Employers’ Pension Provision Survey 2017

Pub. Date

Pub. Date

Pub. Type

Pub. Type

Background

The workplace pension reforms, introduced following the 2008 Pensions Act (and updated as part of the 2011 and 2014 Pensions Acts), require all employers to automatically enrol all eligible employees into a qualifying workplace pension scheme, although employees can choose to opt out.

The Employers’ Pension Provision Survey (EPP) has been measuring the extent of pension provision among private sector employers since the mid-1990s. The survey is a key source of information on the impact of the workplace pension reforms so far. Prior to the introduction of the reforms, the proportion of private sector employers who offered pension provision had been declining since around the mid-2000s. This trend has reversed following the implementation of the reforms, and in 2017, just over half (56 per cent) of private sector organisations made some form of pension provision for their employees.

About the survey

The EPP survey is conducted every two years. The 2017 survey was conducted among a representative sample of private sector employers in Great Britain. The sample was drawn from the Inter-Departmental Business Register (IDBR) with fieldwork taking place between July and October 2017. Some 2,859 organisations took part in the survey. The response rate at the main interview stage was 45 per cent, an increase from 41 per cent in 2015.

At the time the survey took place the vast majority of small, medium and large employers reported that they had passed their staging date, that is, the date from which employers must comply with the reforms. However, only around two-fifths (42 per cent) of micro employers stated that they had passed their staging date. There was also considerable uncertainty amongst this group; one-third (33 per cent) stated that they did not know if they had yet passed their staging date.

Virtually all medium and large employers stated that they had automatically enrolled their eligible employees and the vast majority (84 per cent) of small employers had also done so. However, just over half of micro employers had not yet automatically enrolled their employees at the time of the 2017 survey.

The profile of staged employers has changed considerably between the 2013, 2015 and 2017 surveys as the reforms have been rolled out. It is important to bear this in mind when drawing comparisons across these years.

Key Findings

The extent of pension provision in 2017

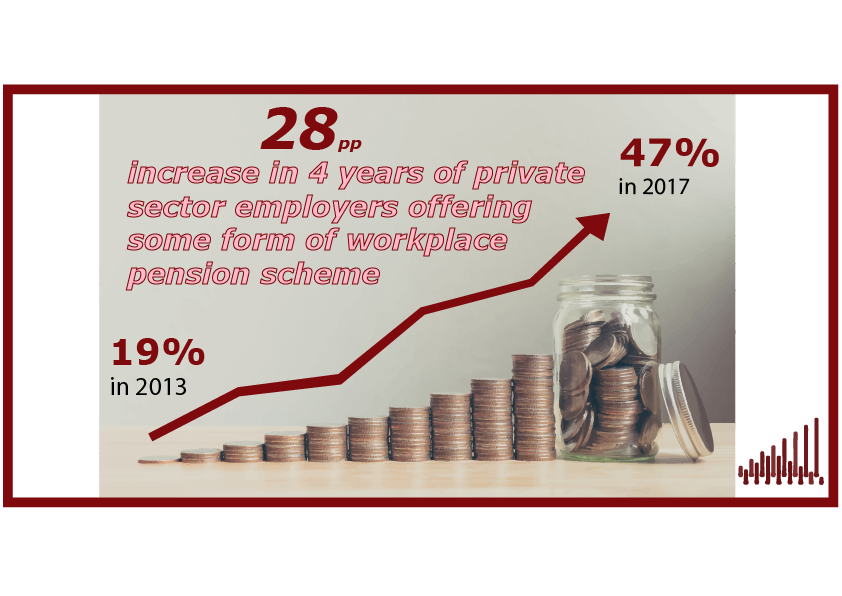

The extent of pension provision has increased substantially since 2013. In 2017, just over half (56 per cent) of private sector organisations made some form of pension provision for their employees compared with 32 per cent in 2013.[1] Focusing solely on workplace pension schemes, 47 per cent of private sector employers offered some form of workplace pension scheme in 2017, compared with 19 per cent in 2013.

Most small, medium and large employers provided a workplace pension scheme, but provision was less common among micro employers. This is likely to reflect, at least in part, that while most small, medium and large employers had passed their staging date, micro employers were less likely to have done so.

Estimates for all private sector employers reflect the dominance of micro employers in the population of firms; yet most employees work in large organisations. Thus while 47 per cent of firms offered a workplace scheme, the vast majority (91 per cent) of all private sector employees worked for an employer who provided a workplace scheme.

In 2017 the most commonly provided scheme type was access to NEST, offered by 30 per cent of employers. Other scheme types remained less common; eight per cent of firms provided stakeholder schemes, five per cent of firms provided GPPs, three per cent provided occupational schemes; and three per cent access to master trust schemes other than NEST.

Membership of workplace pension schemes has also risen; the percentage of private sector employees who were active members of a workplace pension scheme rose from 32 per cent in 2013 to 60 per cent in 2017. In 2017, just under one-fifth (19 per cent) of all private sector employees were members of NEST, 16 per cent were members of GPP schemes, nine per cent were members of occupational schemes; eight per cent were members of Master Trust schemes and five per cent were members of stakeholder schemes.

