- Home

- Publications

- The Effects Of Covid-19 And Brexit On Firms’ Trading Decisions

The Effects of Covid-19 and Brexit on Firms’ Trading Decisions

Pub. Date

Pub. Date

Pub. Type

Pub. Type

Authors

Related Themes

Macro-Economic Dynamics and PolicyThis is a preview from the Quarterly UK Economic Outlook, May 2021.

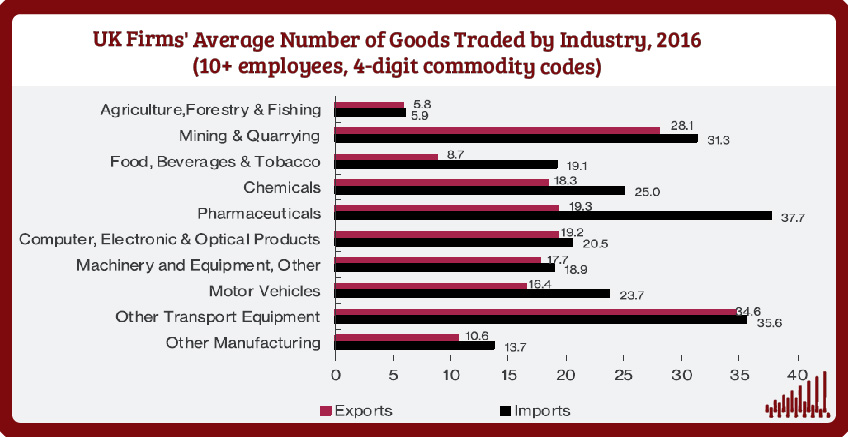

This box focuses on adjustments of firms' product trade portfolio, i.e. the number of products exported and inputs imported, and it looks at the literature on past crises and UK data to infer how UK businesses may be adjusting the range of products traded in response to the twin challenge of Covid-19 and Brexit. A key point is that this adjustment depends on firms' perception of the nature of these crises. Thus, firms tend to maintain their product portfolio when faced with temporary shocks and alter it when faced with permanent ones.

Considering the perceived natures of Covid-19 and Brexit, along with the experience from previous crises, it is arguably the case that the long-run Brexit effects will prevail in firms' product mix decisions, translating into fewer products being traded with the EU. However, much more information is required to disentangle the effects of both shocks and draw more evidence-based conclusions. And while it is not clear how trade in services with the EU will be affected in terms of number of services traded, the lack of a clear service sector deal raises questions for future research and policy-making.

The analysis in this Box has been prepared by NIESR Economist Manuel Tong Koecklin.

Related Blog Posts

Public Debt Sustainability and Fiscal Rules

Stephen Millard

Benjamin Caswell

05 Feb 2024

4 min read

Related Projects

Related News

Call for Papers: Lessons From Quantitative Easing & Quantitative Tightening

09 Feb 2024

1 min read

Related Publications

Job Boom or Job Bust? The Effect of the Pandemic on Actual and Measured Job and Employment Growth

07 Feb 2024

UK Economic Outlook Box Analysis

Implications of the Transition from Defined Benefit to Defined Contribution Pensions in the UK

07 Feb 2024

UK Economic Outlook Box Analysis

Inflation Differentials Among European Monetary Union Countries: An Empirical Evaluation With Structural Breaks

20 Nov 2023

National Institute Economic Review

Related events

Assessing Cycles and Structural Changes in Markets

Business Conditions Forum

2022 Dow Lecture: The Economy and Policy Trade-Off