Brisk but not Better Growth

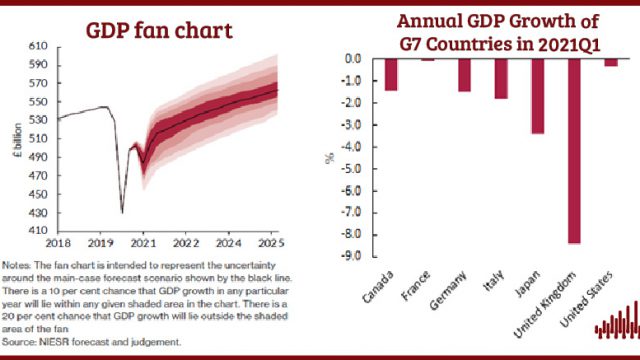

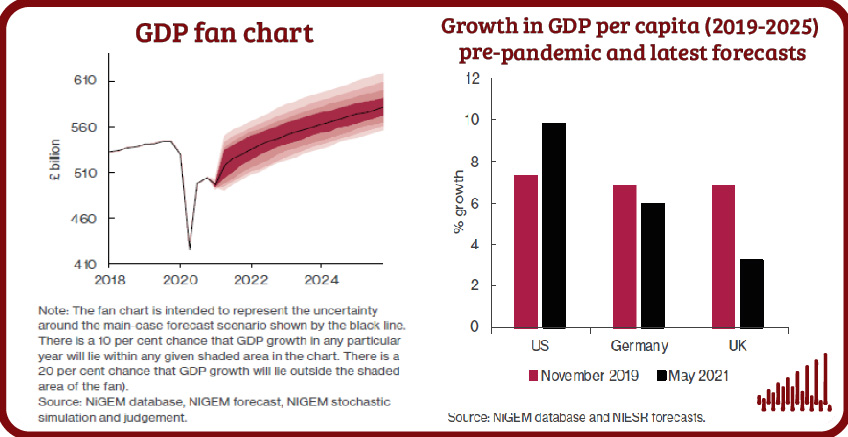

Our central forecast for economic growth in 2021 has been revised up to 5.7 per cent from 3.4 per cent in February. The immediate economic effects of the virus, which have been concentrated in the low-waged service sector, are expected to wane, while remaining negative consequences of Brexit will make themselves felt over the long-run and largely in sectors less affected by Covid-19.

Pub. Date

Pub. Date

10 May, 2021

Pub. Type

Pub. Type

Key points

- The third national lockdown has seen the adaptation of much of the economy to pandemic conditions, meaning that a smaller fall in first-quarter GDP than previously forecast provides a strong basis for the rest of the year. This is followed by the projected re-opening of the remaining affected sectors, thanks to the successful vaccination programme. The principal downside risk remains a resurgence of the Covid-19 virus, through new variants or the failure of vaccines, and the UK will not be physically or economically protected from a failure to control the virus globally

- Thanks to the extension of furlough and other support measures to the autumn, we now forecast unemployment to peak at 6.5 per cent in the final quarter of this year. Even after allowing for compositional effects wage growth seems robust. As a result, disposable incomes, which fell by 0.6 per cent in 2020 in real terms, are forecast to rise by 3.1 per cent this year and 2.7 per cent in 2022.

- Income growth and a degree of forced savings under lockdown provide a strong basis for forecast consumption growth of 5.9 per cent in 2021. We forecast household saving to fall to a level higher than that seen before the pandemic but close to historical averages: a faster or further fall constitutes the principal upside risk to our consumption and GDP forecasts in 2021.

- We forecast CPI inflation to rise over the coming months, reaching 1.8 per cent in the final quarter of 2021, before falling to 1.5 per cent at the end of 2022 and settling just below its 2 per cent target between 2023 and 2025. Bank Rate is not forecast to rise until 2023.

- Government debt, which rose in response to the pandemic, peaks at 104 per cent of GDP in 2022-23, with interest payments forecast to remain low and decline further as a share of GDP. Given the increased intertwining of monetary and fiscal policy as a result of quantitative easing, greater clarity is urgently needed about the way that tightening will be conducted when required and how HM Treasury will deal with any potential interest rate volatility.

- The general conduct of fiscal policy is long overdue a serious rethink. Prior underinvestment in health and social care capacity had devastating consequences in 2020 and also contributed to the UK’s relative economic underperformance during the pandemic. The long-term challenges of low wage growth, slow productivity and inequalities across regions and between groups of people have not been resolved by Covid-19; indeed, the risk is that they have been exacerbated.

- We forecast growth this year of 9 per cent in the non-traded services sector, which includes badly affected industries such as hospitality, but expect it to shed a further 190,000 jobs after the furlough scheme comes to an end later this year