- Home

- Publications

- Panel Estimation Of The Impact Of Exchange Rate Uncertainty On Investment In The Major Industrial Countries

Panel Estimation of the Impact of Exchange Rate Uncertainty on Investment in the Major Industrial Countries

Pub. Date

Pub. Date

Pub. Type

Pub. Type

Downloads

DP208Authors

External Authors

Byrne, J

Related Themes

Productivity, Trade, and Regional EconomiesJEL Code

E22, F31

Paper Category Number

208

We estimate the impact of exchange rate uncertainty on investment, using panel estimation featuring a decomposition of exchange rate volatility derived from the components GARCH model of Engle and Lee (1999). For a poolable subsample of EU countries, it is the transitory and not the permanent component of volatility which adversely affects investment, implying high frequency shocks of the type that may be generated by volatile short term capital flows are most deleterious for investment. Results based on EGARCH also suggest that the response of investment to exchange rate uncertainty may depend partly on the sign of the initial shock.

Related Blog Posts

Exploring the Data on UK Productivity Performance

Issam Samiri

Stephen Millard

11 Dec 2023

4 min read

UK Investment Past and Prospects: A Framework for Analysis

Catherine Mann

01 Dec 2023

6 min read

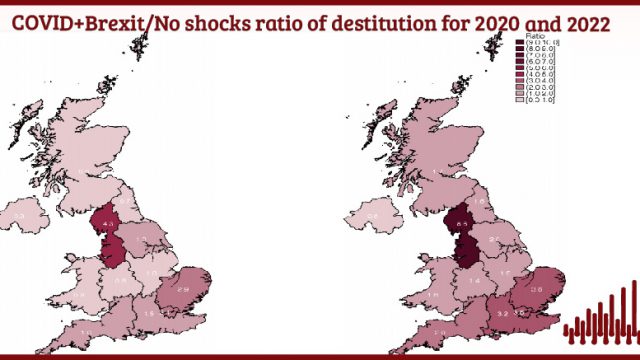

Where Are We With Regional Inequalities in the UK?

Adrian Pabst

Jagjit S. Chadha

01 Nov 2023

5 min read

Related Projects

Related News

Related Publications

The Nature of the Inflationary Surprise in Europe and the USA

21 Mar 2024

Discussion Papers

Productivity and Investment: Time to Manage the Project of Renewal

12 Mar 2024

UK Productivity Commission

Energy and Climate Policy in a DSGE Model of the United Kingdom

08 Mar 2024

Discussion Papers

Related events

Investing for Growth: boosting productivity through higher public and private investment

The Outlook for the Welsh Economy

Prais Lecture with Chris Pissarides: The Future of Work and Wellbeing

A View and Prospects for British Investment

How Can We Raise Investment?

Productivity Commission Evidence Session: Examining the Role of International Investment

High Dimensional Forecasting and its Pitfalls – M. Hashem Pesaran

Finance and Growth Workshop