Recovery: Stalling Not Soaring

A combination of rising prices, lagging wages and the withdrawal of the Universal Credit uplift will all contribute to a massive rise in destitution and increased regional inequalities, despite the modest increase in the national minimum wage. The next few months are likely to bring stuttering growth, rising inflation and widening income inequalities to the UK economy. Household incomes will be painfully squeezed by a combination of earnings growth lagging inflation, rising interest rates and tighter fiscal policy.

Pub. Date

Pub. Date

09 November, 2021

Pub. Type

Pub. Type

Key Points

- Universal Credit recipients the hardest hit and those in receipt of significant non-labour income - not subject to the Health and Social Care Levy - relatively unaffected.

- The squeeze on household incomes from rising prices and withdrawal of the Universal Credit uplift will lead to a doubling of destitution: despite the reduced taper rate, neither the recovery nor the increase in the minimum wage will be enough to make up for this squeeze. Affected households are concentrated in certain regions and localities of the UK, especially in the North of England (notably the North West) and in Northern Ireland.

- While the additional green investment announced in the Budget is welcome, it does not yet go far enough. Our research shows that central banks can play their part in mitigating extreme weather events, but the onus is on HM Treasury and other finance ministries to use the fiscal space they have to invest in the green measures necessary.

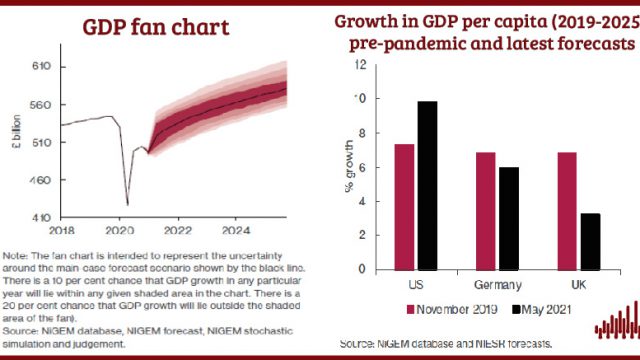

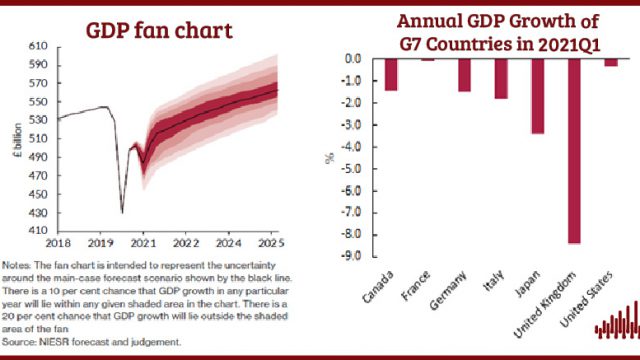

- In our Autumn forecast for the UK economy, GDP grows by 6.9 per cent in 2021 followed by 4.7 per cent in 2022, with supply constraints assumed to continue until the middle of 2022 and rising prices weighing on consumer confidence. Supply disruptions have driven the autumn slowdown but consumer confidence is also contingent on controlling the further spread of Covid-19.

- We do not expect unemployment to rise noticeably following the end of the Coronavirus Job Retention Scheme, with those remaining on furlough largely returning to jobs or finding jobs thanks to the current record levels of advertised vacancies. Wage growth is being flattered at present by base effects but an unusual degree of pay drift suggests that starting salaries are outpacing settlements, while hours are also increasing.

- We forecast that consumer price index inflation will peak at around 5 per cent in the second quarter of 2022, falling thereafter but remaining above target until 2024. Above-target inflation is being driven by supply shortages, base effects and a global rise in energy prices. The Bank of England must ensure that inflation expectations do not become de-anchored but we do not foresee a wage-price spiral taking hold.

- After a 15 basis point rise in the final quarter of 2021 we expect the Monetary Policy Committee to raise interest rates to 0.5 per cent in the second quarter of 2022, thereafter tightening policy through the run-off of maturing QE holdings, with further rate rises in 2023.

- We expect the fiscal deficit to return to close to 4 per cent of GDP next fiscal year and public sector net debt to fall below 90 per cent of GDP by the end of the forecast period – around 10 percentage points higher than it was before the pandemic. This constitutes an unwelcome tightening of fiscal policy, which will not be significantly offset by the slight loosening announced at October’s Budget.

- Brexit has caused the UK to orientate its goods imports away from the European Union, with a larger share now imported from the Rest of the World. The current account deficit is forecast to settle at around 3 per cent of GDP, partly driven by lower capital inflows from the EU.