- Home

- Publications

- Intra-Euro Area Spillovers – Simulating The Effects Of Fiscal Stimulus

Intra-Euro Area Spillovers – Simulating the Effects of Fiscal Stimulus

Sign in to Access Pub. Date

Pub. Date

Pub. Type

Pub. Type

Downloads

This content is restricted to corporate members, NiGEM subscribers and NIESR partners.

Related Themes

Macro-Economic Dynamics and PolicyThis is a preview from the National Institute Economic Review, August 2018, no 245.

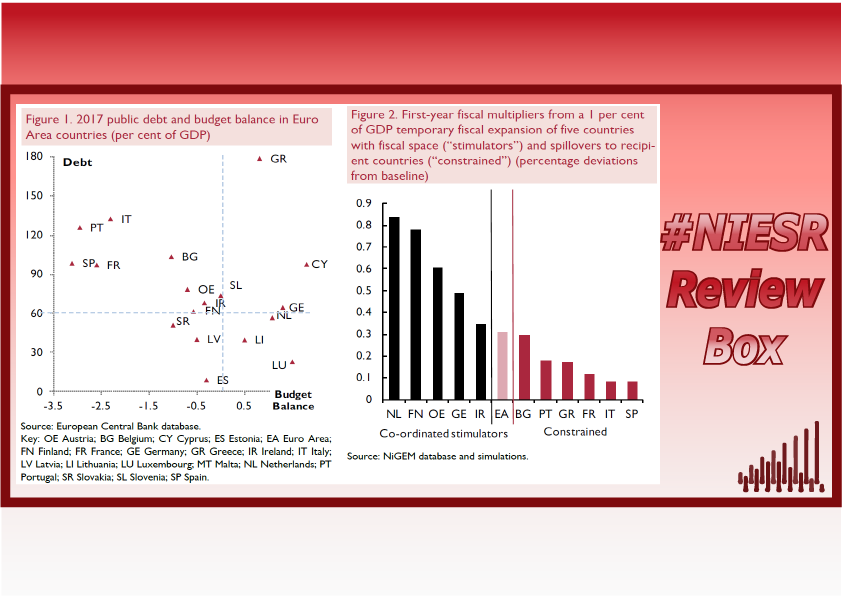

This Box, prepared by NIESR Economist Marta Lopresto, addresses the heterogeneity of fiscal positions in the Euro Area, with a view to examining the effectiveness of fiscal expansions undertaken individually and collectively in stimulating aggregate demand in the monetary union.

The analysis uses the National Institute’s Global Econometric Model (NiGEM) to examine the effect of a co-ordinated Euro Area fiscal expansion and an expansion conducted by member states in isolation. The different scenarios simulate an expansion to government spending of the same magnitude (1 per cent of GDP) and duration (for two years), before they gradually revert to baseline. Monetary policy and exchange rates are kept exogenous for the duration of the shock.

"Many factors would contribute to the size of the final effect of a fiscal expansion. These results, however, provide a basis for ranking the effectiveness of various policies either co-ordinated across countries or undertaken in isolation. If a fiscal boost is implemented simultaneously, the fiscal multipliers are larger for all countries in the monetary union, with the trade spillover channel accounting for some 30 per cent of the average rise in output".

Related Blog Posts

Public Debt Sustainability and Fiscal Rules

Stephen Millard

Benjamin Caswell

05 Feb 2024

4 min read

Related Projects

Related News

Call for Papers: Lessons From Quantitative Easing & Quantitative Tightening

09 Feb 2024

1 min read

Related Publications

The Financial (In)Stability Real Interest Rate, R**, as a Monetary Policy Constraint

07 Feb 2024

Global Economic Outlook Box Analysis

Geopolitical Risks and the Global Economy

07 Feb 2024

Global Economic Outlook Box Analysis

The Spectre of a US House Price Correction

07 Feb 2024

Global Economic Outlook Box Analysis

Inflation Differentials Among European Monetary Union Countries: An Empirical Evaluation With Structural Breaks

20 Nov 2023

National Institute Economic Review

Related events

Assessing Cycles and Structural Changes in Markets

Business Conditions Forum

2022 Dow Lecture: The Economy and Policy Trade-Off