- Home

- Publications

- The Sustainability Of Scottish Public Finances: A Generational Accounting Approach

The sustainability of Scottish public finances: a Generational Accounting approach

Pub. Date

Pub. Date

Pub. Type

Pub. Type

Downloads

DP456External Authors

Sefton, J

Related Themes

Productivity, Trade, and Regional EconomiesJEL Code

E620, H550

Paper Category Number

456

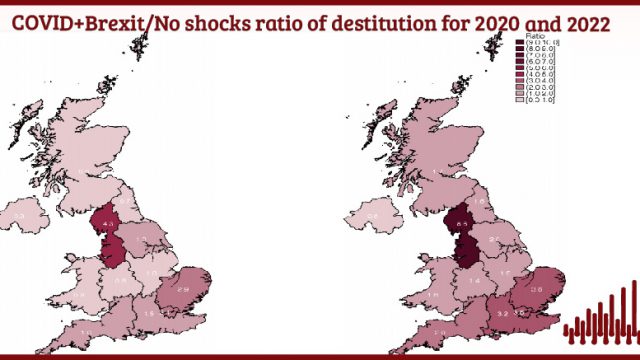

This paper analyses the long-term sustainability and intergenerational equity of the Scottish public finances by employing a generational accounting model. This represents a novel approach to analysing these issues in the case of Scotland, while having the advantage of capturing policy-relevant intergenerational aspects. We find that, under the baseline scenario, assuming that Scotland has “full fiscal autonomy”, large intertemporal and intergenerational fiscal gaps open up. The three main reasons behind this result are: declining North Sea revenues, a budget deficit at the beginning of the simulation period and a widening gap over time primarily due to population ageing. The model suggests that both the intertemporal fiscal and generational imbalances can be addressed via a permanent increase in taxes equivalent to about 8.5 per cent of Scottish GDP, levied on both living and future generations.

Related Blog Posts

Exploring the Data on UK Productivity Performance

Issam Samiri

Stephen Millard

11 Dec 2023

4 min read

UK Investment Past and Prospects: A Framework for Analysis

Catherine Mann

01 Dec 2023

6 min read

Where Are We With Regional Inequalities in the UK?

Adrian Pabst

Jagjit S. Chadha

01 Nov 2023

5 min read

Related Projects

Related News

Related Publications

The Nature of the Inflationary Surprise in Europe and the USA

21 Mar 2024

Discussion Papers

Productivity and Investment: Time to Manage the Project of Renewal

12 Mar 2024

UK Productivity Commission

Related events

Investing for Growth: boosting productivity through higher public and private investment

The Outlook for the Welsh Economy

Prais Lecture with Chris Pissarides: The Future of Work and Wellbeing

A View and Prospects for British Investment

How Can We Raise Investment?

Productivity Commission Evidence Session: Examining the Role of International Investment

High Dimensional Forecasting and its Pitfalls – M. Hashem Pesaran

Finance and Growth Workshop