NIESR CPI Tracker – February 2020

Pub. Date

Pub. Date

Pub. Type

Pub. Type

CPI Inflation accelerated in new year as expected

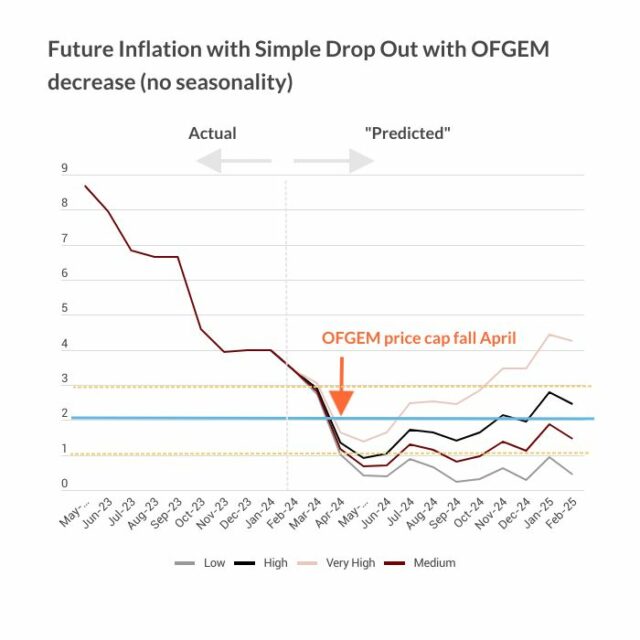

The consumer price index inflation rate increased to 1.8 per cent in the year to January 2020, as per data released by the ONS. Our new analysis of 130,278 locally collected goods and services indicates that inflation in the housing and household services and the transport categories contributed the most to the uptick in inflation. The clothing and footwear category has also recorded positive inflation for the first time since October, further contributing to a squeeze on consumer budgets. Underlying inflation, which excludes the most extreme price changes, grew at 0.9 per cent in January, up from 0.8 percent in December. This is consistent with headline CPI inflation reaching the Bank of England’s target of 2 per cent in the 12 months to January 2021.

Main points

- Underlying inflation increased by 0.1 percentage points to 0.9 per cent in the year to January 2020, as measured by the trimmed mean, which excludes 5 per cent of the highest and lowest price changes (figure 1).

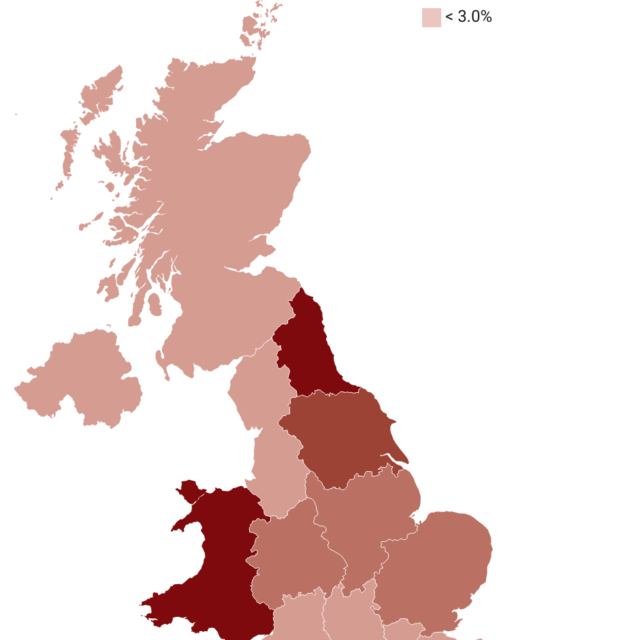

- At the regional level, underlying inflation was highest in Northern Ireland at 1.3 per cent and lowest in East Anglia at 0.7 per cent in the year to January 2020 (table 1).

- 23.9 per cent of goods and services prices changed in January, implying an average duration of prices of 4.2 months. 6.9 per cent of prices were reduced due to sales, 5.1 per cent fell for other reasons and 11.9 per cent were increases (figure 2).

- The historical relationship between current trimmed mean inflation and future CPI inflation implies CPI inflation of 2 per cent in the year to January 2021.

“Headline CPI inflation increased to 1.8 per cent in the year to January 2020, up from 1.3 per cent recorded in December. This is consistent with our previous forecast that judged the decline in December to be a short-lived phenomenon. Headline CPI is likely to remain volatile in the months ahead. Our analysis of approximately 130,000 goods and services included in the basket indicates that higher prices in the housing and household services as well as transport categories were not fully offset by sales in the month of January. Our measure of underlying inflation, which excludes extreme price movements, increased by 0.1 percentage point to 0.9 per cent in January. Underlying inflation increased in 11 regions of the UK. On this basis, we expect CPI inflation to settle around the Bank of England’s target of 2 per cent in the coming year.”

Janine Boshoff

Economist, Macroeconomic Modelling and Forecasting