Filling the Fiscal Gap May Extend the Low Growth Trap

The reversal of the greater part of the Mini-Budget measures by the current Chancellor, and the reduction in long term interest rates, means that the fiscal hole can be filled with relatively small changes. Rather than deciding to collectively demonstrate fiscal credibility by limiting support for poor households, or reducing critically important elements of public investment, our quarterly UK Economic Outlook suggests that there is another way.

Pub. Date

Pub. Date

11 November, 2022

Pub. Type

Pub. Type

Main points

- Since our previous Outlook, we are into our second Prime Minister and our third Chancellor of the Exchequer; we have experienced a mini-budget and its near complete reversal, neither of which involved the analysis and scrutiny of the independent Office for Budget Responsibility (OBR); and we await an Autumn Statement that will be accompanied by an OBR Forecast. This political turmoil has damaged the UK economy by generating higher interest rates and greater economic uncertainty at a time when it was already in a fragile position with low growth and high inflation.

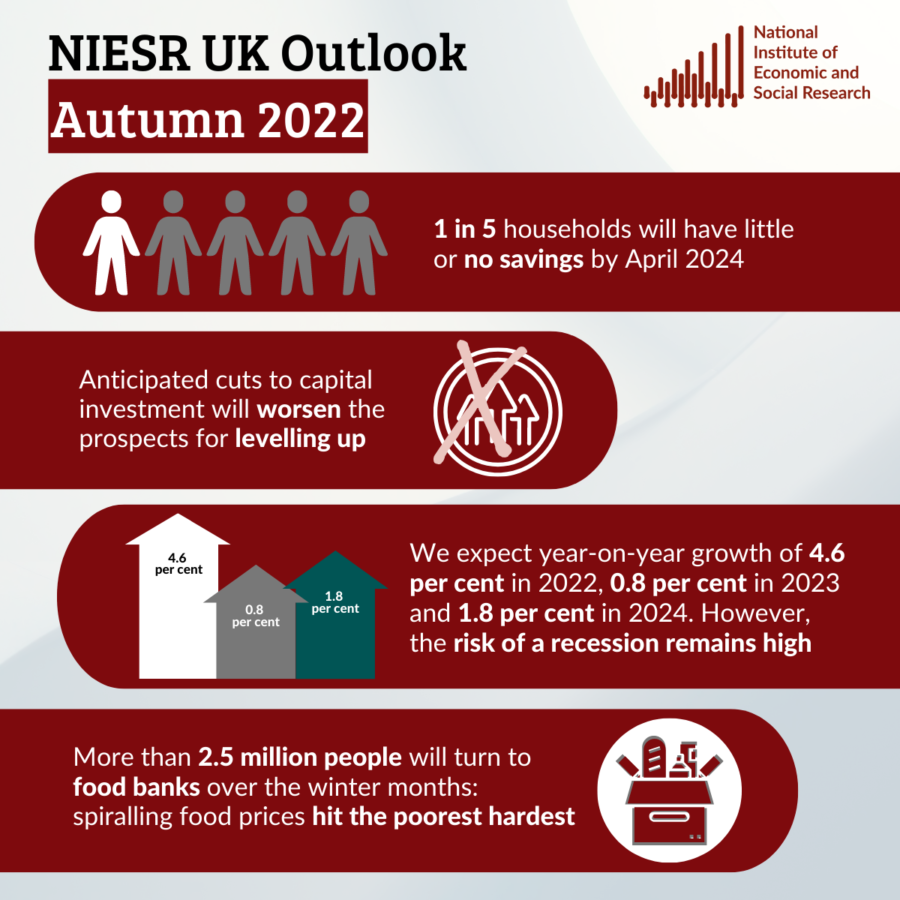

- We expect GDP to fall in the third quarter of this year but to grow from the fourth quarter of this year and beyond. We expect year-on-year growth of 4.6 per cent in 2022, 0.7 per cent in 2023 and 1.7 per cent in 2024. All that said, the risk of a recession remains high with a roughly 55 per cent probability of negative annual growth in the first quarter of 2023.

- The Energy Price Guarantee (EPG) has lowered the peak in CPI inflation, which we now expect to be 11 per cent in January 2023. Nonetheless, we think inflation is likely to be more persistent than previously forecasted, only falling to 5.7 per cent by the end of 2023 and not reaching the Bank of England’s target of 2 per cent until the third quarter of 2025.

- Given the greater persistence in inflation, there is a greater risk of high inflation becoming embedded in expectations. The Monetary Policy Committee (MPC) will need to monitor the situation closely and be prepared to raise interest rates by more and more quickly if necessary to stop this from happening. At the same time, the Bank of England needs to start normalising its balance sheet, so we support the MPC’s decision to start quantitative tightening on 1 November.

- We project that nearly 1 in 5 households will have little or no savings by April 2024: faced with the triple shock of soaring energy, food and mortgage rates/rental costs, nearly six million households will see their savings fall to negligible levels despite the Energy Price Guarantee (EPG) and other support measures.

- In terms of the Autumn Statement, we would advise against tightening fiscal policy further. At hard economic times such as we are currently experiencing, the government should increase borrowing to support the hardest-hit households, explain what it is doing, and put in place a plan for reducing public-sector debt at a point in the future once the shock has dissipated. Furthermore, if the government really is serious about growth, it should not be reducing the capital investment that can help spur growth.

- In fact, our forecast suggests that the government debt and deficit would be on-track to fall as a percentage of GDP over the next few years, though this is predicated on the assumption that the EPG is stopped in April 2023. We would hope that the government consider replacing the existing EPG in April with our suggestion of a ‘variable cap’ where households that use more energy (typically richer households) pay more per unit of energy use than households that use less energy (typically poorer households).

- The recent political and economic turmoil has demonstrated again the need for new fiscal framework, something NIESR has been advocating for a while. We need to make sure that: 1) fiscal events happen to a regular timetable and are properly scrutinised by the OBR; 2) the aims of fiscal policy are made clear and that policy is assessed against these aims by the OBR; 3) the government makes clear how it would respond to certain risks transpiring and the OBR publishes its analysis of these risks; 4) the government has access to independent economic experts from a multitude of backgrounds, not just the financial sector, for ex ante advice and ex post evaluation of fiscal choices; 5) and fiscal policy is ‘joined up’ across the UK and all its constituent parts.

- Our policy proposal for a variable price cap (where the price per unit of energy used rises with usage) provides targeted assistance to vulnerable households: whereas the EPG represents a general price subsidy that is expensive, subsidises top earners and does not incentivise energy saving, a variable price cap is fiscally more efficient, socially more just and ecologically more responsible.

- Mortgage repayments on a variable rate will increase by at least 50 per cent on average when interest rates hit their projected peak of 4.75 per cent: together with projected rent increases, this may push an additional 250,000 households into extreme poverty. We propose a £2bn Housing Support Fund administered at local authority level to help with fast-rising housing costs.

- More than 2.5 million people will turn to food banks over the winter months: spiralling food prices hit the poorest hardest; government needs to raise benefits in line with inflation to prevent a further increase in destitution, which already affects about 1.2 million people; government should also introduce a Universal Credit uplift of £25 per week for twelve months at a total cost of £2.7bn.

- Anticipated cuts to capital investment will worsen the prospects for levelling up: government should use the Autumn Statement on 17 November to maintain capital spending outside London and the South East and work with business to unlock private investment.

- Devolving decision-making and spending powers is key to a sustained regional regeneration strategy, particularly in policy areas such as skills, housing and R&D; the three devolved nations and the English regions require stability and greater resource and power to address some of the root causes of regional inequalities.