- Home

- Publications

- The (In)Effectiveness Of The Latest Round Of ECB Asset Purchases

The (In)Effectiveness of the Latest Round of ECB Asset Purchases

Sign in to Access Pub. Date

Pub. Date

Pub. Type

Pub. Type

Downloads

This content is restricted to corporate members, NiGEM subscribers and NIESR partners.

Authors

External Authors

Sanchez Juanino, P

Related Themes

Macro-Economic Dynamics and PolicyThis is a preview from the National Institute Economic Review, November 2019, no 250.

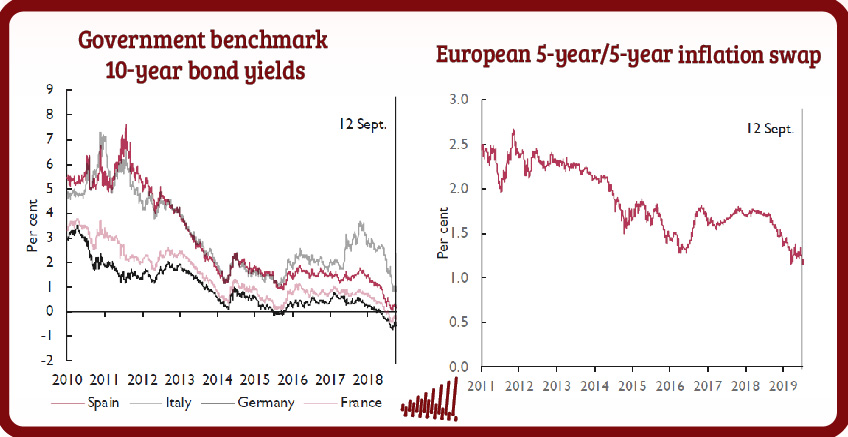

On 12 September 2019, the ECB Governing Council announced a comprehensive package of stimulatory measures in response to a weaker outlook for growth and inflation and a concern that inflation expectations were drifting further below the level consistent with the inflation target. A key component of the package was the decision to restart net purchases under the asset purchase programme (APP) at a monthly pace of €20 billion from 1 November. Purchases would continue until around the time that the ECB decided to withdraw monetary stimulus by raising rates again. This was seen by the markets as an open-ended commitment to further quantitative easing to ‘infinity and beyond’. In explaining the monetary measures, ECB President Draghi was keen to stress that the calibration of the package could be adjusted in the future to ensure that inflation moved towards its target in a sustained manner.

In this box, Patricia Sanchez Juanino (NIESR Database Manager) and Garry Young( Director of Macroeconomic Modelling and Forecasting) explore whether the stimulus package as currently calibrated is likely to be large enough to achieve its stated aim within a reasonable timescale.

"Our assessment is that it is not and that a substantial recalibration or additional policy measures (probably including fiscal policy) will be necessary in due course."

Related Blog Posts

Public Debt Sustainability and Fiscal Rules

Stephen Millard

Benjamin Caswell

05 Feb 2024

4 min read

Related Projects

Related News

Call for Papers: Lessons From Quantitative Easing & Quantitative Tightening

09 Feb 2024

1 min read

Related Publications

The Financial (In)Stability Real Interest Rate, R**, as a Monetary Policy Constraint

07 Feb 2024

Global Economic Outlook Box Analysis

Geopolitical Risks and the Global Economy

07 Feb 2024

Global Economic Outlook Box Analysis

The Spectre of a US House Price Correction

07 Feb 2024

Global Economic Outlook Box Analysis

Inflation Differentials Among European Monetary Union Countries: An Empirical Evaluation With Structural Breaks

20 Nov 2023

National Institute Economic Review

Related events

Assessing Cycles and Structural Changes in Markets

Business Conditions Forum

2022 Dow Lecture: The Economy and Policy Trade-Off