Reindustrialising the United Kingdom

This project is designed to examine the issues that may arise, should the UK seek to reindustrialise.

Summary & aims

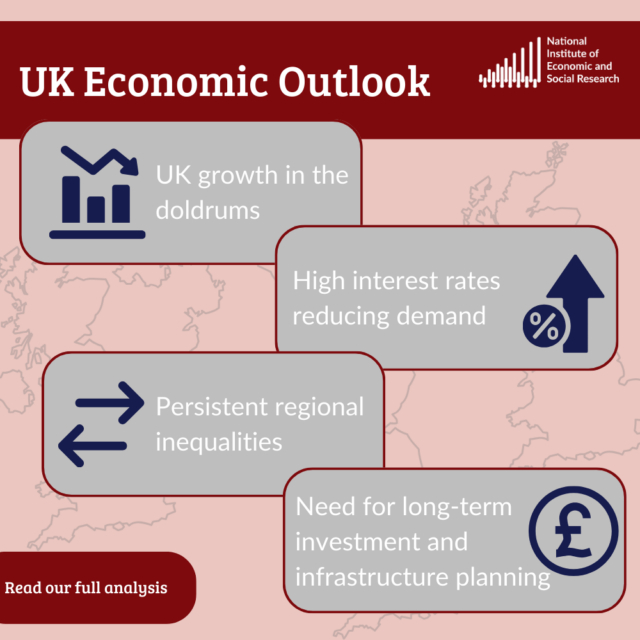

The UK’s lagging productivity growth since the 2008-2009 Global Financial Crisis, together with a renewed focus on ‘Levelling Up’ to address regional inequalities and rebalance the economy has led to calls for the UK to reindustrialise. Not only might this improve productivity levels, given that manufacturing productivity tends to grow faster than service-sector productivity, but it could also reduce national vulnerabilities highlighted by the Covid-19 pandemic and the invasion by Russia of Ukraine.

This project aims to examine whether these statements are correct, whether reindustrialisation is possible and, if so, how it could be brought about, and what the implications of reindustrialisation would be in terms of exchange rates and monetary and fiscal policy.

Methodology

Using our Global Macroeconometric Model (NiGEM), as well as existing literature and work on this topic, we will examine a range of scenarios to assess how the UK economy would perform were there to be a concerted policy to reindustrialise by export-led growth in the manufacturing sector. Within a possibly extended version of NiGEM, we will be assessing the implications for the exchange rate and for UK monetary and fiscal policy.

Findings and Recommendations

Our findings are that:

- There may be a case that manufacturing may have shrunk too far as a proportion of the economy with a negative effect on UK productivity growth.

- But, attempting to reindustrialise solely via engineering a large sterling devaluation will, at best, only work in the short run.

- Specifically, although a large nominal exchange rate depreciation can lead to temporary increases in exports, investment and GDP, we found that, in a tight labour market, these gains would eventually be reduced by rises in inflation and, more importantly, unit labour costs.

The empirical evidence from the United Kingdom, and the experience of China and Singapore, suggest that it is not an overvalued exchange rate that explains deindustrialization but rather a general lack of investment that has led to deindustrialization, low productivity growth and falls in the real and nominal exchange rate. Although it was posited that a lower exchange rate when paired with a large surplus of labour may have played a positive role in China in supporting higher levels of GDP growth, the evidence does not support the contention that simply by depreciating the exchange rate on its own, an economy could bring about reindustrialization; other policies to support investment and productivity growth need to be in place.

The UK government could only follow a policy of a competitive depreciation of sterling by giving up control over UK monetary policy or by imposing capital controls, neither of which seem feasible in the current political climate and both of which would carry their own economic costs. Our suggested answer to the problem of low productivity growth in the United Kingdom is that we need to increase business investment as a proportion of GDP, though this will require a change in the savings behaviour of both the private and public sectors.

Principal Investigator