- Home

- Publications

- Financial Spillovers Of The American Rescue Plan On Emerging Markets

Financial spillovers of the American Rescue Plan on emerging markets

Sign in to Access Pub. Date

Pub. Date

10 May, 2021

Pub. Type

Pub. Type

Downloads

This content is restricted to corporate members, NiGEM subscribers and NIESR partners.

External Authors

Kucuk, Hande

Related Themes

Macro-Economic Modelling and ForecastingPublisher

NIESR, London

Key points

- The American Rescue Plan is expected to have a positive effect on economic activity in emerging markets via trade, with those that are commodity exporters also benefiting from higher commodity prices.

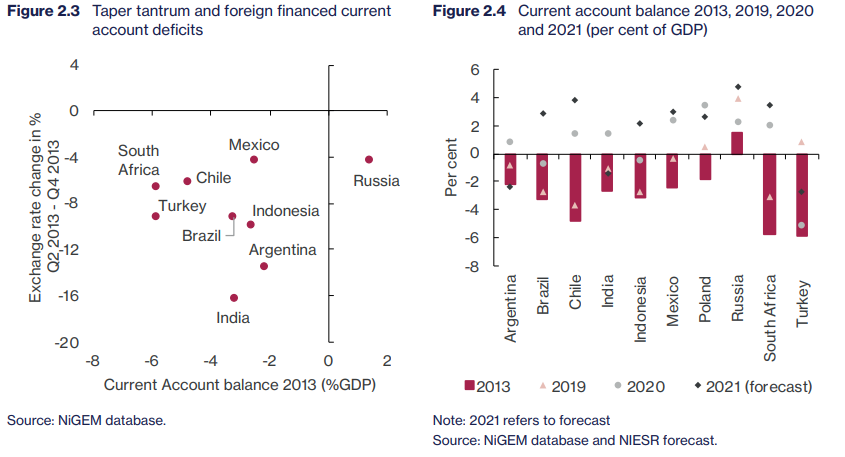

- However, it poses certain risks for emerging economies through tighter domestic financial conditions caused by a potentially stronger dollar and higher global long-term interest rates, especially if coupled with a rise in global risk aversion like the one observed during the taper tantrum episode in 2013.

- Using our NiGEM model, we show that financial spillovers have the potential to offset fully the positive impacts of the American Rescue Plan in countries with higher risk premia such as Argentina, Brazil and Turkey, and may also constrain the positive spillovers in lower risk-rated countries such as Indonesia and Russia. These results highlight the need for international policy coordination to ease external finance constraints should these constraints become binding.

Related Blog Posts

Blog

What is the Current State of the UK Economy?

Paula Bejarano Carbo

Stephen Millard

26 Feb 2024

7 min read

Related Projects

Related News

news

Why it’s not worth worrying that the UK has technically entered a recession

26 Feb 2024

4 min read

news

1.2 million UK Households Insolvent This Year as a Direct Result of Higher Mortgage Repayments

22 Jun 2023

2 min read

news

The Key Steps to Ensuring Normal Service is Quickly Resumed in the Economy

13 Feb 2023

4 min read

Related Publications

This category can only be viewed by members.

publication

Recessionary Pressures Receding in the Rearview Mirror as UK Economy Gains Momentum

12 Apr 2024

GDP Trackers

Related events

Summer 2023 Economic Forum

NIESR is delighted to bring to you our latest Economic Forum where we presented our forecast for the next economic quarter. With inflation remaining stubbornly high, a labour market that...

11:00 to 12:00

11 August, 2023

Spring 2023 Economic Forum

NIESR is delighted to bring to you our latest Economic Forum where we present our forecast for the next economic quarter. As King Charles III is officially crowned, and the...

11:00 to 12:00

12 May, 2023

Winter 2023 Economic Forum

With recent UK GDP figures prompting a cautious optimism amongst some analysts, the question has arisen around whether the UK can avoid a recession? Was the 0.1% growth in November...

11:00 to 12:00

10 February, 2023

Autumn 2022 Economic Forum

Join us, the day after the Chancellor’s autumn statement, to hear our analysis of the measures announced and their likely impact at both a UK, and individual household, level. Utilising...

11:30 to 12:30

18 November, 2022

Summer 2022 Economic Forum

We are delighted to invite you to our Summer 2022 Economic Forecast, where we will present and discuss NIESR’s latest forecasts on the UK and global economies, with an opportunity...

11:00 to 12:00

5 August, 2022

Spring 2022 Economic Forum

We are delighted to invite you to our Spring 2022 Economic Forecast, at which we will present and discuss NIESR’s latest forecasts on the UK and global economies, with an...

11:00 to 12:00

13 May, 2022

Winter 2022 Economic Forum

With rising inflation asking questions of central banks, consumer incomes hit by rising energy prices and Omicron continuing to disrupt the supply of both goods and labour, what does the...

11:00 to 12:00

11 February, 2022

Autumn 2021 Economic Forum

We are delighted to invite you to our Autumn 2021 Economic Forum, at which we will present and discuss NIESR’s latest forecasts on the UK and global economies, with an opportunity for you to ask questions.

11:00 to 12:00

12 November, 2021