Underlying Inflation at Six Month High

Pub. Date

Pub. Date

Pub. Type

Pub. Type

Underlying inflation at 6-month high

Main points

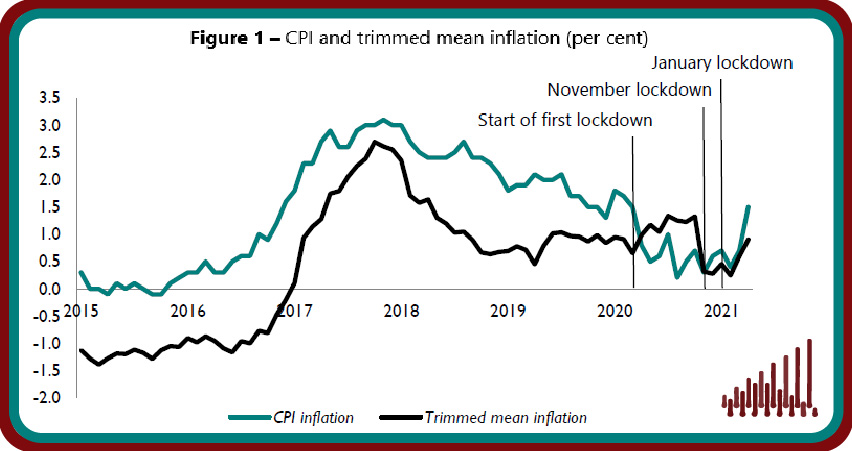

- Underlying inflation increased to a six-month high in April. The trimmed mean, which excludes 5 per cent of the highest and lowest price changes, recorded 0.9 per cent in April, up from 0.6 per cent in March 2021 (figure 1).

- 18.3 per cent of goods and services prices changed in April, implying an average duration of prices of 5.5 months which is slightly higher than the long-term average of 5.1 months.

- 5.0 per cent of prices were reduced due to sales, 3.1 per cent fell for other reasons and 10.1 per cent recorded increases. Despite the pickup in underlying inflation, there has not been a significant rise in the share of prices that recorded increases (figure 2).

- At the regional level, underlying inflation in London more than tripled in April, increasing from 0.7 per cent in March to 2.2 per cent in April. But significant declines were recorded in Wales, Northern Ireland, East Midlands, and the North which had seen persistently higher underlying inflation since the start of the pandemic last year (table 1).

- The gradual easing of the lockdown has re-introduced goods and services in the non-essential retail and hospitality categories to the calculation of consumer price inflation. We expect that the rise in energy prices and pent-up demand will be reflected in higher headline inflation going forward.

- CPI inflation is likely to pick up in the second half of the year, finishing the year to April 2022 closer to the Bank of England’s target of 2 per cent but there are upside risks on this forecast driven by the possibility of a stronger than expected recovery in consumption as we emerge from the pandemic on the back of a successful vaccination programme as described in more detail in our recent UK Economic Outlook.

“While annual headline inflation rose to 1.5 per cent in April, more than doubling the 0.7 per cent recorded in March, our measure of underlying inflation, which excludes extreme price movements, increased to a six-month high of 0.9 per cent in April from 0.6 per cent in March. The rise in international oil prices and the consumption-driven recovery in conjunction with the gradual easing of the lockdown will lead to higher consumer price inflation in the coming months, with base effects also contributing to higher inflation in the short-term, but we expect that annual headline inflation will end the year close to the Bank of England’s target of 2 per cent with upside risks due to the possibility of a stronger than expected recovery in consumption.”

Janine Boshoff

Economist, Macroeconomic Modelling and Forecasting