- Home

- Publications

- Scotland’s Economic Performance And The Fiscal Implications Of Moving To Independence

Scotland’s Economic Performance and the Fiscal Implications of Moving to Independence

Pub. Date

Pub. Date

Pub. Type

Pub. Type

External Authors

John McLaren

Jo Armstrong

Related Themes

Productivity, Trade, and Regional EconomiesJournal

, No. 227

External Resources

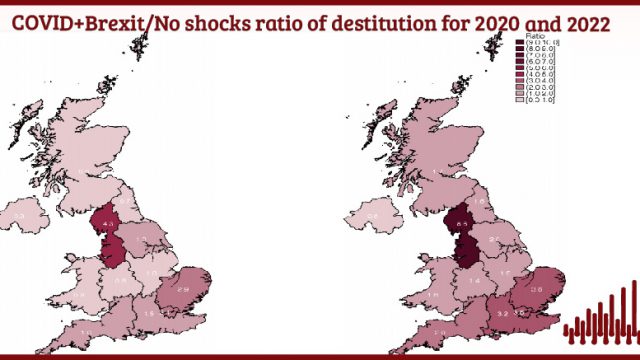

Scotland's economic performance and fiscal make-up are key elements in the debate leading up to the forthcoming referendum on independence. However, in terms of understanding Scotland's economic performance, the situation is complicated by the high degree of overseas ownership, especially with regards to North Sea activity, and the importance of a natural commodity, oil. This makes the use of traditional measures of economic performance, like GDP or GDP per capita, less relevant than for most countries and suggests a greater need to use both constant price and cash GNI, neither of which are currently available. In terms of its fiscal balance, Scotland's independence would require taxes derived from its offshore (North Sea) activity to be sufficient to offset the extra monies (in per head terms) currently transferred from the rest of the UK (via the Barnett formula system) in order to pay for the current level of public services. Based on current projections, such North Sea related tax revenues would amount to less than the likely Barnett transfer, leading to a net loss in funding at the time of independence. Under such circumstances the question of whether or not Scotland could afford to initiate the building up of an ‘Oil Fund', is largely a redundant one. However, uncertainties over both future oil and gas revenues and over the continuation of the existing Barnett system make it difficult to predict with any great certainty whether Scotland would see a longer-term net fiscal gain or loss post-independence. Apparent inconsistencies between official GNI and Scottish revenue figures also means that the existing fiscal balance position remains open to question.

Related Blog Posts

Exploring the Data on UK Productivity Performance

Issam Samiri

Stephen Millard

11 Dec 2023

4 min read

UK Investment Past and Prospects: A Framework for Analysis

Catherine Mann

01 Dec 2023

6 min read

Where Are We With Regional Inequalities in the UK?

Adrian Pabst

Jagjit S. Chadha

01 Nov 2023

5 min read

Related Projects

Related News

Related Publications

Productivity and Investment: Time to Manage the Project of Renewal

12 Mar 2024

UK Productivity Commission

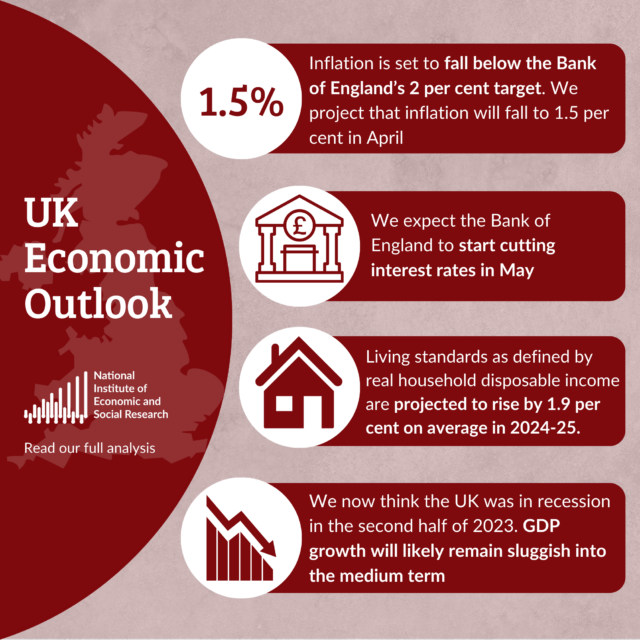

UK Households Should Start Feeling Better Off as Election Looms

07 Feb 2024

UK Economic Outlook

Adam Smith and the Bankers: Retrospect and Prospect

04 Jan 2024

National Institute Economic Review

Related events

Investing for Growth: boosting productivity through higher public and private investment

The Outlook for the Welsh Economy

Prais Lecture with Chris Pissarides: The Future of Work and Wellbeing

A View and Prospects for British Investment

How Can We Raise Investment?

Productivity Commission Evidence Session: Examining the Role of International Investment

High Dimensional Forecasting and its Pitfalls – M. Hashem Pesaran

Finance and Growth Workshop