Bank Leverage Ratios, Risk and Competition – An Investigation Using Individual Bank Data

Pub. Date

Pub. Date

Pub. Type

Pub. Type

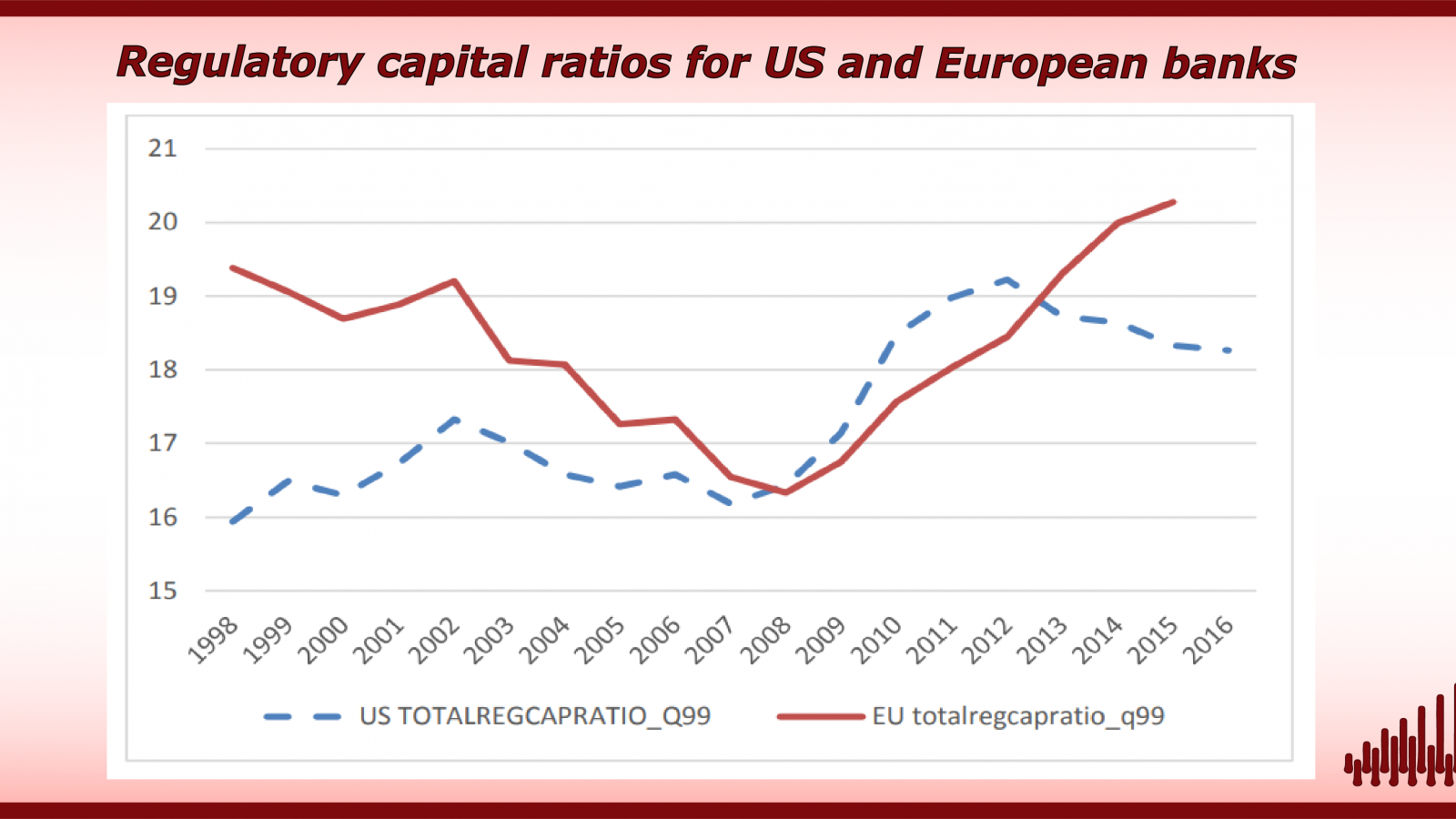

Following experience in the global financial crisis (GFC), when banks with low leverage ratios were often in severe difficulty, despite high-risk-adjusted capital measures, a leverage ratio was introduced in Basel III to complement the risk-adjusted capital ratio (RAR). Empirical testing of the leverage ratio, individually and relative to regulatory capital is, however, sparse. More generally, the capital/risk/competition nexus has been neglected by regulators and researchers. In this paper, we undertake empirical research that sheds light on leverage as a regulatory tool controlling for competition. We assess the effectiveness of a leverage ratio relative to the risk-adjusted capital ratio (RAR) in predicting bank risk given competition for up to 8216 banks in the EU and 1270 in the US, using the Fitch-Connect database of banks’ financial statements.

On balance, US banks tend to behave in a manner consistent with “skin in the game” (a negative relation of competition to risk) while European banks tend to follow the “regulatory hypothesis” (positive relation), although there are exceptions to these generalisations. Accordingly, the expected effect of changes in capital on risk needs careful attention by regulators. There is a tendency for the leverage ratio to be more often significant than the risk-adjusted measure in a number of the regressions. This observation favours its use in macroprudential policy. The effect of capital on risk varies considerably over time and cross sectionally for Europe vis a vis the US; effects often differ between low-leverage and high-leverage ratio banks as well as pre- and post-crisis and for individual EU countries. The overall results are robust to a number of variations in sample and specification.

We consider the inclusion of competition as a control variable to be a major contribution that adds to the relevance of our study. The results show that bank competition, allowing for capital, is a significant macroprudential indicator in virtually all regressions and hence more note should be taken of this by regulators, notably in the US where there is mainly evidence of competition-fragility (a positive link of competition to risk). On the other hand we note that exclusion of competition does not markedly change the effect of capital. Finally there are differences in the relation of risk both to competition and capital adequacy for banks at different levels of risk that need to be taken into account by regulators both in Europe and the US. There is some evidence of greater vulnerability of weaker banks to low capital and high competition than would be shown by the sample average or median.