Underlying Inflation at Record Level High

Pub. Date

Pub. Date

Pub. Type

Pub. Type

Main points

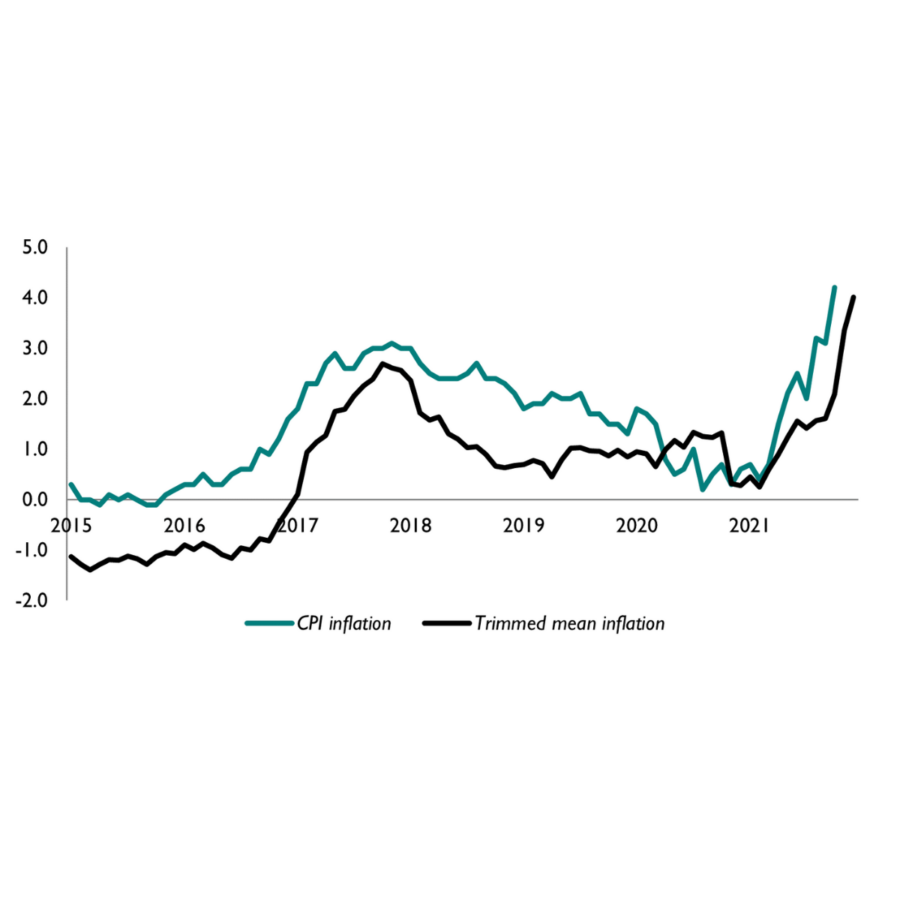

- Headline consumer inflation increased to 5.4 per cent in December from 5.1 in November 2021. Our measure of underlying inflation as measured by the trimmed mean, which excludes 5 per cent of the highest and lowest price changes, increased to 4 per cent in December from 3.4 per cent recorded in November (figure 1).

- The food and non-alcoholic beverages contributed 0.2 percentage points to the headline figure, with a smaller increase in restaurants and hotels almost completely offset by price reductions in the transport category.

- Looking at prices of individual items, 19.6 per cent of goods and services prices changed in November, implying an average duration of prices of 5.1 months. 3.6 per cent of prices were reduced due to sales, 3.7 per cent fell for other reasons and 12.3 per cent recorded increases.

- Our measure of underlying inflation increased in all 12 UK regions. Underlying inflation was highest in London at 5 per cent and lowest in Northern Ireland at 3 per cent in December 2021.

- Higher inflation in the medium term will likely wipe out pay increases negotiated in the last three months. Higher commodity prices and an additional VAT hike scheduled for April 2022 means consumer prices are likely to remain above the Bank of England’s target until 2024.

- We expect that the Bank of England will continue to raise interest rates in 2022 but the change in the policy rate will only have an effect some 12 to 18 months later. Our analysis indicates that annual consumer inflation will remain close to 5 per cent in the first half of the year.

“Annual headline CPI inflation increased to 5.4 per cent in December from 5.1 per cent in November. High demand during the festive season was reflected in the food and non-alcoholic beverages category which contributed 0.2 percentage points to the headline figure. Our measure of underlying inflation, which excludes extreme price movements, increased to 4 per cent in December from 3.4 per cent in November. Underlying inflation increased in all 12 UK regions, indicating the broad-based nature of increasing living costs. Our analysis suggests annual consumer price inflation will remain close to 5 per cent in the first half of 2022, well above the Bank of England’s 2 per cent target.”

Janine Boshoff

Economist, Macroeconomic Modelling and Forecasting