- Home

- Publications

- Some Evidence On Financial Factors In The Determination Of Aggregate Business Investment For The G7

Some evidence on financial factors in the determination of aggregate business investment for the G7

Pub. Date

Pub. Date

Pub. Type

Pub. Type

Downloads

dp187Authors

External Authors

Paul Ashworth

Related Themes

Productivity, Trade, and Regional EconomiesPaper Category Number

187

Standard theories of investment behaviour have concentrated on the neoclassical and Tobin's Q approaches, with most empirical work on aggregate data focusing on the former. In contrast, a separate literature on monetary transmission, centred on the credit channel and financial accelerator effects, has highlighted the potential impact of credit market imperfections in constraining the investment behaviour of firms. In this paper we present evidence at a macro level for the G7 countries that a broad range of financial variables, consistent with the valuation ratio, financial accelerator and credit channel approaches, are relevant determinants of business fixed investment above those variables normally included in traditional macroeconomic investment functions. The results indicate a wider incidence of these financial effects on investment than the existing literature, focused as it is on the US, would otherwise indicate.

Related Blog Posts

Exploring the Data on UK Productivity Performance

Issam Samiri

Stephen Millard

11 Dec 2023

4 min read

UK Investment Past and Prospects: A Framework for Analysis

Catherine Mann

01 Dec 2023

6 min read

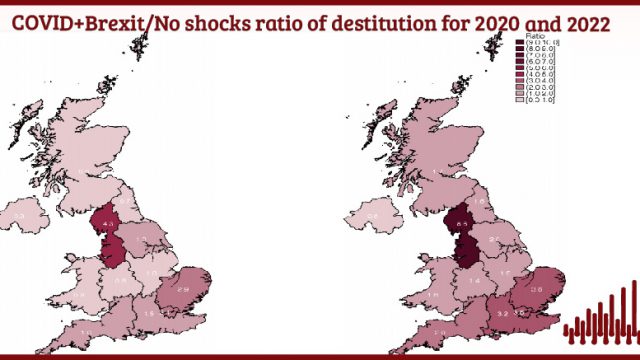

Where Are We With Regional Inequalities in the UK?

Adrian Pabst

Jagjit S. Chadha

01 Nov 2023

5 min read

Related Projects

Related News

Related Publications

The Nature of the Inflationary Surprise in Europe and the USA

21 Mar 2024

Discussion Papers

Productivity and Investment: Time to Manage the Project of Renewal

12 Mar 2024

UK Productivity Commission

Energy and Climate Policy in a DSGE Model of the United Kingdom

08 Mar 2024

Discussion Papers

Related events

Investing for Growth: boosting productivity through higher public and private investment

The Outlook for the Welsh Economy

Prais Lecture with Chris Pissarides: The Future of Work and Wellbeing

A View and Prospects for British Investment

How Can We Raise Investment?

Productivity Commission Evidence Session: Examining the Role of International Investment

High Dimensional Forecasting and its Pitfalls – M. Hashem Pesaran

Finance and Growth Workshop