Headline inflation inches up, but the worst is yet to come

Pub. Date

Pub. Date

Pub. Type

Pub. Type

Main points

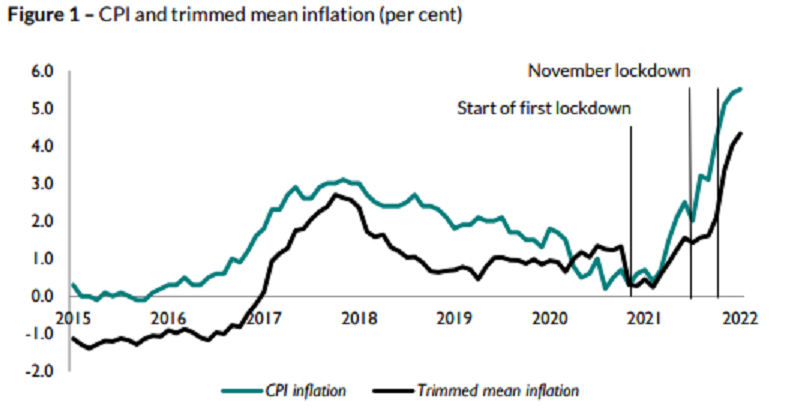

- Headline consumer price inflation increased to 5.5 per cent in January 2022 from 5.4 in December 2021. Our measure of underlying inflation as measured by the trimmed mean, which excludes 5 per cent of the highest and lowest price changes, increased to 4.3 per cent in January from 4 per cent recorded in December (figure 1), another record high.

- The clothing and footwear category contributed 0.2 percentage points to the headline figure. Historically, the January headline inflation number benefits from sales, but the combination of base effects due to last year’s winter lockdown and the smallest moderation in clothing and footwear prices since January 1990 means that the first month of 2022 has bucked this trend.

- Looking at prices of individual items, 22.5 per cent of goods and services prices changed in January, implying an average duration of prices of 4.4 months. 5.3 per cent of prices were reduced due to sales, 4.4 per cent fell for other reasons and 12.9 per cent recorded increases.

- Our measure of underlying inflation increased in the majority of the 12 UK regions. Underlying inflation was highest in the West Midlands at 5.3 per cent and lowest in Wales at 3.4 per cent in January 2022.

- We have raised our forecast for consumer price inflation in the most recent UK economic outlook and expect headline inflation will likely peak at 7 per cent during the second quarter of 2022.

- We expect the Bank of England to continue to raise interest rates in 2022 which will bring the official headline number down close to 5 per cent by the end of the year.

“Annual headline CPI inflation increased to 5.5 per cent in January from 5.4 per cent in December. Our measure of underlying inflation, which excludes extreme price movements, increased to 4.3 per cent in January 2022 from 4 per cent in December 2021. This reading of our trimmed mean measure is now broadly in line with the 4.4 per cent recorded for core inflation (CPI excluding energy, food, alcoholic beverages, and tobacco) in January 2022. Underlying inflation increased in 10 of the 12 UK regions, with the South West and Wales recording marginal decreases. Our analysis suggests annual consumer price inflation will peak at 7 per cent in the second quarter of 2022 before the effect of the interest rate hiking cycle causes headline inflation to moderate to 5 per cent by the end of the year.”

Janine Boshoff

Economist, Macroeconomic Modelling and Forecasting