UK Term Premium Drops to Four Month Low Over Summer

Pub. Date

Pub. Date

09 September, 2021

Pub. Type

Pub. Type

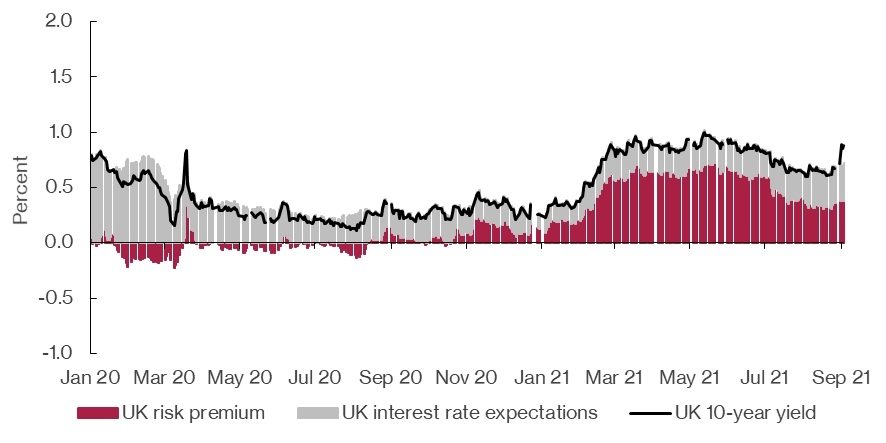

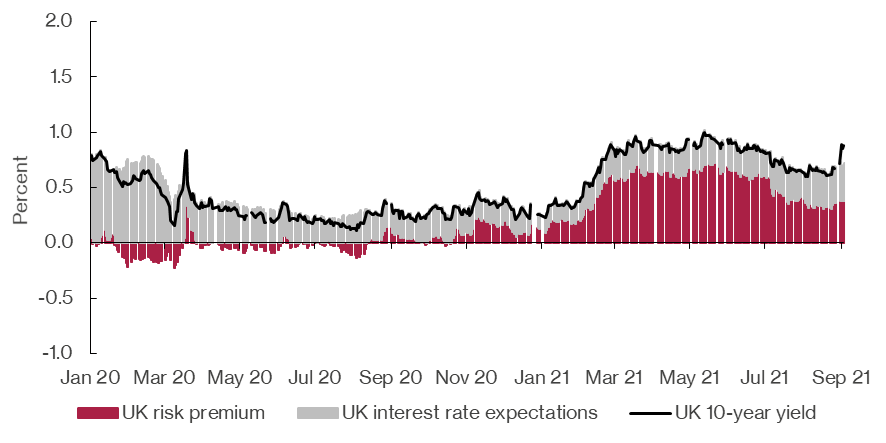

Figure 1: UK 10-year government bond yield and decomposition (percent)

- We decompose long-term treasury yields into two components: expectations of the future path of short-term bond yields and a term premium. The term (or risk) premium is the compensation investors require for bearing the risk that short-term bond yields will not evolve as expected.

- In July 10-year treasury yields fell to 0.7 per cent, the lowest in almost four months and the second largest monthly decline since the start of the pandemic. This has been mainly driven by a drop in the term premium. In contrast, short-term interest rate expectations remained broadly stable, and they have increased in September (figure 1).

- US government bond rates fell by more, driven by the term premium at the 10-year maturity, which now stands at -0.3 per cent, down from 0.3 at the end of May. Interest rate expectations have increased to average 1.6 per cent over the next year and a half. German 10-year Bund yields dropped to -0.3 percent from over 0 percent in May, with euro are interest rate expectations and term premia remaining largely negative.

- The Federal Reserve's tone during its latest meeting on 25 July and in its minutes showed the FOMC is moving towards tapering. In his speech to the ‘Jackson Hole Economic Policy Symposium' at the end of last month, Fed’s Chair Powell downplayed the possibility of additional sustained inflation, focusing instead on the need for job creation to hit the Fed’s target of “maximum employment”. He said tapering the Fed’s bond purchases would likely begin in 2021.

- According to the most recent US payroll data, job growth slowed significantly in August as the Delta variant curbed services demand and labour supply. In the light of this, market expectations have increased that during its upcoming meeting, on 22 September, the Fed could delay starting to taper by a few months. The Bank of England is likely to follow this lead, as the ONS confirmed in July that the UK labour market remains about 200.000 jobs below pre-pandemic levels.

- For the moment, the central banks significant presence in the bond market is likely to keep yields subdued.

- The adjustment in the UK risk premium is consistent with our latest GDP growth forecast of 4.8 per cent q/q in the second quarter of 2021. The risk premium decreased from 0.6 per cent at the end of May to 0.37 per cent in September. Interest rate expectations, capturing markets expectations of rates over the longer horizon, remained broadly stable at 0.35 per cent.

- While consumer confidence is not expected to plummet, UK households continued to build up savings during the summer, implying that the spike in Covid-19 cases because of the Delta variant hurt private spending.

- The consumer price index will be released by mid-September. If data continues to be strong, treasury rates may rise again possibly driven by movements in the risk premium.

“Extreme yield movements are likely to be limited for now. The idea that a robust economic recovery, underpinned by monetary easing, would boost inflation – and inevitably force a tightening – remains a possibility, particularly as inflation is projected to overshoot the BoE inflation target earlier than expected. Nevertheless, the central bank is now rather engaged in a balancing act with softer-than-expected labour market data and worries about Covid-19 variants representing downsize risks.”

Dr Corrado Macchiarelli

Research Manager for Global Macroeconomics