Employer awareness of the reforms

Awareness of the requirement to automatically enrol eligible workers into a pension scheme was high with 90 per cent of all private sector employers aware of this requirement.

Awareness about specific aspects of the reforms, namely the minimum contribution requirements and the need to declare compliance with The Pensions Regulator, was lower. Two-thirds of employers (66 per cent) were aware of the minimum contribution requirements. The lower level of awareness was largely driven by micro employers; 59 per cent were aware of the minimum contributions compared with 96 per cent of large employers. There were similar patterns of awareness of the need to declare compliance with The Pensions Regulator with 91 per cent of large employers aware of this compared with 60 per cent of micro employers.

Employers’ responses to the reforms

Employers can choose to defer automatically enrolling new or newly eligible workers for up to three months. One fifth (19 per cent) of staged employers had adopted a deferral or waiting period for new or newly eligible employees. This was more common among medium and large employers, such that 65 per cent of employees worked for a firm that had adopted a deferral or waiting period.

Almost two-thirds (65 per cent) of employers who had begun automatic enrolment stated that its introduction had resulted in an increase in the total pension contributions they had to make. The most common action taken by employers in response to an increase in total pension contributions was to absorb this cost as part of other overheads (stated by 71 per cent of employers), followed by a reduction in profits (stated by 47 per cent of employers).

Almost all small, medium and large employers had communicated, or planned to communicate, with their employees about the reforms. However, 42 per cent of micro firms had not communicated or had no plans to do so; employers tended to report not having done so because they did not have any eligible employees.

Employer contributions

The minimum contribution required from employers as part of the reforms is increasing over time (sometimes referred to as phasing).[2] In 66 per cent of schemes used for automatic enrolment, employers were phasing in contributions, but in 24 per cent of such schemes, employers were contributing at least three per cent from the start.

The mean employer contribution, averaged across schemes, was equivalent to four per cent of gross pay, while the median contribution was one per cent.[3] Averaged across members, the median contribution was two per cent of pay. This varied by scheme type: the median contribution received by members of NEST and master trust schemes was one per cent of pay, in comparison with three per cent for members of stakeholder schemes, four per cent for members of GPP schemes and five per cent for members of occupational schemes.

Opt-out, cessation and opt-in

Among firms with a scheme used for automatic enrolment, nine per cent of employees who were automatically enrolled in the last financial year (2016/17) had decided to opt out. This figure does not suggest any notable increase in average opt-out rates since 2015.[4]

Employers estimated that 16 per cent of employees who had been automatically enrolled in the last financial year had ceased active membership. Based on those employers who were able to provide an estimate, 67 per cent of all employees who ceased saving did so because they had left their employer.

In eight per cent of firms with a scheme used for automatic enrolment, at least some non-eligible workers had been enrolled into a scheme in the last financial year. This was more common among larger employers; applying for 34 per cent of large firms compared with two per cent of micro firms.

In 63 per cent of schemes where at least some non-eligible employees had been enrolled, the employees had actively asked to join the scheme. However, in 29 per cent of such schemes the employer stated that it was company policy to enrol everyone.

Re-enrolment

Approximately three years after employers have first passed their staging date they are required to re-assess all employees and automatically enrol any that are eligible for automatic re-enrolment but not currently members of a pension scheme. Overall, 62 per cent of staged employers were aware of the requirement to automatically re-enrol their employees. Awareness was higher among larger employers who had either passed their re-enrolment date or were closer to this date.

When the EPP 2017 survey was conducted, only employers with 50 or more employees had passed their re-enrolment date. Only a small proportion of employers who took part in the 2017 survey reported having passed their re-enrolment date (nine per cent). This was higher among large employers (79 per cent) and medium employers (32 per cent).

Opt-out levels following re-enrolment were higher than those following initial automatic enrolment. The overall opt-out level following re-enrolment was 33 per cent. This varies by size of employer, with an opt-out rate of 50 per cent for medium employers and 31 per cent for large employers[5].

The overall level of cessation following re-enrolment was 24 per cent, with medium employers having a higher cessation rate compared with large employers (51 per cent compared with 18 per cent).

Employers who had not yet passed their re-enrolment date were asked whether they had started preparing for re-enrolment. Among these employers only eight per cent had begun any preparations for re-enrolment.

[1] This provision could include an occupational pension scheme, a group personal pension (GPP) scheme, a stakeholder scheme, access to the National Employment Savings Trust (NEST), a master trust scheme (other than NEST) or an arrangement whereby the employer made contributions to employees' personal pensions.

[2] Initially employers were required to contribute a minimum of one per cent, with this increasing to two per cent in April 2018 and three per cent by April 2019.

[3] Note that employers were asked about contributions as a percentage of gross pay, rather than as a percentage of qualifying earnings.

[4] Direct comparisons with earlier surveys in the EPP series are not possible due to changes in question wording.

[5] Employment-weighted estimates