- Home

- Publications

- Interest Rate Rises And Covid-19 Government Debts

Interest rate rises and Covid-19 government debts

Pub. Date

Pub. Date

Pub. Type

Pub. Type

Authors

Related Themes

Macro-Economic Dynamics and PolicyThis is a preview from the Quarterly UK Economic Outlook, May 2021.

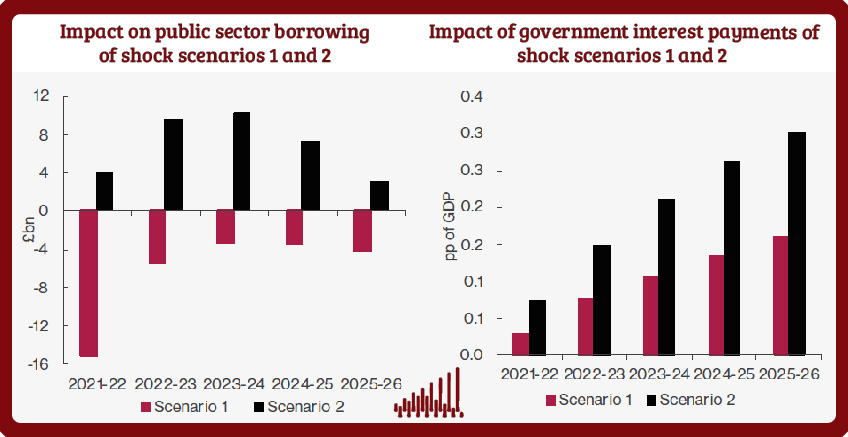

The increase in government debt will translate into an increased sensitivity of any debt service costs to interest rate changes but the level of service costs remains low.

To place interest rate rises of the order cited by the Chancellor in their economic context, we used the Institute’s NiGEM model to simulate two scenarios in which rate rises of one percentage point may take place: (1) a positive GDP shock and (ii) a negative term premia shock. No other variables are shocked, and we assume that in both cases the stock of QE each year is unchanged from the OBR baseline – a strong assumption, but one which also underpins

the OBR estimates of rising interest rate costs so is preserved here to aid comparison.

The analysis in this Box has been prepared by NIESR Principal Economist Rory Macqueen.

Please see the full analysis and its findings in the pdf document.

Related Blog Posts

Public Debt Sustainability and Fiscal Rules

Stephen Millard

Benjamin Caswell

05 Feb 2024

4 min read

Related Projects

Related News

Call for Papers: Lessons From Quantitative Easing & Quantitative Tightening

09 Feb 2024

1 min read

Related Publications

Job Boom or Job Bust? The Effect of the Pandemic on Actual and Measured Job and Employment Growth

07 Feb 2024

UK Economic Outlook Box Analysis

Implications of the Transition from Defined Benefit to Defined Contribution Pensions in the UK

07 Feb 2024

UK Economic Outlook Box Analysis

Inflation Differentials Among European Monetary Union Countries: An Empirical Evaluation With Structural Breaks

20 Nov 2023

National Institute Economic Review

Related events

Assessing Cycles and Structural Changes in Markets

Business Conditions Forum

2022 Dow Lecture: The Economy and Policy Trade-Off