3948 4488