UK short-term interest rate expectations highlight upside inflation risks

Pub. Date

Pub. Date

16 March, 2022

Pub. Type

Pub. Type

Main points

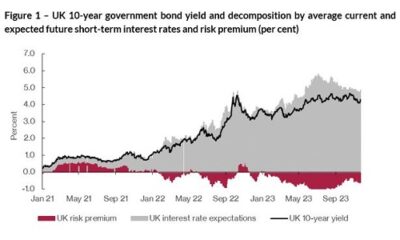

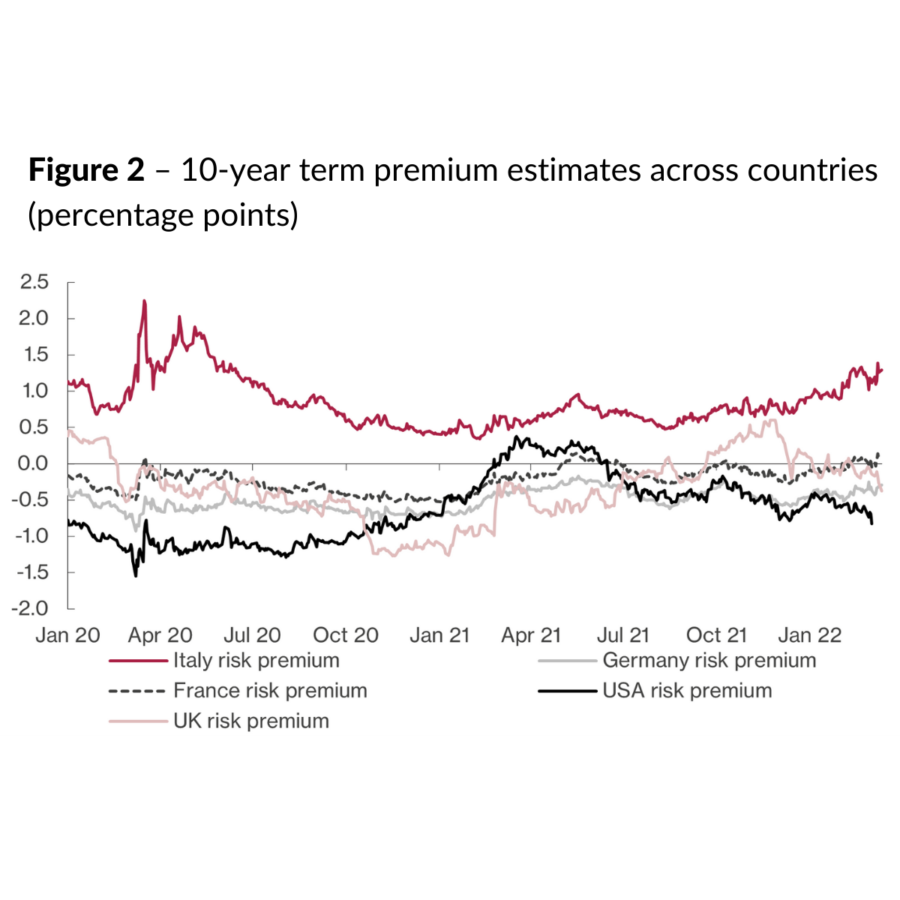

- We decompose long-term treasury yields into two components: expectations of the future path of short-term bond yields and a term premium. The term (or risk) premium is the compensation investors require for bearing the risk that short-term bond yields will not evolve as expected.

- After the 1.2 per cent peak in October, the highest level since the start of the pandemic, the 10-year bond rate increased again since December, to 1.1 per cent, coinciding with the beginning of the Bank tightening cycle. Short-term interest rate expectations are now growing much above the pre-pandemic level, and a further compression in the term premium suggests the market sees no risk of policy rates going higher than the current level, particularly as the Russia-Ukraine conflict points to a high inflation-low growth risk scenario.

- The adjustment in the UK risk premium is consistent with our latest GDP growth forecast: economic activity has continued to grow during the first quarter of this year but we expect future growth to slow as the war in Ukraine and expected long-term elevation of energy prices are likely to affect the economy in the coming months. The risk premium decreased from 0.15 per cent in December to -0.2 by mid-March. Interest rate expectations, capturing markets’ expectations of rates over the longer horizon, have been more volatile recently, increasing up to 1.84 per cent until mid-February, the highest raise since the start of the pandemic, but have subsequently moderated to around 1.40 at the beginning of March and currently stand at 1.76 as markets have incorporated the news of the Russia-Ukraine conflict.

- The UK headline inflation rate has increased significantly to 5.5 per cent in January 2022 and is now expected to peak at around 8.6 per cent in the second quarter of 2022 (revised up from 7 per cent in our February Outlook) based on our latest simulation taking into account the economic costs of the Russia-Ukraine conflict. As inflation data continue to be strong, mainly driven by energy prices (28.3 per cent) and electricity (19.1 per cent) in February, treasury rates could rise further over the coming months.

- While the market expects no surprise, it is now unclear whether short-term expectations will increase further as the Bank of England might decide to postpone any further tightening of policy to avoid pushing the UK economy into a technical recession.

- US government bond rates have also increased close to 2 per cent, with a still negative term premium at the 10-year maturity, consistent with the estimates by the Federal Reserve Bank of New York. Interest rate expectations have continued to increase to average 2.5 per cent as the latest FOMC meeting in January signalled tightening policy sooner than expected given persistent upward inflation. However, this position will likely be revised during the March FOMC meeting given that the Russia-Ukraine conflict now poses a dilemma to monetary policy makers.

- German 10-year Bund yields turned positive since the beginning of March to reach 0.2 per cent. Euro area interest rate expectations turned positive since October 2021, and are now close to 0.5 per cent, suggesting that the odds of the ECB overshooting its target have gone up significantly. The inflation rate is over three times higher than the European Central Bank's target of 2 per cent and hopes that it would peak during the first half of 2022 have evaporated as the war in Ukraine threatens to drive oil prices up further.

“UK short-term interest rate expectations are growing well above the pre-pandemic level and the continued compression in the term premium suggests the market expects no surprises, with interest rates increasing gradually, particularly as the Russia-Ukraine conflict points to a high inflation-low growth risk scenario. This poses a significant trade-off for monetary policy makers after the pandemic.”

Dr Corrado Macchiarelli

Manager for Global Macroeconomics Research

See our previous term premium tracker to follow the analysis