Slight Pickup in Underlying Inflation Amid High Uncertainty

Pub. Date

Pub. Date

Pub. Type

Pub. Type

Slight pickup in underlying inflation amid high uncertainty

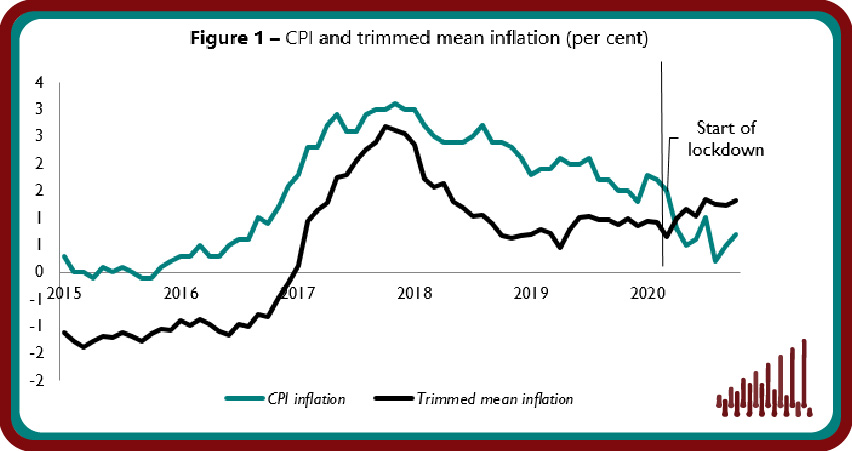

Headline inflation increased to 0.7 per cent in the year to October 2020, up from 0.5 per cent in September. Our new analysis of 119,627 locally collected goods and services indicates that increases in clothing and footwear and food and non-alcoholic beverages contributed to the uptick in inflation during October 2020. The imposition of a three-tier lockdown system on the 12th of October to stem the rise in Covid-19 infections likely introduced a greater level of uncertainty for consumers. Households now face the prospect of deteriorating personal finances in the face of weaker economic growth and delayed recovery prospects for the UK economy.

Our measure of underlying inflation, which excludes the most extreme price changes, increased to 1.3 per cent in October 2020, up from 1.2 per cent in September. Regional trimmed mean inflation indicated that underlying inflation was highest in Northern Ireland at 2.5 per cent, and lowest in the South West at 0.7 per cent. The current national lockdown and ongoing discussions about policy measures over the festive season will further weigh on already weak demand and labour market prospects. Our analysis suggests that inflation for the rest of the year will stay subdued but will rise gradually towards the Bank of England’s inflation target of 2 per cent in the year to October 2021. The possibility of a quicker recovery from the pandemic thanks to new vaccines and a no-deal Brexit might pose upside risks on our inflation forecast for next year.

Main points

- Underlying inflation increased to 1.3 per cent in the year to October 2020, as measured by the trimmed mean, which excludes 5 per cent of the highest and lowest price changes (figure 1).

- At the regional level, underlying inflation was highest in Northern Ireland at 2.5 per cent and lowest in the South West which saw an increase of only 0.7 per cent in the year to October 2020 (table 1).

- 20.4 per cent of goods and services prices changed in October, implying an average duration of prices of 4.9 months, close to the historical average. 4.7 per cent of prices were reduced due to sales, 5.7 per cent fell for other reasons and 10 per cent were increases (figure 2).

- The second lockdown is likely to put downward pressure on inflation in the short-term as we expect the UK economy to contract in the fourth quarter of the year. Our analysis suggests that CPI inflation is likely to settle around 2 per cent in the year to October 2021.

“Headline CPI inflation increased to 0.7 per cent in the year to October 2020, up from 0.5 per cent recorded in September, reflecting the higher transport costs and clothing and footwear prices recorded during the month. Our measure of underlying inflation, which excludes extreme price movements, increased to 1.3 per cent in October, thanks to an increase in underlying inflation across all 12 of the UK regions. Inflation is likely to remain subdued in the short-term but the possibility of early roll-out of a Covid-19 vaccine and a no-deal Brexit pose upside risks on consumer inflation in 2021.”

Janine Boshoff

Economist, Macroeconomic Modelling and Forecasting